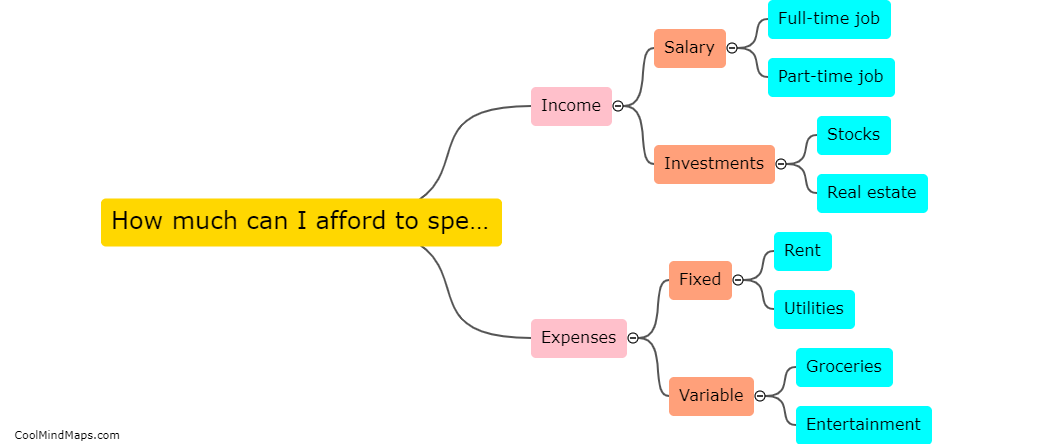

How much can I afford to spend?

When determining how much you can afford to spend, it is important to consider both your income and your expenses. Start by calculating your monthly income after taxes, and then subtract all of your fixed expenses such as rent or mortgage, utilities, car payments, and insurance. Next, factor in variable expenses like groceries, gas, entertainment, and savings. The remaining amount is what you can afford to spend on non-essential items like dining out, shopping, or vacations. It is crucial to create a budget and stick to it in order to ensure financial stability and avoid overspending.

This mind map was published on 30 September 2024 and has been viewed 43 times.