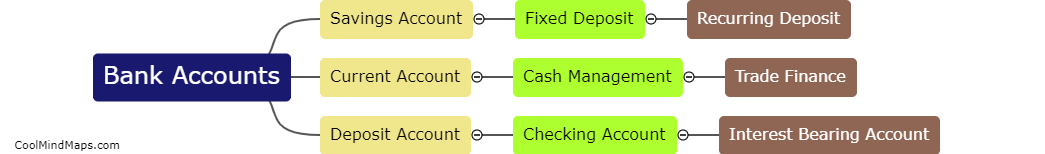

Types of bank accounts

There are several types of bank accounts available to individuals, each with its own features and benefits. Checking accounts are the most widely used type of account and are used for daily transactions such as bill payments and purchases. Savings accounts, on the other hand, are designed for long-term saving and earning interest. Money market accounts offer higher interest rates than savings accounts but require a higher minimum balance. Certificate of Deposits (CDs) are another option for saving money, and they usually have higher interest rates but cannot be withdrawn until the end of the term. Other types of accounts include joint accounts, trust accounts, and business accounts. It is important to understand the differences between these types of accounts to choose the best option for your financial needs.

This mind map was published on 24 June 2023 and has been viewed 107 times.