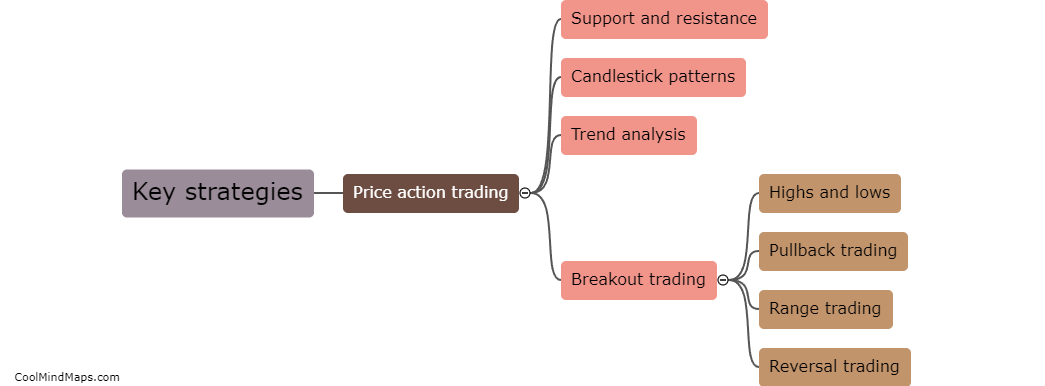

What are the key strategies of price action trading?

