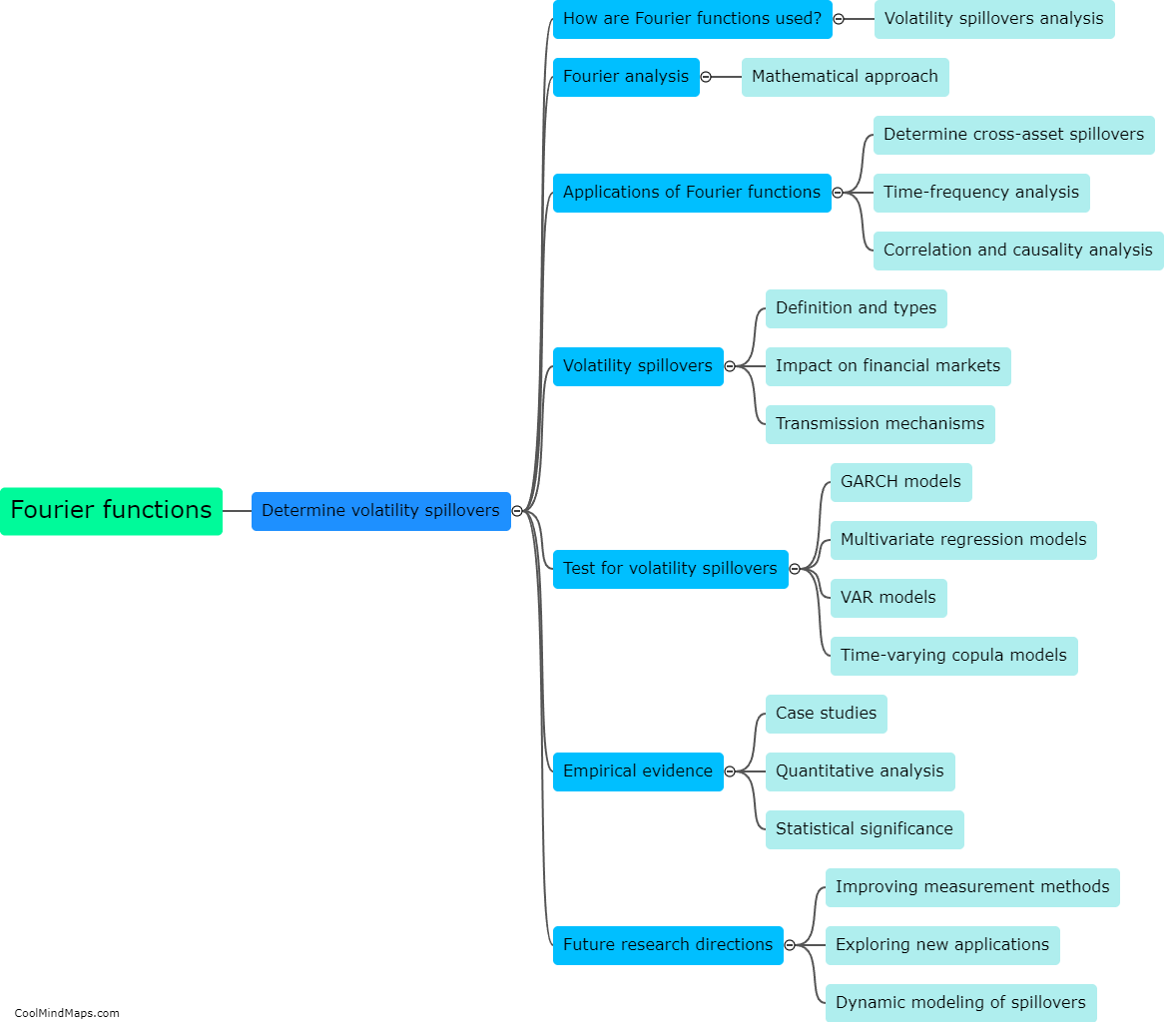

What are the impacts of volatility spillovers during crises?

