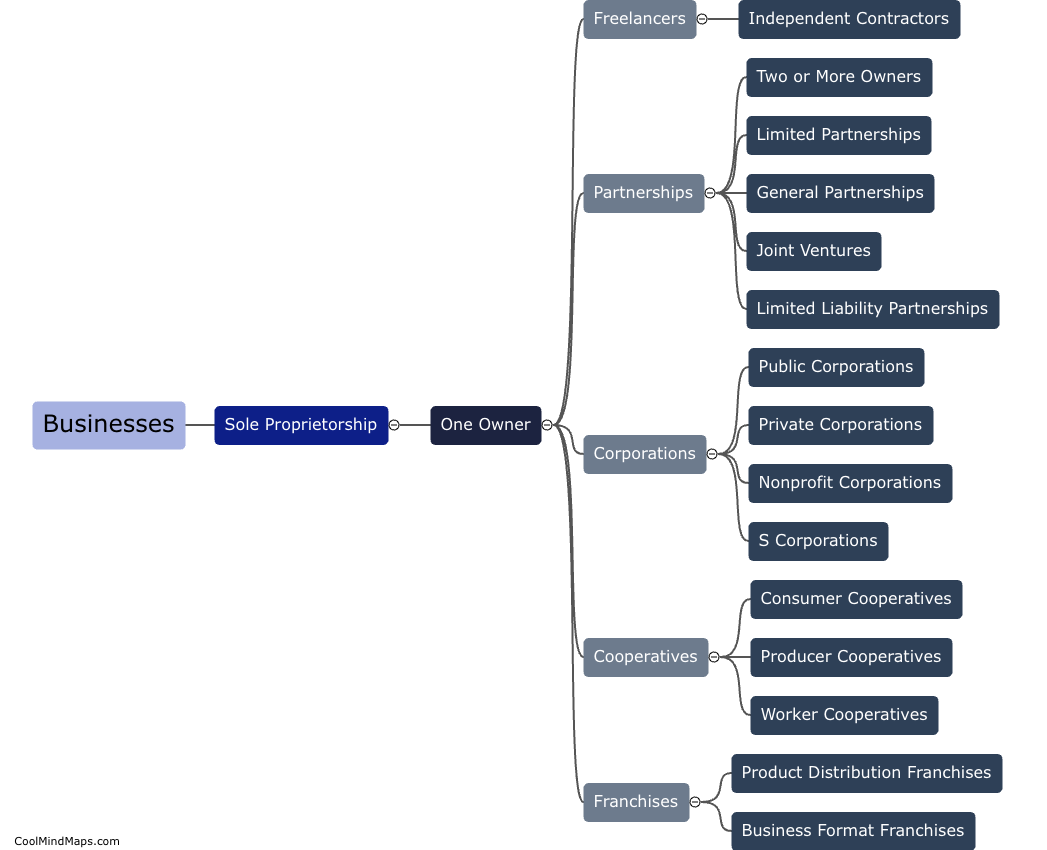

What are the different types of businesses?

There are various types of businesses, including sole proprietorships, partnerships, corporations, and limited liability companies. A sole proprietorship is a business owned and operated by a single individual, whereas a partnership involves two or more people sharing ownership and profits. A corporation is a legal entity that is separate from its owners and offers limited liability protection. A limited liability company combines the liability protection of a corporation with the tax benefits of a partnership. Each type of business has its advantages and disadvantages, and choosing the right structure depends on factors such as the size, nature of the business, and tax implications.

This mind map was published on 20 April 2023 and has been viewed 122 times.