Definition of expansionary monetary policy

Expansionary monetary policy refers to the implementation of monetary measures by the central bank in order to stimulate economic growth and increase the country's money supply. It involves lowering interest rates, increasing the money supply and reducing the reserve requirements for banks. The main aim is to increase aggregate demand and encourage spending, investment and borrowing. Expansionary monetary policy is commonly used during times of economic recession or depression, and is implemented with the goal of reducing unemployment and boosting economic activity. However, it can also lead to inflation and other economic challenges if implemented excessively.

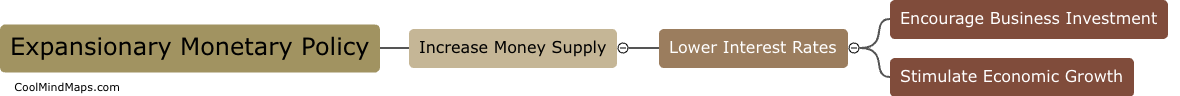

This mind map was published on 17 May 2023 and has been viewed 105 times.