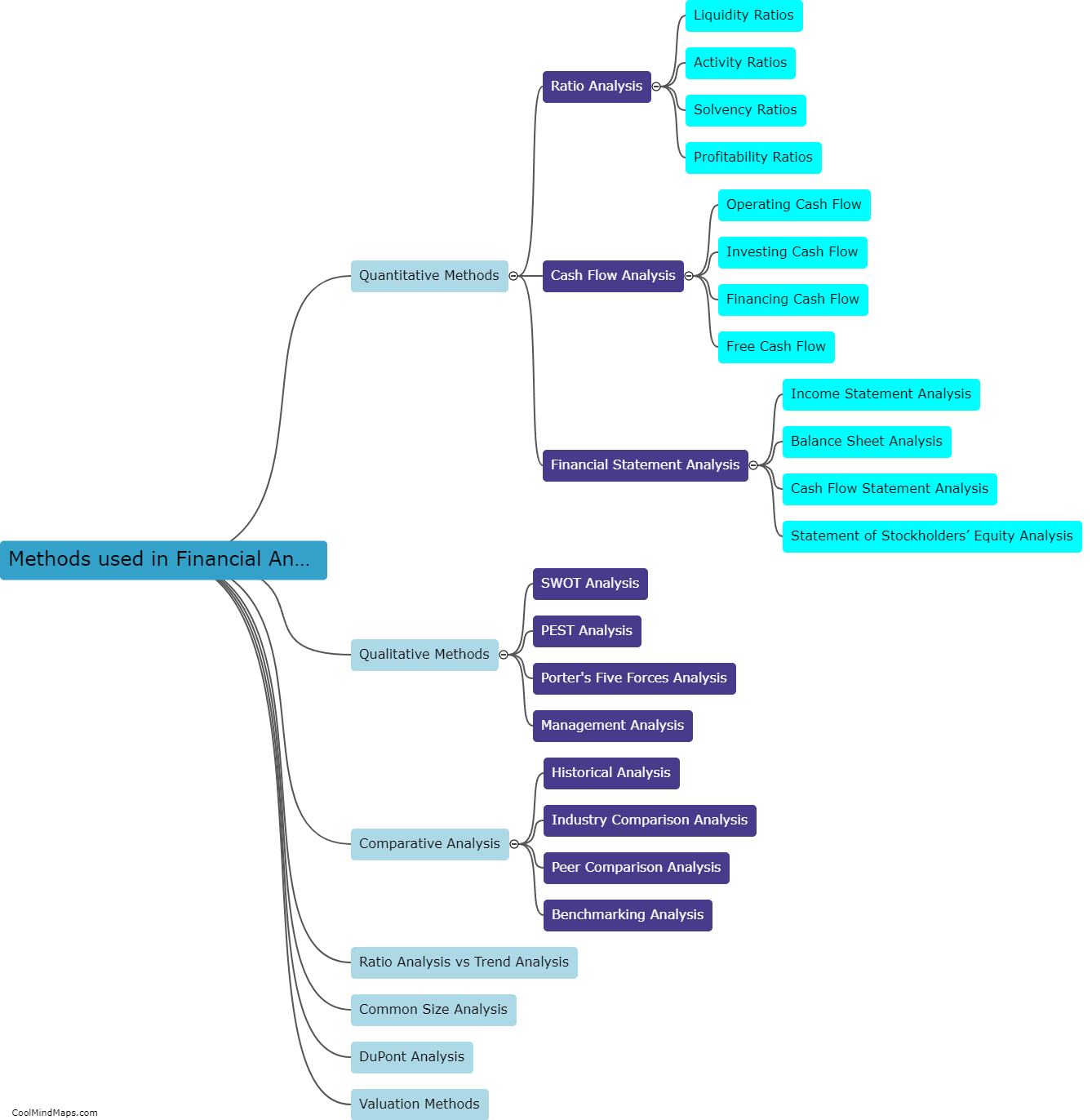

What are the different methods used in financial analysis?

Financial analysis is a crucial aspect of assessing the performance and health of a company. There are several different methods used in financial analysis to evaluate various aspects of a business. These methods include ratio analysis, which involves determining relationships between different financial variables to measure profitability, liquidity, and financial stability. Another method is trend analysis, which involves analyzing financial data over a period of time to identify patterns and trends. Additionally, financial statement analysis involves examining income statements, balance sheets, and cash flow statements to assess an organization's financial position. Finally, benchmarking compares a company's financial performance to industry standards or competitors to gauge its relative standing. By utilizing these various methods, financial analysts can gain insights into a company's financial health and make informed decisions.

This mind map was published on 19 September 2023 and has been viewed 108 times.