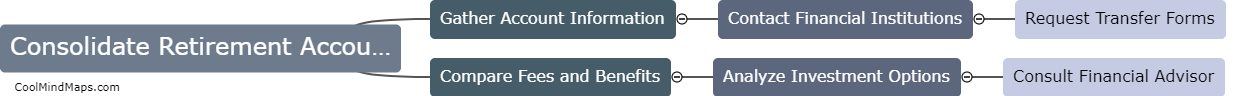

How to consolidate multiple retirement accounts into one?

Consolidating multiple retirement accounts into one can help simplify your financial portfolio and make it easier to track and manage your retirement savings. To consolidate your accounts, start by gathering information on all of your existing retirement accounts, including their balances, investment options, and fees. Next, choose a single financial institution or brokerage firm to roll over your accounts into. Make sure to consider factors such as investment options, fees, and customer service when selecting a new account. Finally, initiate the rollover process by contacting the financial institution holding your current accounts and completing any necessary paperwork or online forms to transfer the funds. Be sure to follow proper rollover procedures to avoid any penalties or taxes on the transfer.

This mind map was published on 31 July 2024 and has been viewed 49 times.