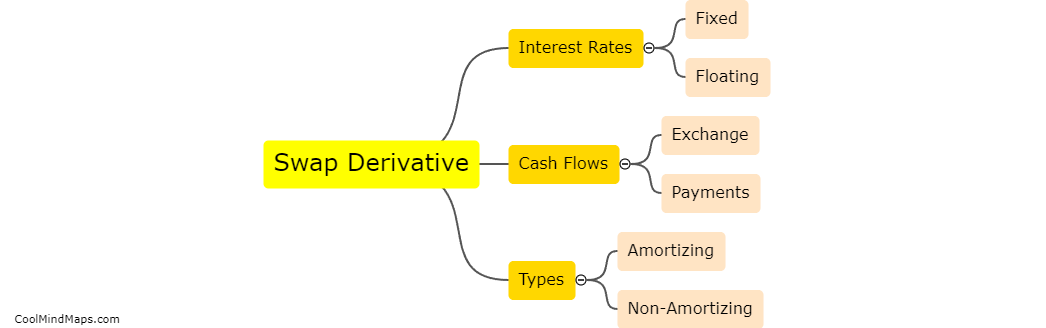

What is a swap derivative?

A swap derivative is a financial contract between two parties where they agree to exchange cash flows based on an underlying asset, such as interest rates, currencies, or commodities. The agreement usually involves a fixed rate payment and a variable rate payment, with the fixed rate payment securing a reliable return for one party while the variable rate payment provides potential gains for the other party. Swap derivatives are often used by investors to manage risk, such as interest rate risk, or to speculate on future market movements.

This mind map was published on 17 May 2023 and has been viewed 112 times.