Should too big to fail banks be allowed to exist?

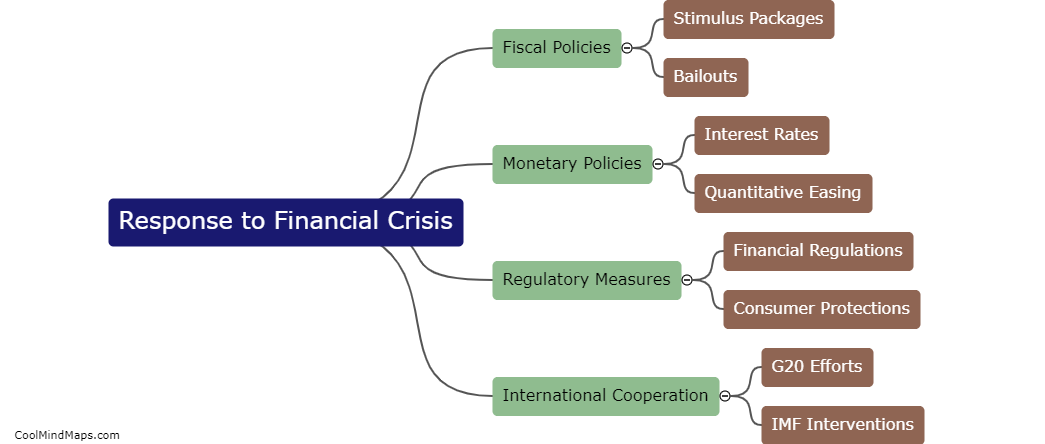

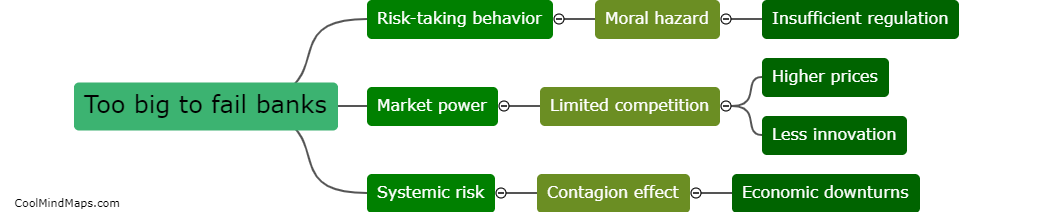

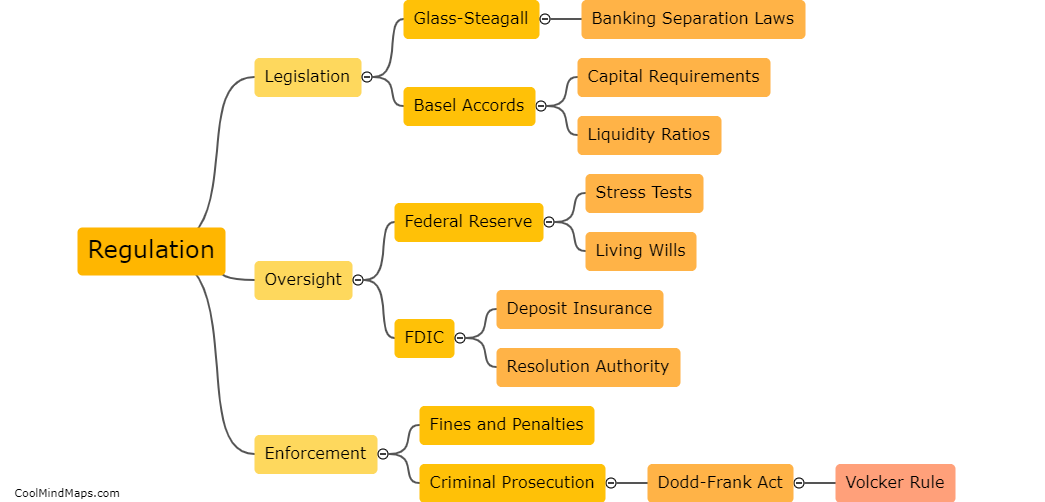

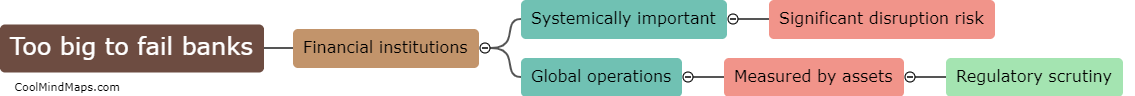

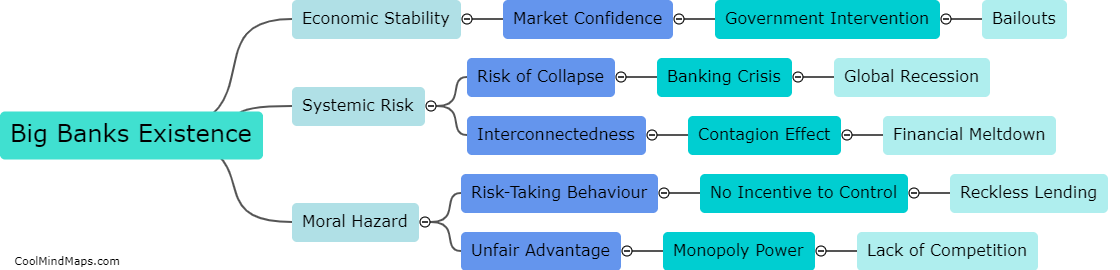

The debate over whether too big to fail banks should be allowed to exist is a contentious issue. Supporters of these banks argue that they play a crucial role in the economy and removing them could cause significant financial disruption. However, opponents argue that allowing these banks to continue to operate puts the economy at risk and further concentrates power within the financial industry. In the aftermath of the 2008 financial crisis, the issue has only become more pressing, with some calling for greater regulation of these institutions. Ultimately, the decision of whether too big to fail banks should be allowed to exist will depend on a range of factors, including economic stability, regulatory oversight, and public opinion.

This mind map was published on 23 May 2023 and has been viewed 113 times.