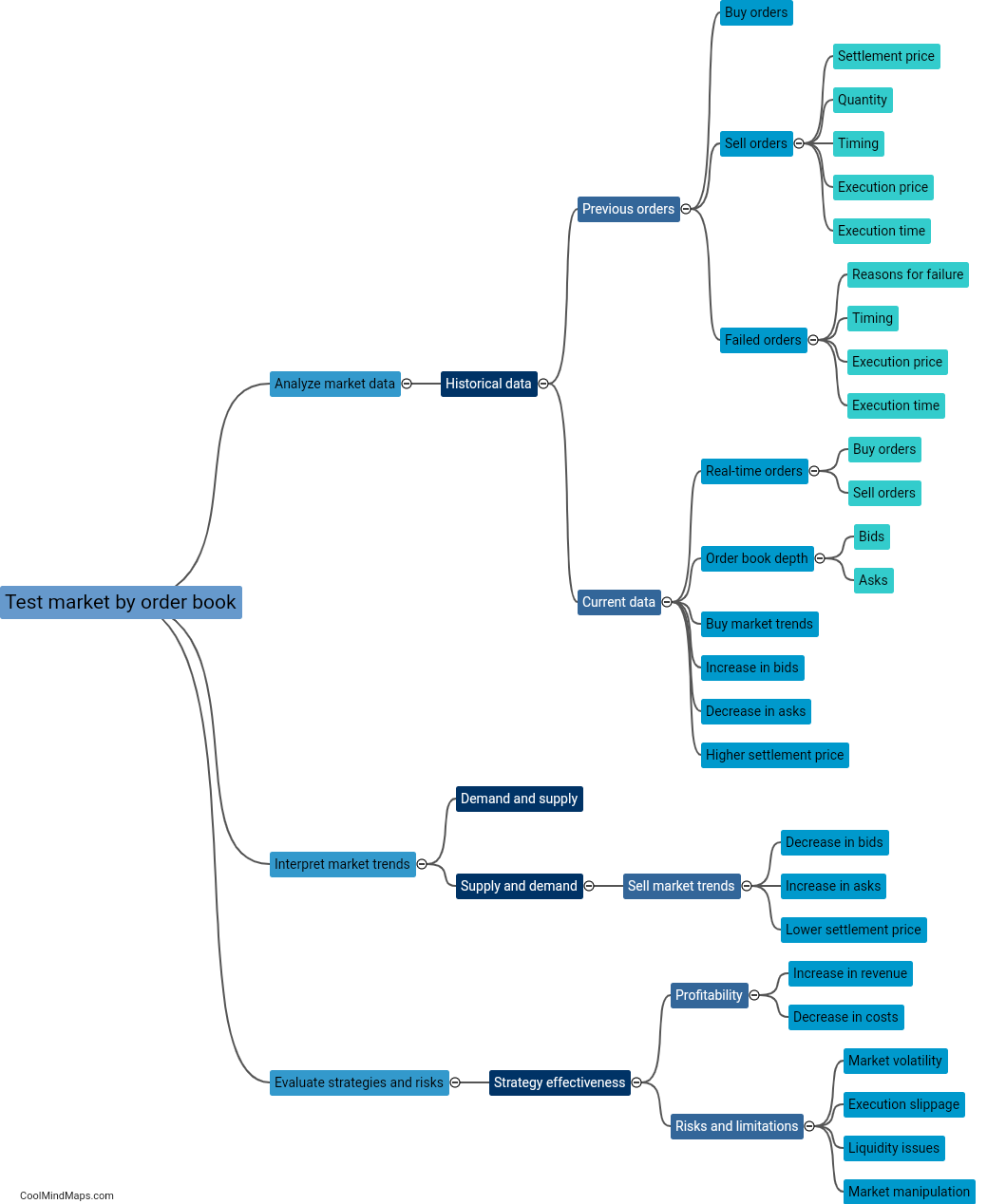

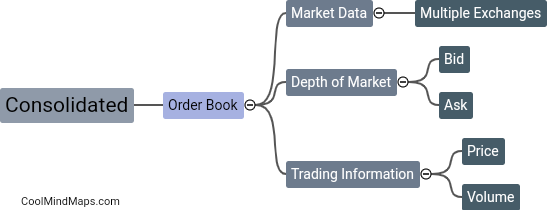

What is a consolidated order book?

A consolidated order book refers to a centralized record of all the buy and sell orders for a particular financial instrument across multiple trading platforms or exchanges. It allows market participants to view and compare the aggregated order flow from different sources, providing a comprehensive picture of the supply and demand dynamics for that instrument. Consolidated order books are particularly useful for traders and investors who want to see the overall market depth, liquidity, and order imbalance at any given time, which can facilitate more informed decision-making. By bringing together orders from various venues, a consolidated order book offers transparency, enhances market efficiency, and promotes fairer trading conditions.

This mind map was published on 11 September 2023 and has been viewed 104 times.