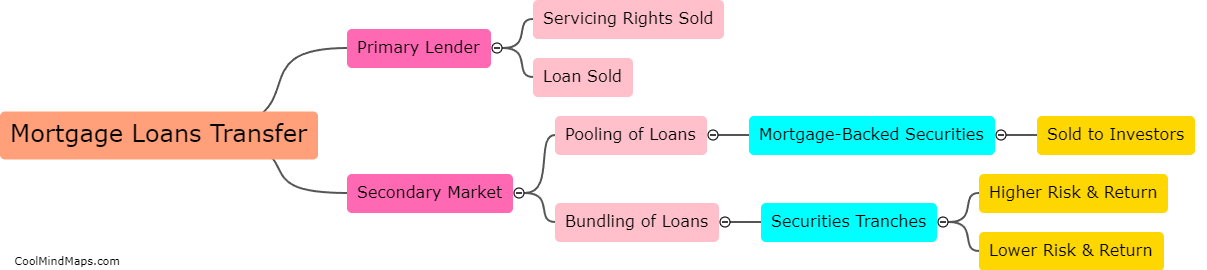

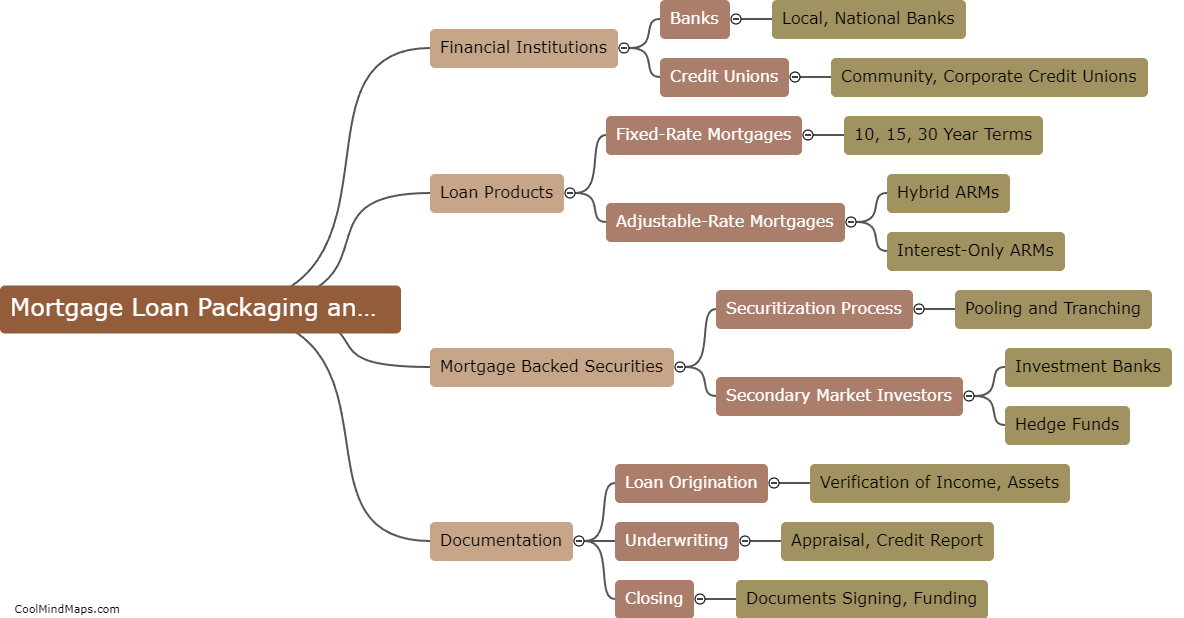

Who are involved in secondary market?

The secondary market involves various groups of participants, including individual investors, institutional investors, stockbrokers, market makers, investment banks, and stock exchanges. These players engage in buying and selling securities, such as stocks, bonds, and mutual funds, from existing owners rather than from the issuing company. The secondary market provides a platform where investors can trade securities, increase liquidity, and price discovery. The involvement of various groups of participants in the secondary market enables investors to access investment opportunities and realize returns based on the securities' market value.

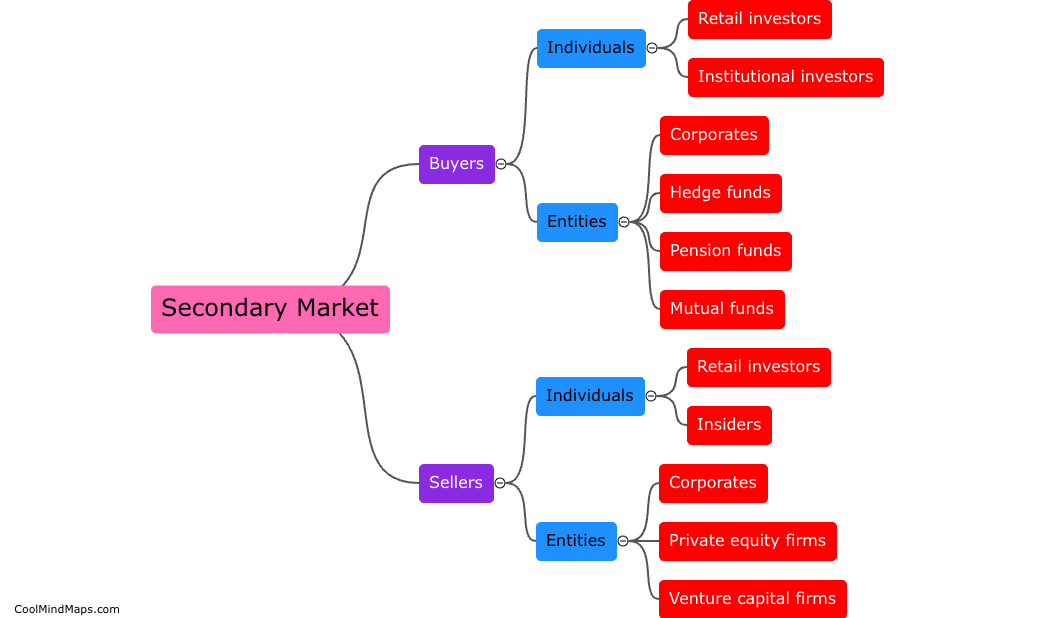

This mind map was published on 28 May 2023 and has been viewed 98 times.