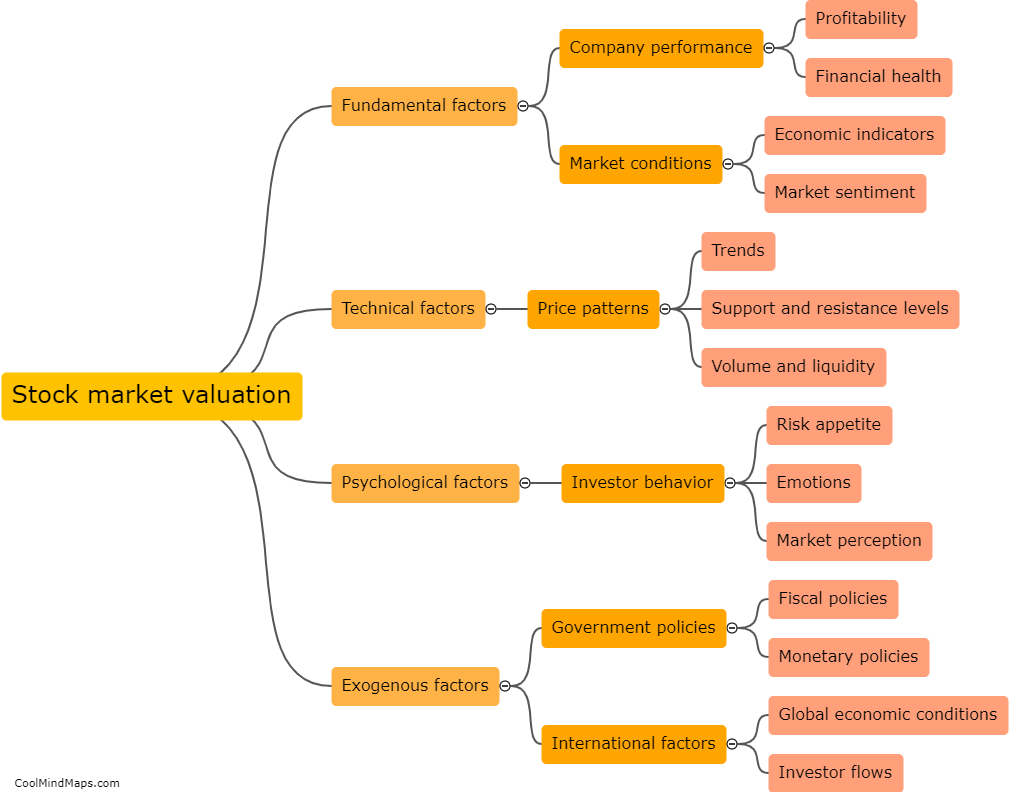

What factors influence the valuation of a stock market?

The valuation of a stock market is influenced by a multitude of factors. Firstly, the overall performance of the economy plays a significant role. A strong economy, characterized by high employment rates, robust GDP growth, and low inflation, generally leads to higher stock market valuations. Secondly, interest rates and monetary policy impact stock market valuations. Lower interest rates stimulate economic growth and increase investor confidence, thereby raising stock prices. Thirdly, corporate earnings and profitability are crucial determinants of stock market valuations. Strong earnings growth, positive cash flows, and good profit margins tend to drive stock prices higher. Additionally, market sentiment and investor behavior also influence stock valuations. Positive sentiment and high investor confidence can lead to a market rally, boosting stock prices. Finally, geopolitical events, such as political instability, trade tensions, and natural disasters, can significantly impact the valuation of a stock market.

This mind map was published on 11 February 2024 and has been viewed 90 times.