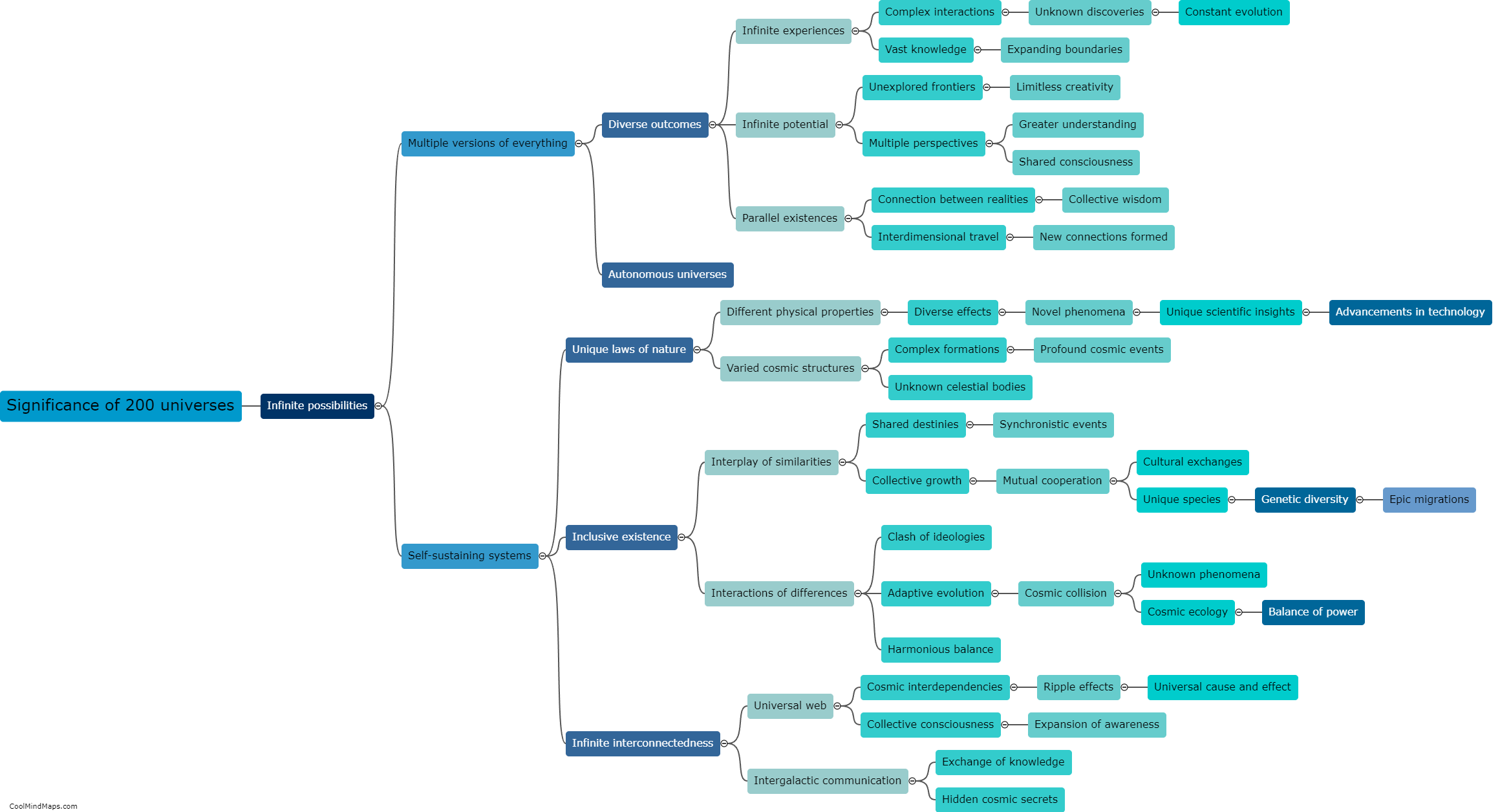

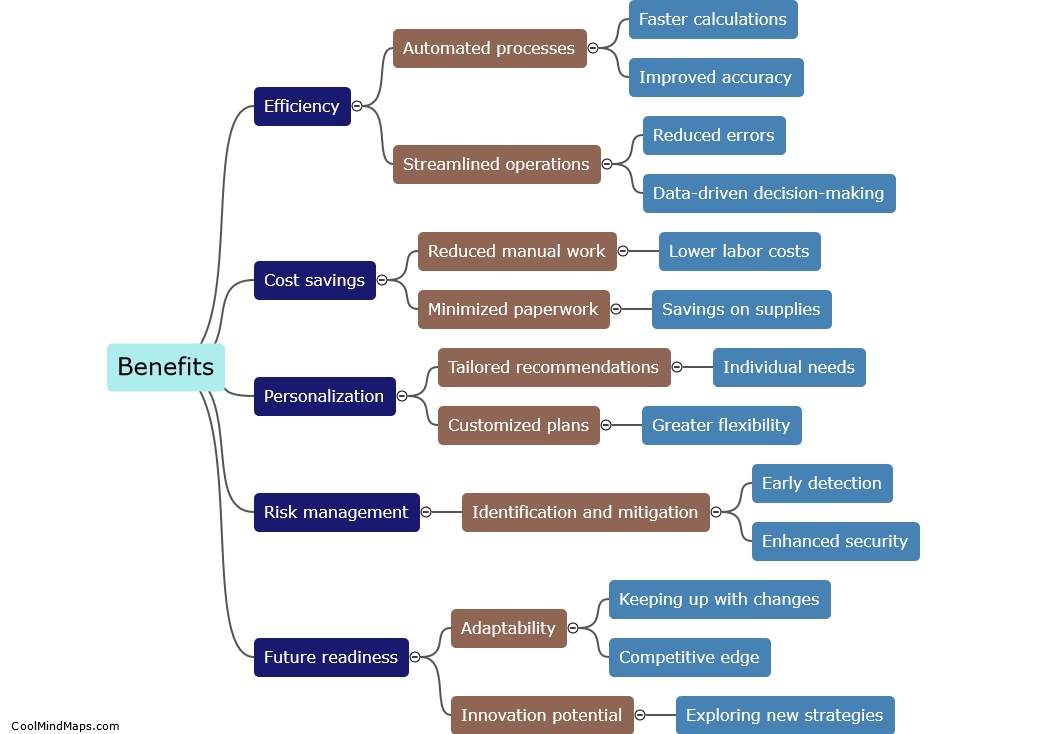

How can artificial intelligence improve pension fund management?

Artificial intelligence (AI) has the potential to significantly enhance pension fund management. By leveraging AI, pension fund managers can make more accurate predictions and better decisions regarding investment strategies, risk assessment, and portfolio management. AI algorithms can analyze vast amounts of financial data from various sources in real-time, enabling identification of patterns, trends, and anomalies that may not be easily discernible through manual analysis. This technology can enable pension fund managers to optimize asset allocation, improve risk management, and enhance overall investment performance. Additionally, AI-powered chatbots and virtual assistants can provide personalized advice and support to pension fund members, improving communication and engagement while increasing operational efficiency. Overall, AI has the ability to transform pension fund management by enhancing decision-making, mitigating risks, and ultimately helping to secure a more secure retirement for individuals.

This mind map was published on 5 December 2023 and has been viewed 102 times.