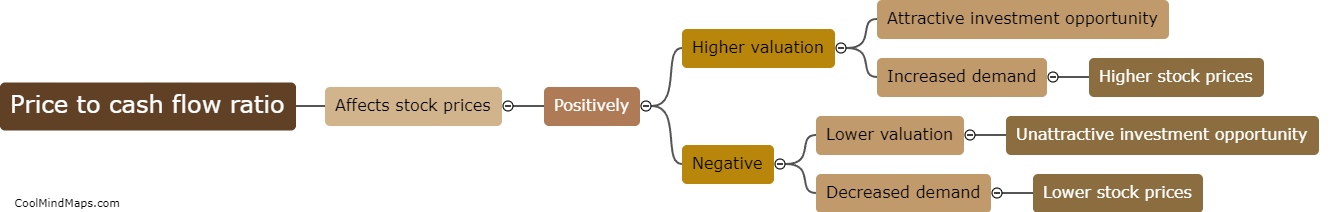

How does price to cash flow ratio affect stock prices?

The price to cash flow ratio, also known as the P/CF ratio, is a financial metric used to assess the valuation of a company's stock. It is calculated by dividing the market price per share by the cash flow per share. The P/CF ratio provides investors with insights into how much they are paying for each dollar of cash flow generated by the company. When the P/CF ratio is high, it suggests that investors are willing to pay a premium for a company's cash flow, indicating a potentially overvalued stock. Conversely, a low P/CF ratio suggests that the stock may be undervalued. Therefore, changes in the P/CF ratio can significantly impact stock prices, as investors' perceptions of a company's future cash flow prospects influence their buying and selling decisions.

This mind map was published on 10 December 2023 and has been viewed 113 times.