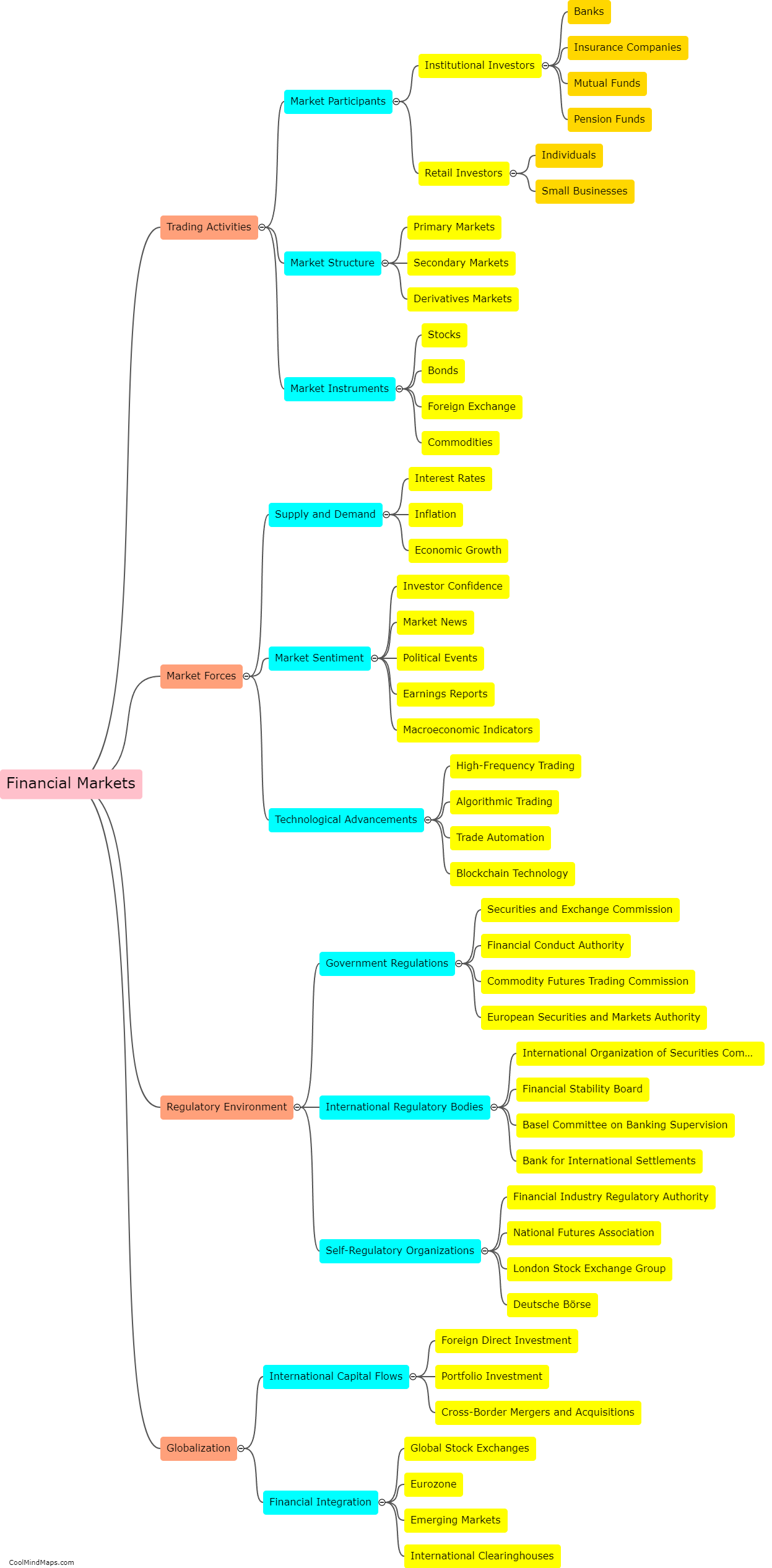

Can time-varying relationships in financial markets be predicted or modeled?

