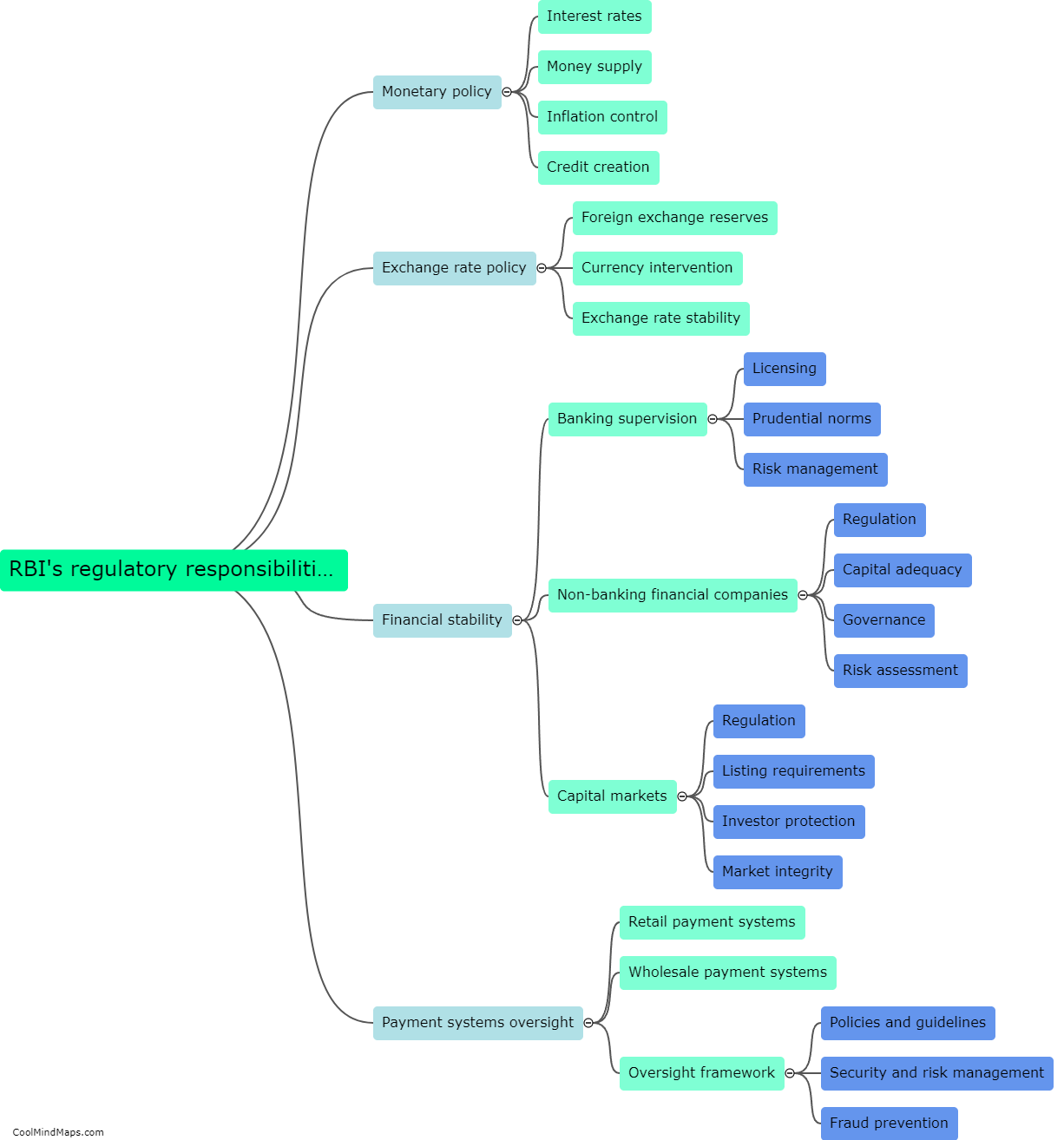

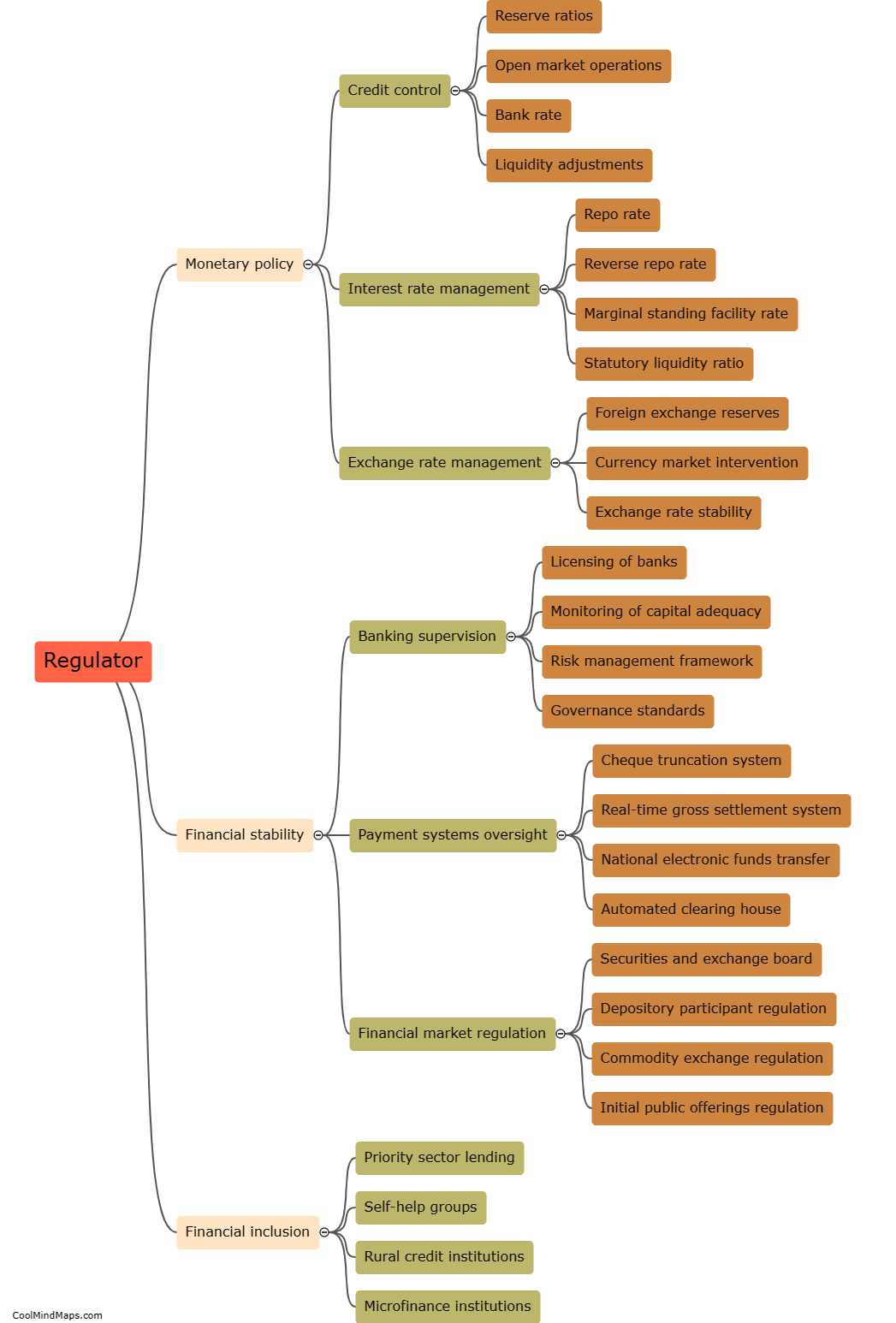

What functions does RBI perform as a regulator?

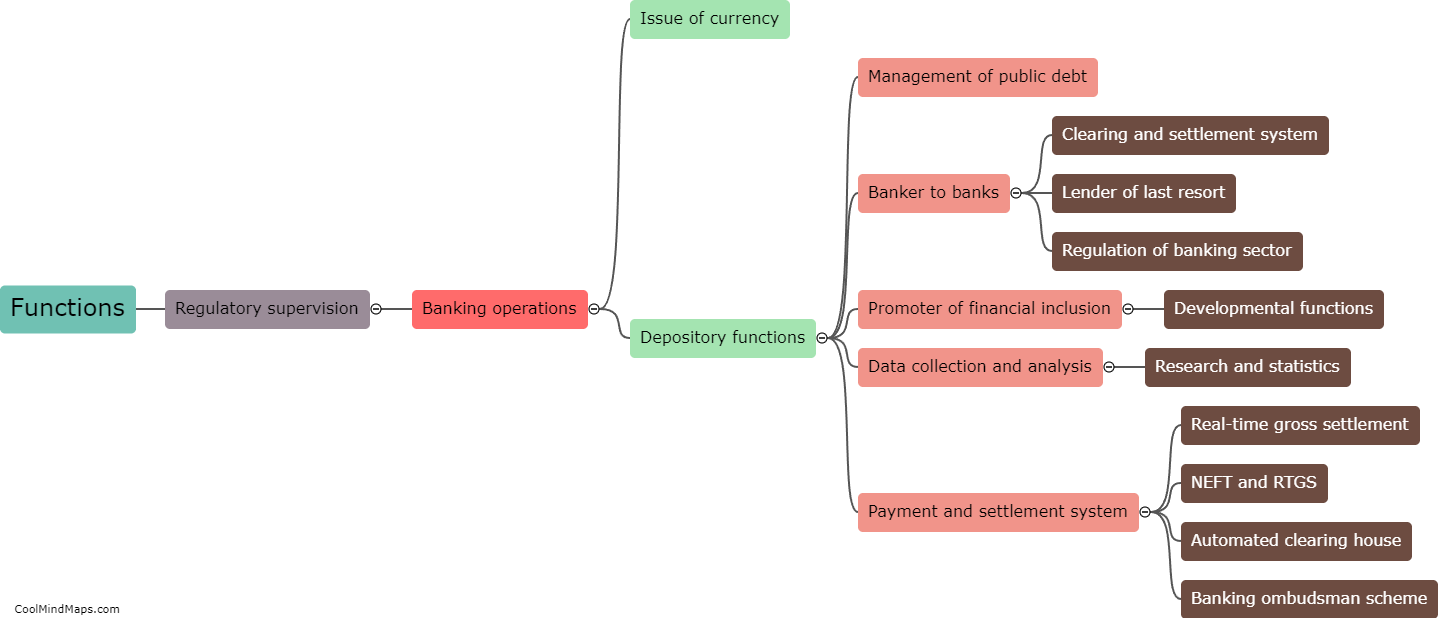

As the regulatory authority for the banking and financial sector in India, the Reserve Bank of India (RBI) performs various crucial functions to ensure the stability and integrity of the financial system. Firstly, RBI formulates and implements monetary policies to control inflation and foster economic growth. It supervises and regulates banks and other financial institutions to maintain the safety and soundness of the banking system. Additionally, RBI enforces rules and regulations related to foreign exchange management, credit control, and payment systems. It also performs the role of a lender of last resort, providing liquidity support to banks during times of financial distress. Overall, RBI serves as a regulator by protecting the interests of depositors, maintaining financial stability, and promoting a healthy and vibrant economy.

This mind map was published on 2 October 2023 and has been viewed 131 times.