How do financial markets function?

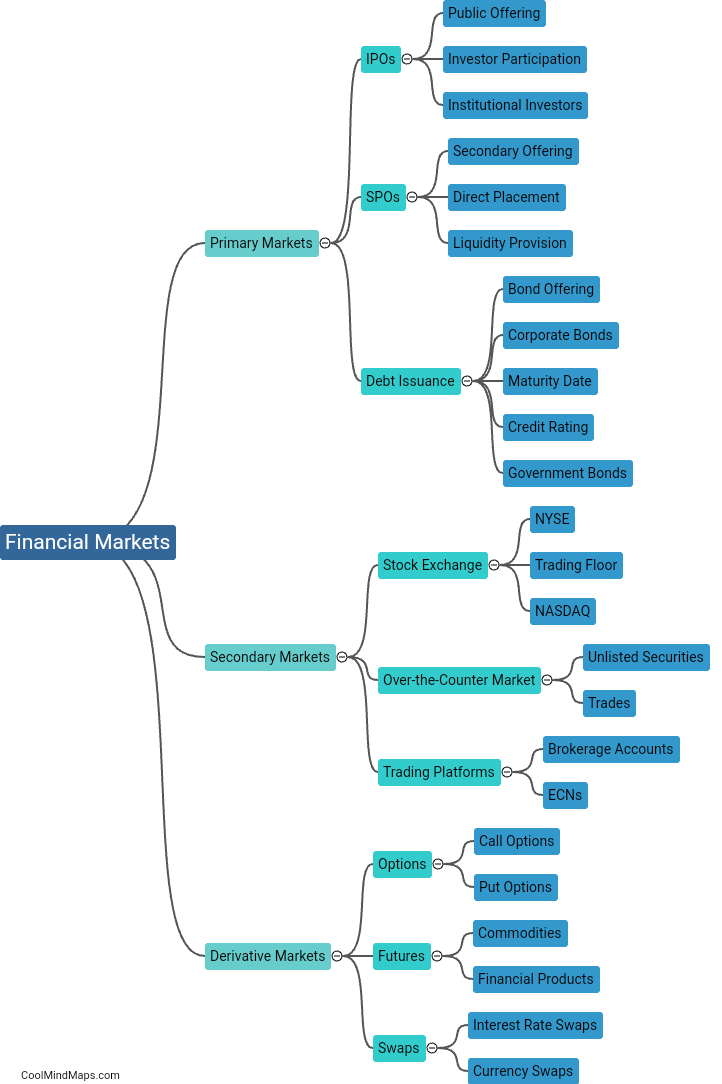

Financial markets function as intermediaries between buyers and sellers, facilitating the exchange of financial assets such as stocks, bonds, currencies, and commodities. They provide a platform where participants can buy and sell these assets based on market supply and demand. Financial markets play a vital role in determining the price of assets and allocating capital efficiently. The two main types of financial markets are primary markets, where new securities are issued and sold directly by the issuer to investors, and secondary markets, where already issued securities are bought and sold among investors. These markets are regulated and facilitated by various institutions, including stock exchanges, investment banks, brokerages, and regulatory authorities, ensuring transparency and fair trading practices. Innovation and advancements in technology have further enabled financial markets to function globally, connecting investors and traders from various regions and time zones.

This mind map was published on 21 January 2024 and has been viewed 87 times.