How are assets managed in credit markets?

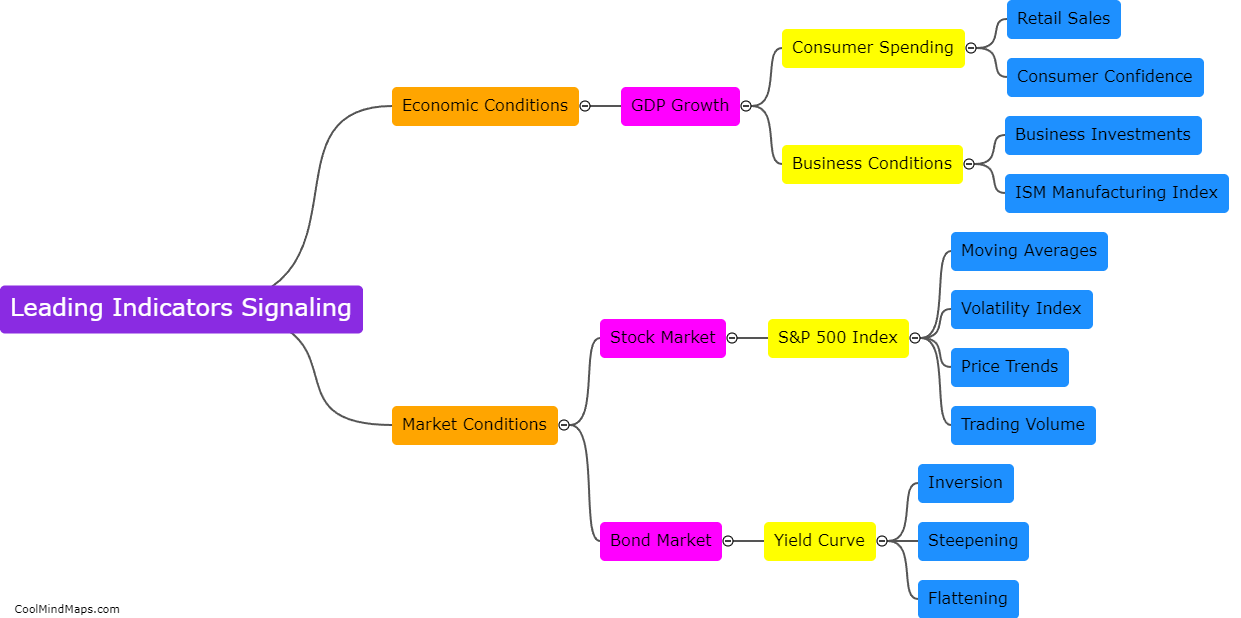

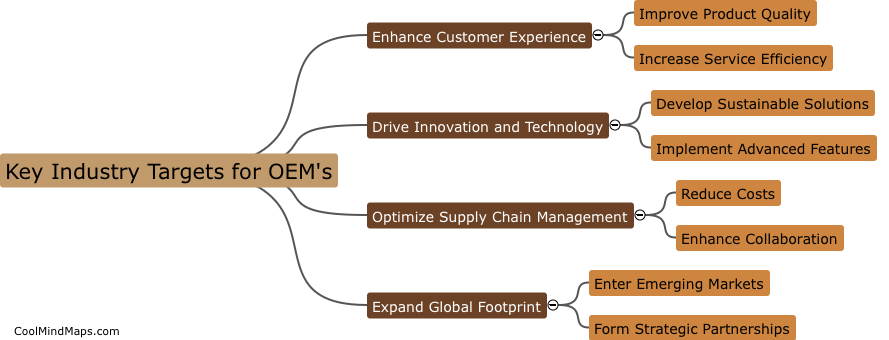

In credit markets, assets are managed through a combination of analysis, risk assessment, and investment strategies. Asset managers will typically evaluate the credit quality of various securities or loans, and make decisions on how to allocate capital based on their assessment of the potential return and risk associated with each asset. This process involves monitoring market conditions, staying abreast of relevant economic news, and adjusting portfolios as needed to optimize performance and manage risk. Additionally, asset managers may use diverse investment tools such as derivatives, hedging techniques, and structured products to enhance returns and mitigate downside risk in credit markets.

This mind map was published on 31 July 2024 and has been viewed 71 times.