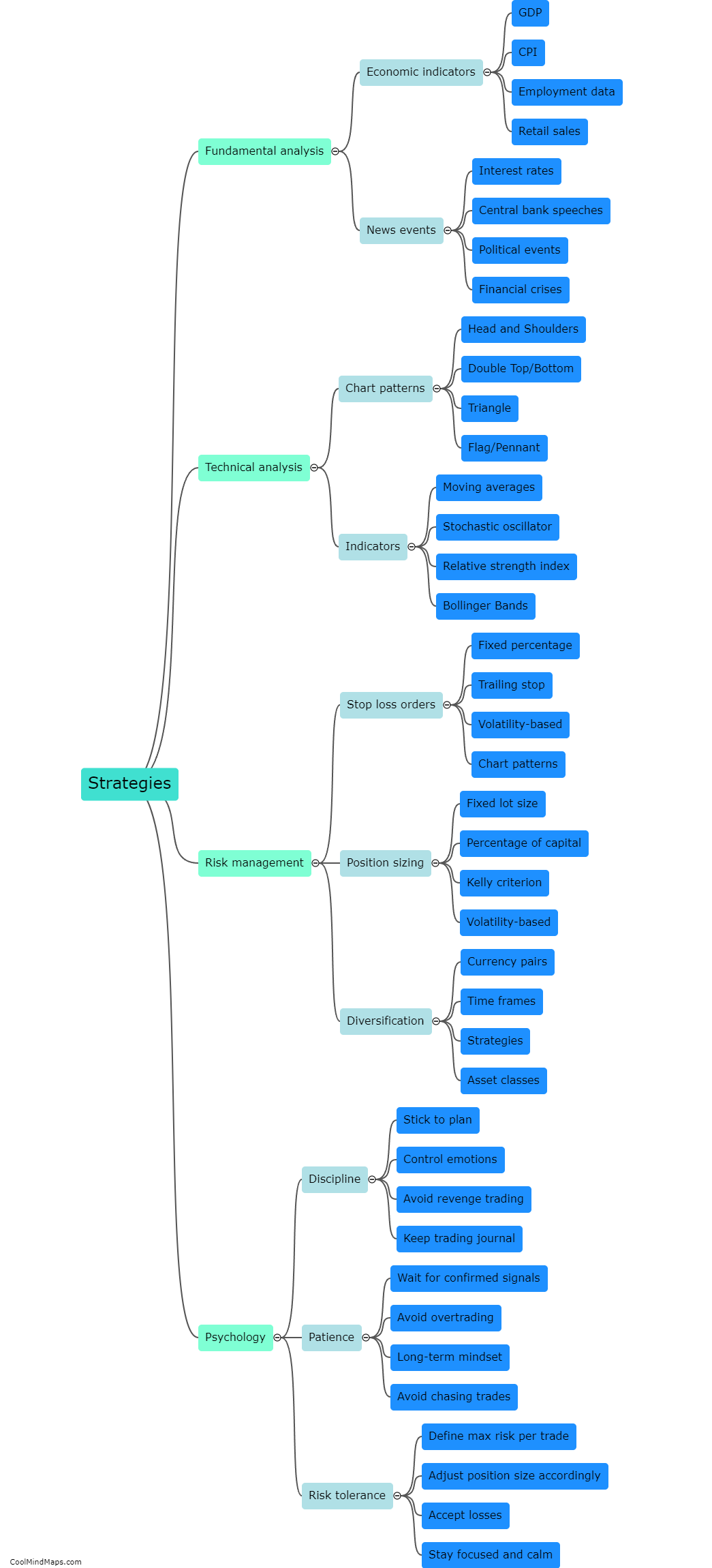

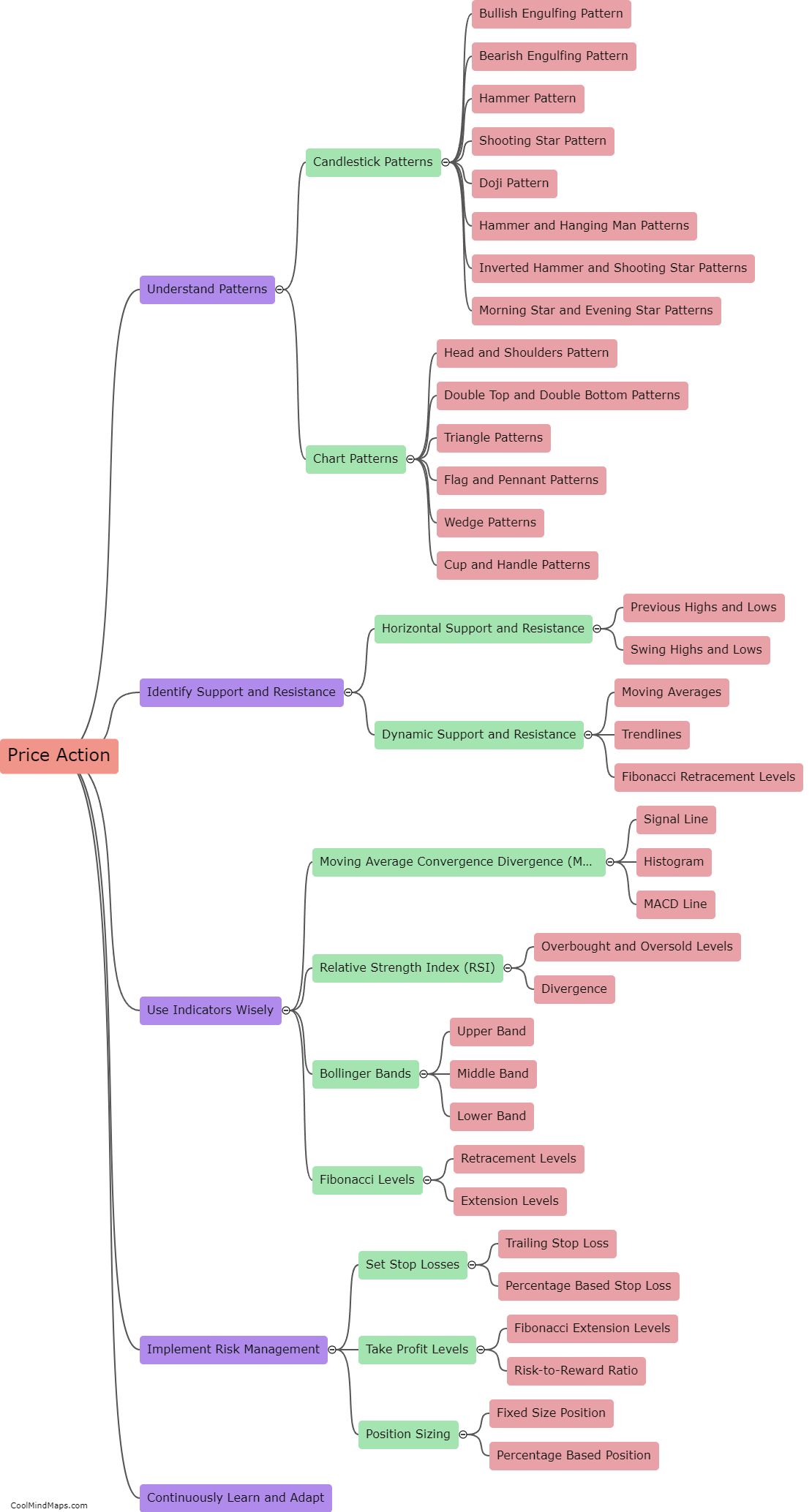

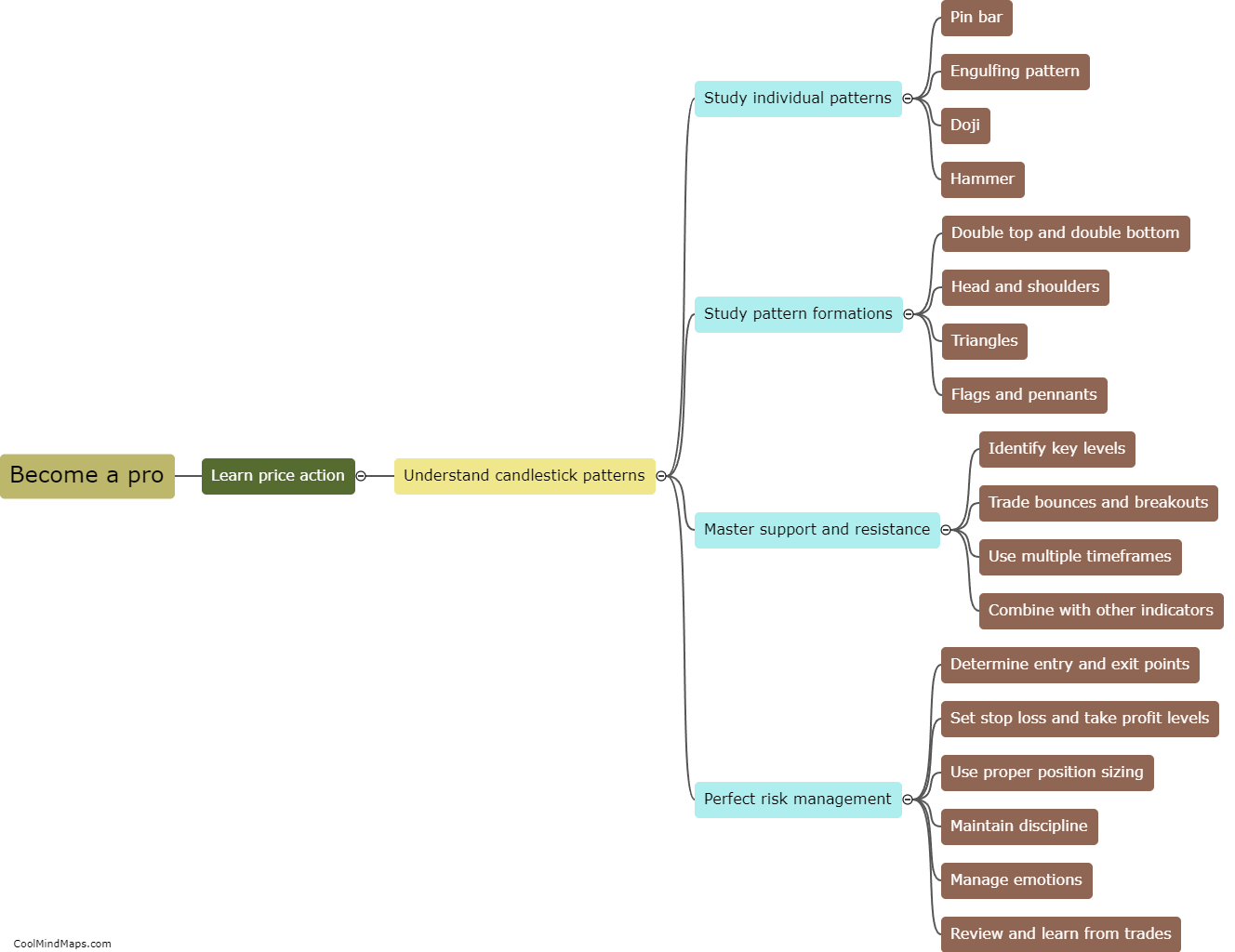

Price action trading is a strategy that focuses on analyzing the actual movements of price on a chart, rather than relying on indicators or technical analysis. Some of the key strategies of price action trading include identifying key support and resistance levels, analyzing candlestick patterns, and understanding price patterns such as trends and ranges. By carefully observing and interpreting price movements, traders can make informed decisions about when to enter or exit trades. Additionally, incorporating risk management techniques, such as setting stop-loss orders and trailing stops, is crucial in price action trading to protect against potential losses. Ultimately, the main objective of price action trading is to make trading decisions based on the current and historical price movements, allowing traders to potentially profit from market trends and reversals.

This mind map was published on 10 October 2023 and has been viewed 89 times.