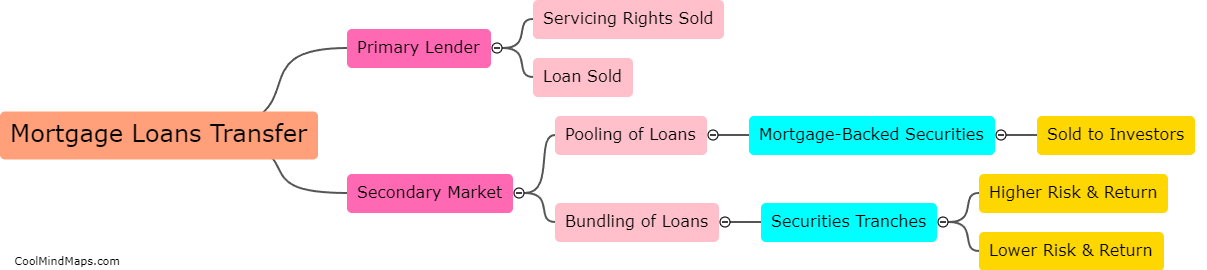

How does technology impact secondary mortgage markets?

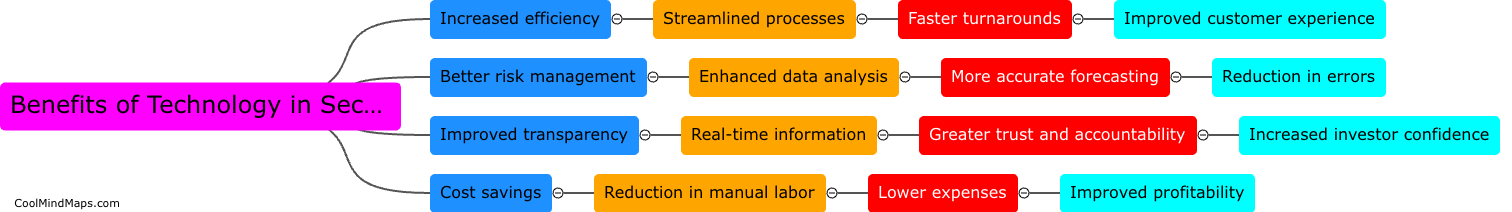

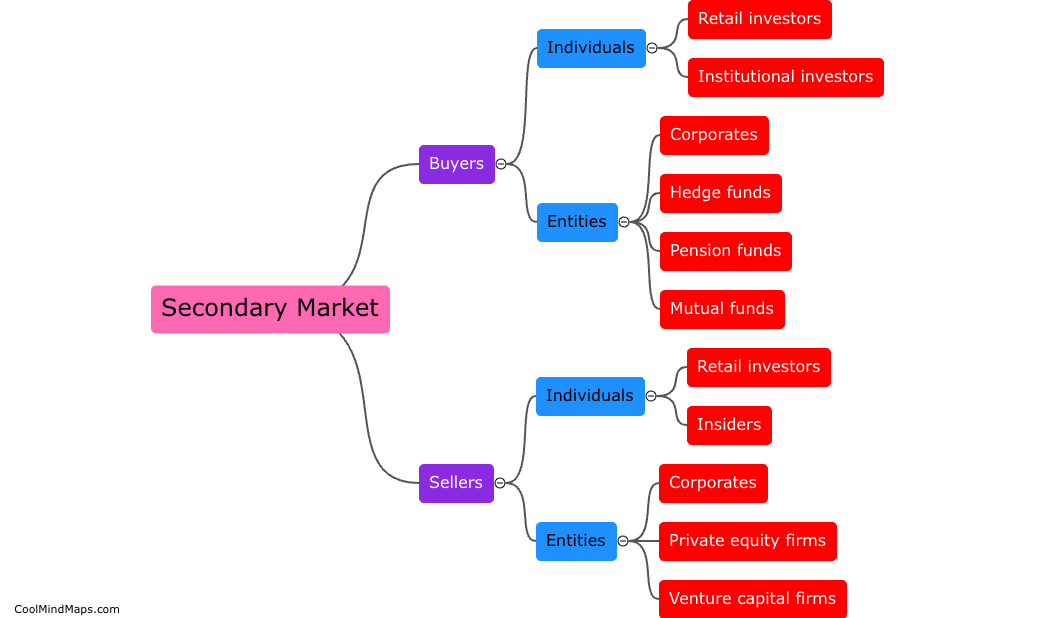

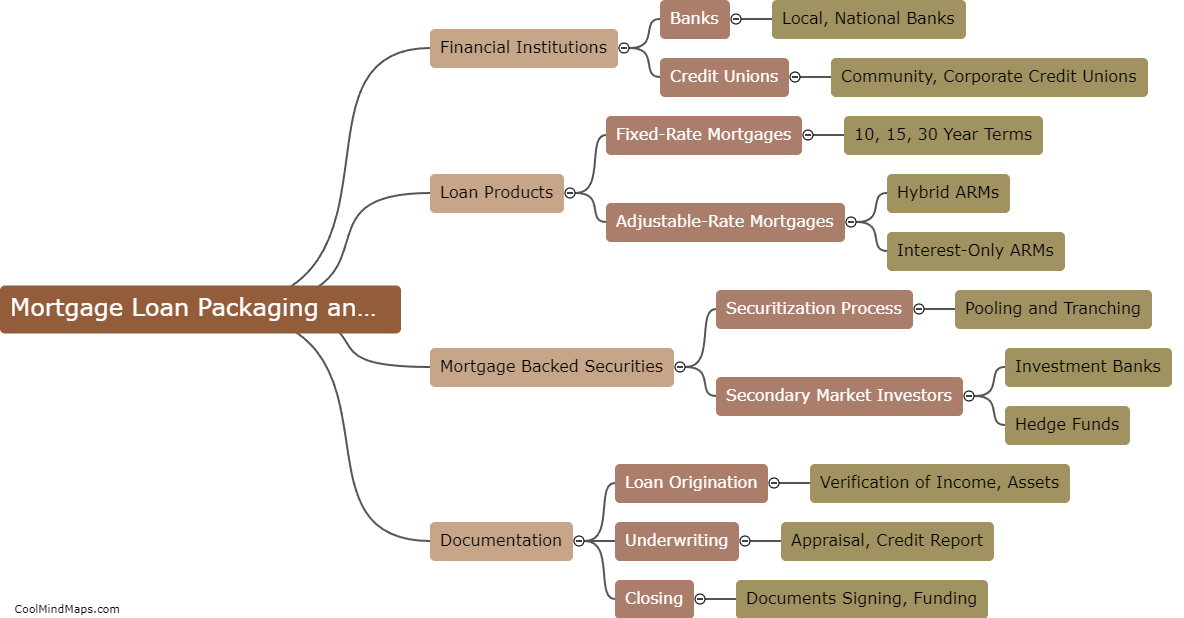

Technology has significantly transformed the way secondary mortgage markets operate. With the advent of digital platforms, mortgage sellers and buyers can connect more efficiently, and transactions can be completed at a faster pace. Technology has also enabled the creation of complex financial instruments, such as mortgage-backed securities (MBS), which has increased liquidity and created new investment opportunities. However, technology has also introduced new risks, including cyber threats and fraud, which must be mitigated to maintain the stability of secondary mortgage markets. Overall, technology has played a pivotal role in shaping and revolutionizing the functioning of the secondary mortgage markets.

This mind map was published on 28 May 2023 and has been viewed 99 times.