How does the Fiscal Procedures & Financial Accountability Act contribute to fiscal discipline?

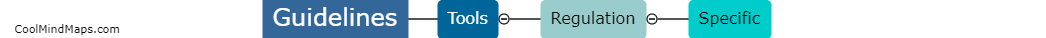

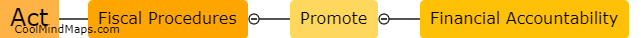

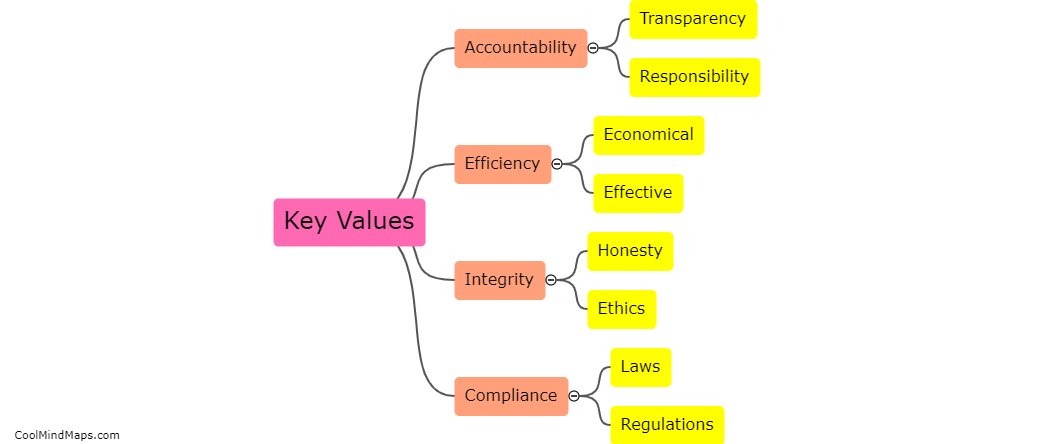

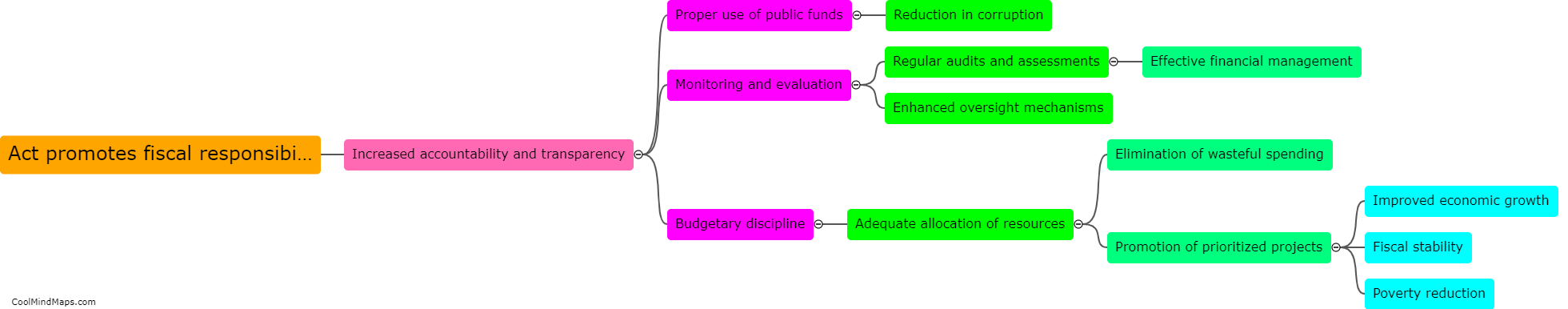

The Fiscal Procedures & Financial Accountability Act plays a crucial role in ensuring fiscal discipline within a country. This act establishes a set of rules and procedures that guide the government's financial management and expenditure decisions. By implementing stringent financial accountability measures, this act promotes transparency and accountability in fiscal matters. It requires the government to prepare annual budgets, track expenditures, and report them accurately to the public. Moreover, it sets limits on government borrowing, ensuring that debt levels remain sustainable. By providing a clear framework for financial management, the Fiscal Procedures & Financial Accountability Act contributes to fiscal discipline by preventing excessive spending, promoting responsible budgeting, and preventing fiscal mismanagement. Ultimately, this act strengthens the government's ability to effectively manage public finances and ensures the long-term financial stability of the country.

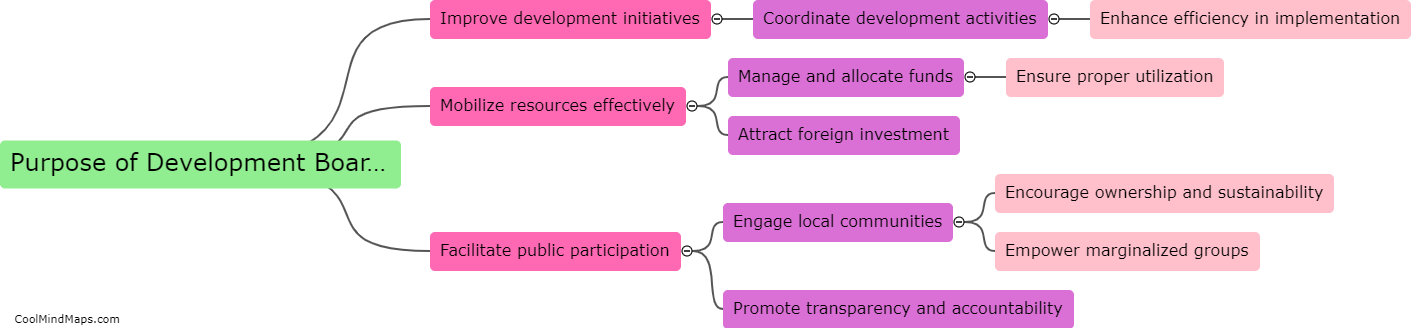

This mind map was published on 28 November 2023 and has been viewed 101 times.