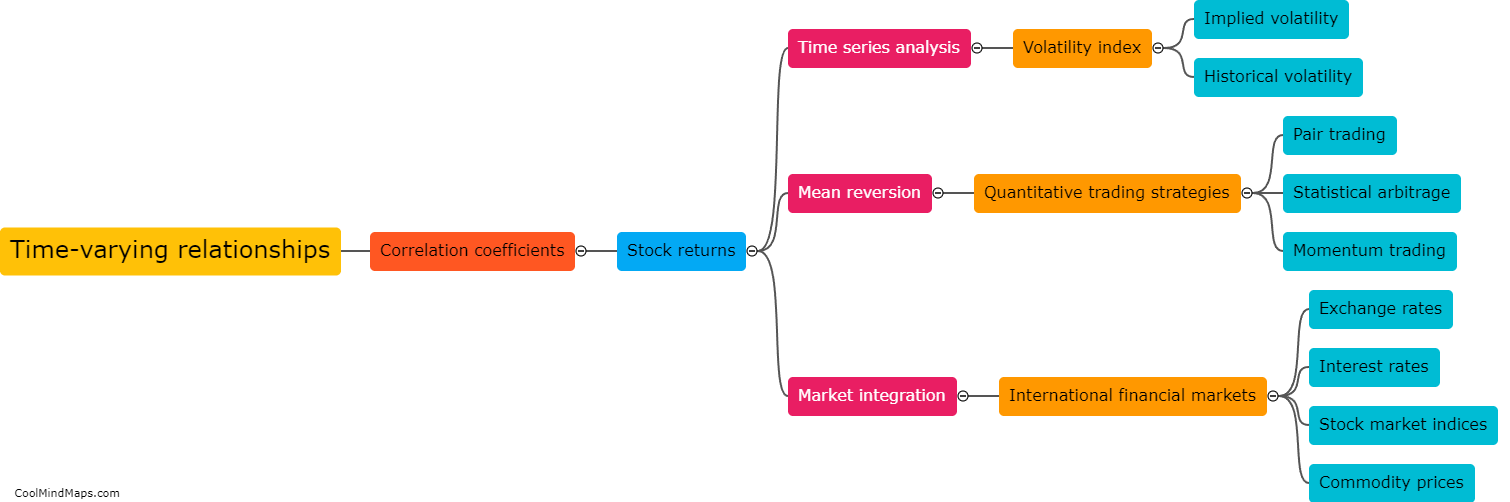

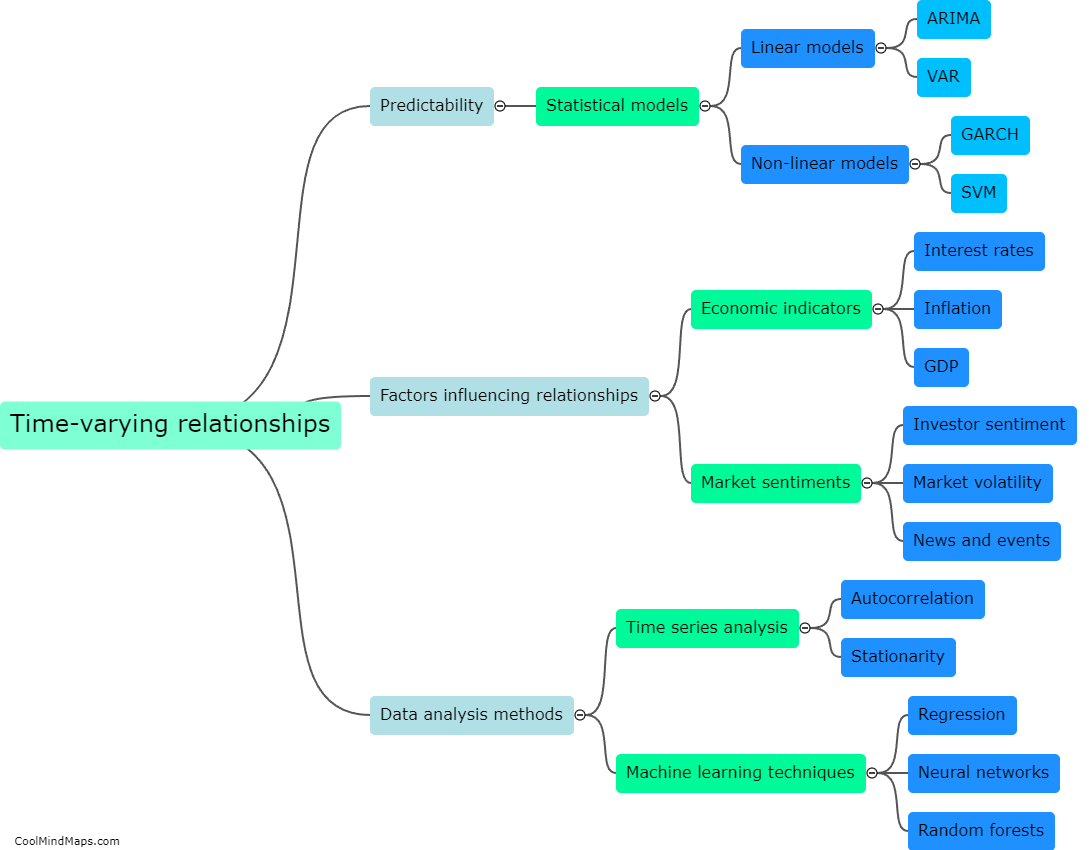

Time-varying relationships in financial markets refer to the changing patterns and dynamics between different assets or variables over time. Predicting or modeling these relationships is a challenging task as financial markets are complex and influenced by numerous factors. However, various techniques and models have been developed to identify and capture these time-varying relationships. These methodologies include statistical models, econometric methods, and machine learning algorithms. While no model can predict market movements with certainty, these approaches aim to provide useful insights and predictions based on historical data and patterns. Nonetheless, the constant evolution and unpredictability of financial markets make it difficult to accurately forecast time-varying relationships, highlighting the need for continuous adaptation and refinement of models and techniques.

This mind map was published on 22 December 2023 and has been viewed 94 times.