Does depreciation have a cost?

Depreciation refers to the decrease in value of an asset over time due to wear and tear, obsolescence, or other factors. While depreciation is an accounting concept that does not involve actual cash outflows, it does carry an implicit cost. When businesses allocate depreciation expenses to their income statements, they are essentially spreading out the cost of an asset over its useful life. This allocation helps determine the true cost of using the asset for a specific period. This cost indirectly affects a company's profitability, as it reduces taxable income and can impact the financial performance when evaluating expenses and investments. Additionally, depreciation plays a crucial role in determining the asset's value for financial reporting purposes, as it reflects the decline in its worth over time. Therefore, while depreciation itself does not involve immediate cash expenditure, it does have an important cost component that affects a company's financial position.

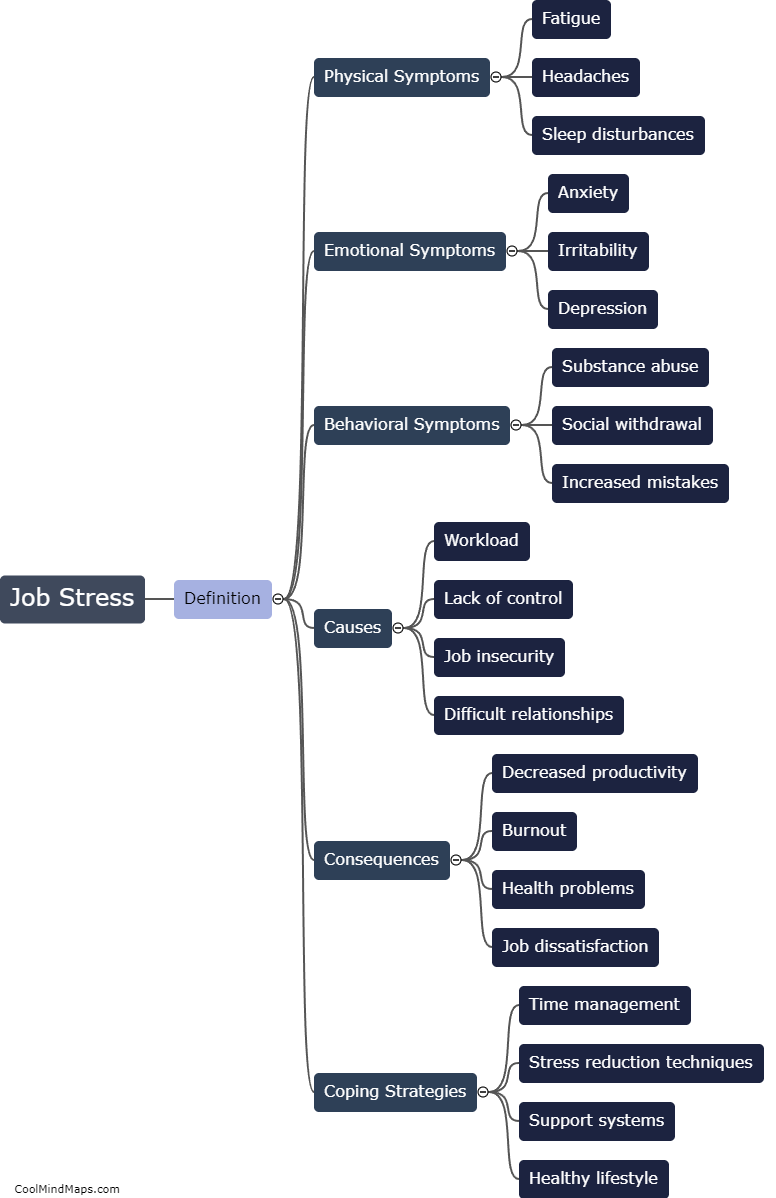

This mind map was published on 5 December 2023 and has been viewed 83 times.