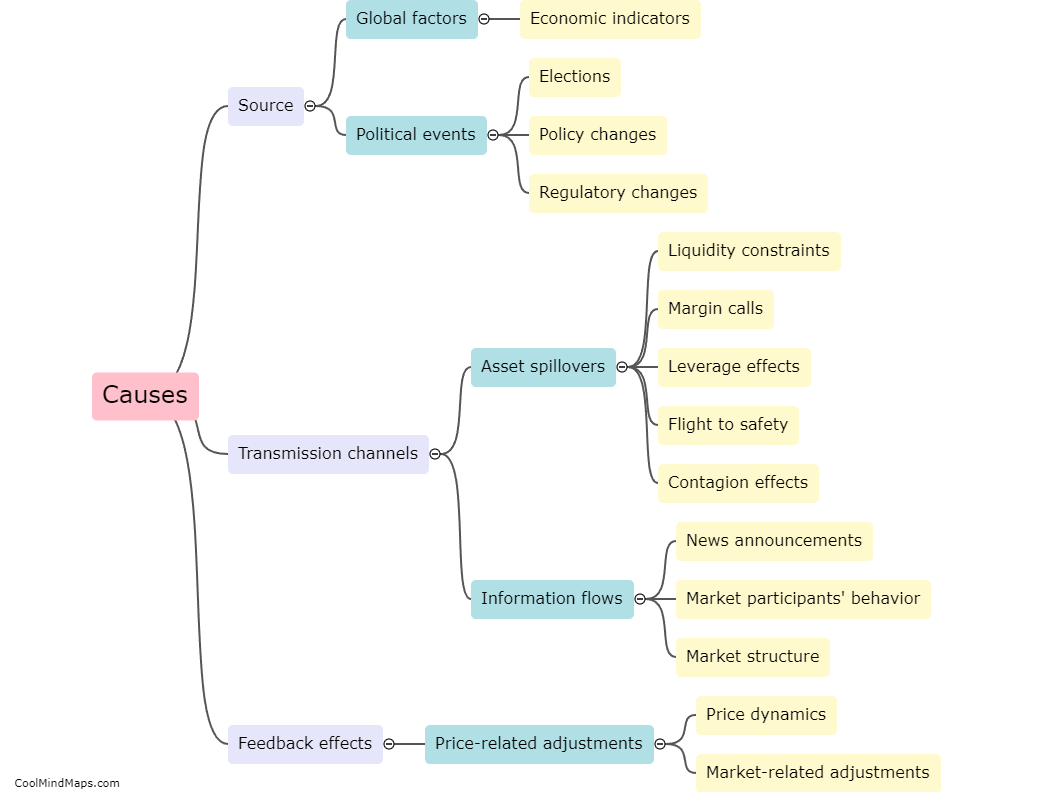

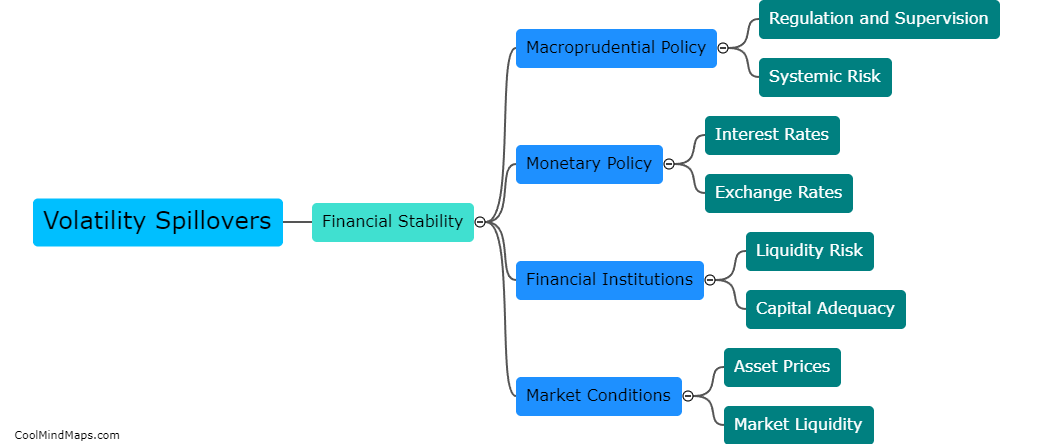

During crises, such as financial or economic downturns, volatility spillovers can have significant impacts on various aspects of the economy. These spillovers occur when volatility in one market or asset class spreads to other markets, creating a domino effect of increased uncertainty and risk. One major impact is the amplification of market turbulence, as volatility spillovers can lead to sharp fluctuations in asset prices, making it difficult for investors to accurately gauge the value or risk of their holdings. This can further erode investor confidence and exacerbate the crisis. Additionally, volatility spillovers can affect the stability of the financial system by increasing the likelihood of contagion, where distress in one institution or country spreads to others. This can lead to a wider systemic crisis and necessitate government interventions to stabilize the system. Furthermore, volatility spillovers can have negative implications for international trade and capital flows. Increased volatility and uncertainty can deter foreign investors and disrupt the flow of goods and services across borders, impacting global economic growth. Overall, volatility spillovers during crises can have far-reaching consequences, impacting markets, financial stability, and global economic activity.

This mind map was published on 28 November 2023 and has been viewed 139 times.