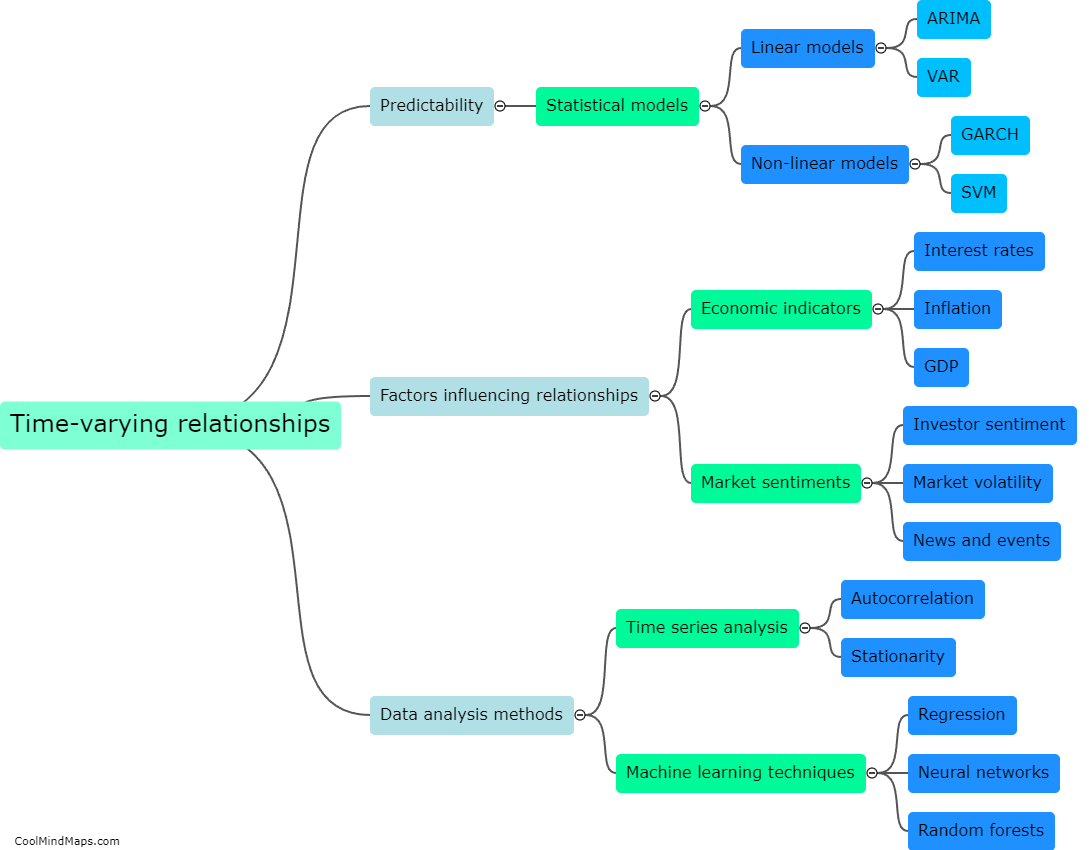

What factors influence the fluctuating relationships in financial markets?

Several factors can influence the fluctuating relationships in financial markets. Economic indicators are crucial in determining the health of an economy, such as GDP growth, inflation rates, and employment figures. Changes in these indicators can affect investor sentiment and subsequently impact the relationships among financial markets. Monetary policy decisions made by central banks, such as interest rate changes and quantitative easing, also play a significant role. These decisions influence borrowing costs, liquidity, and investment decisions, thus affecting relationships within financial markets. Additionally, geopolitical events, such as political instability, trade tensions, and natural disasters, can cause uncertainty and volatility, leading to fluctuations in relationships between different markets. Overall, a wide variety of economic, policy, and external factors contribute to the ever-changing nature of financial market relationships.

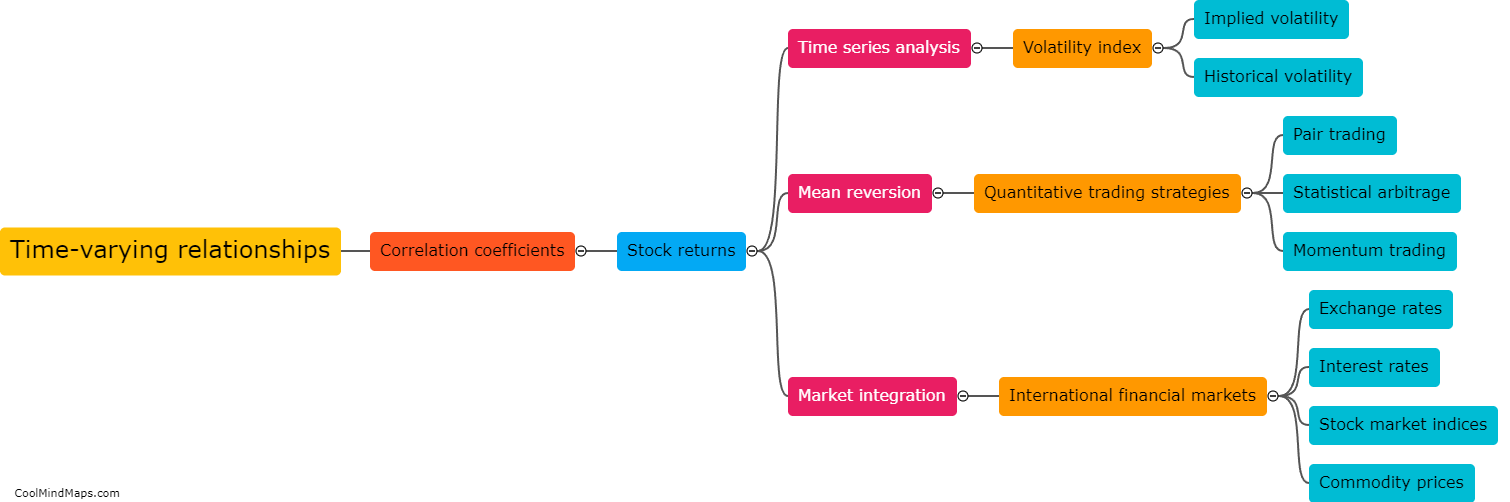

This mind map was published on 22 December 2023 and has been viewed 92 times.