What are the functions of RBI in maintaining financial stability?

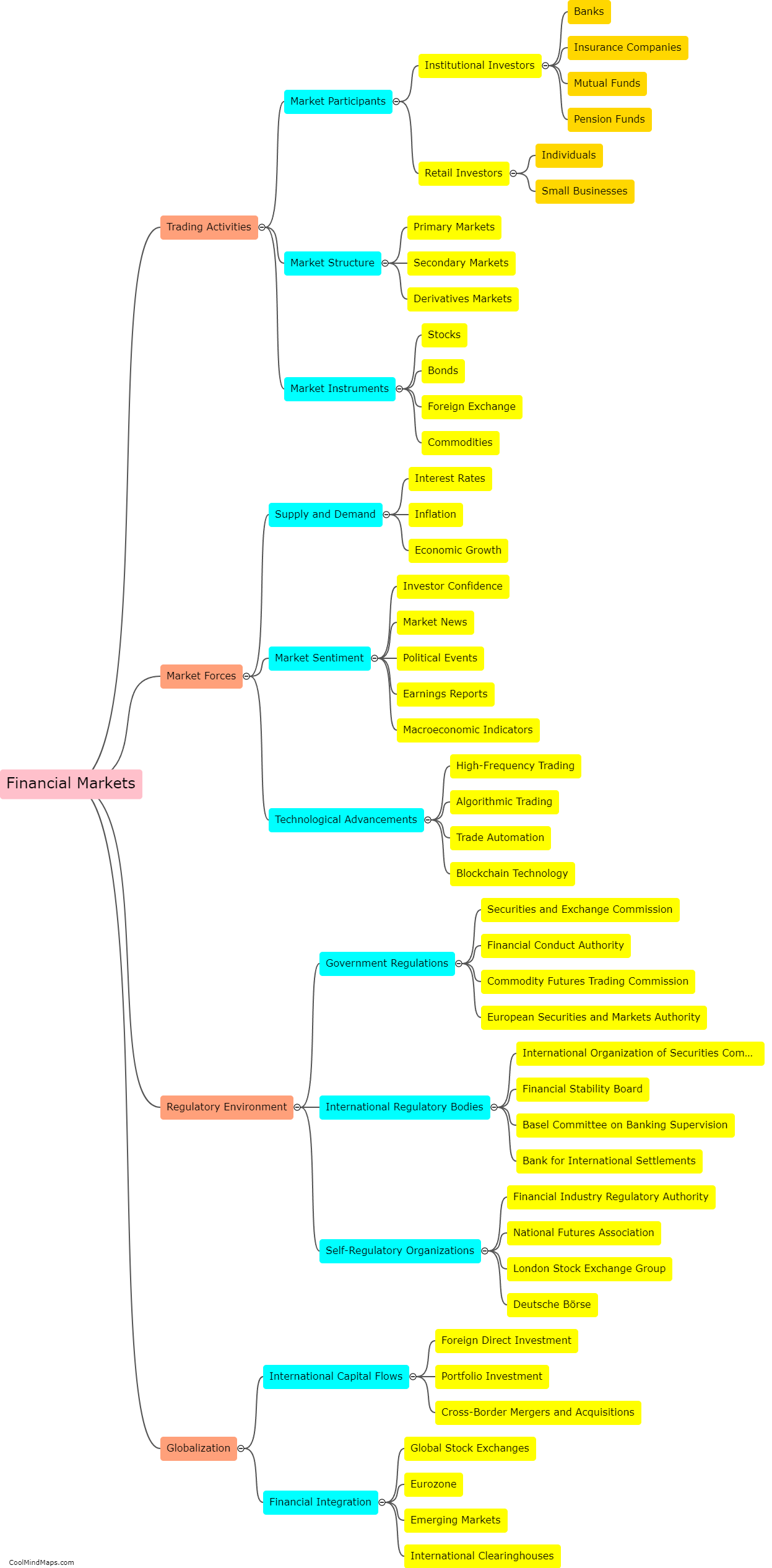

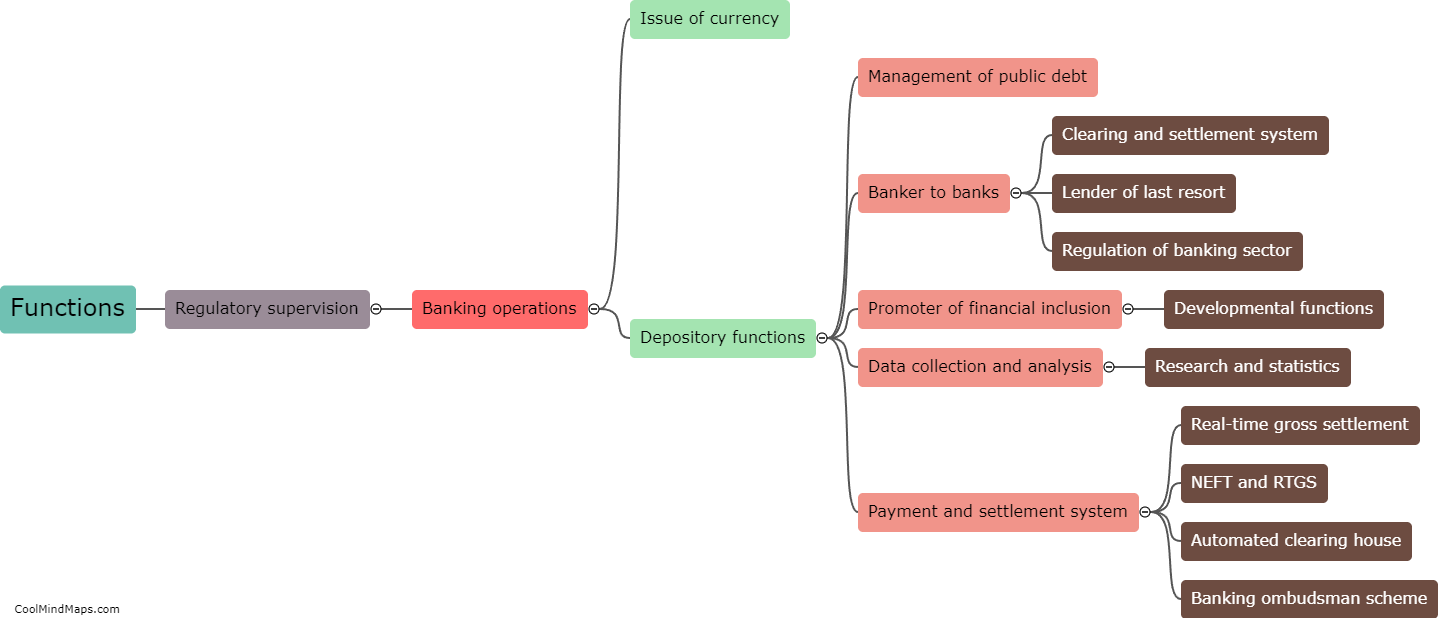

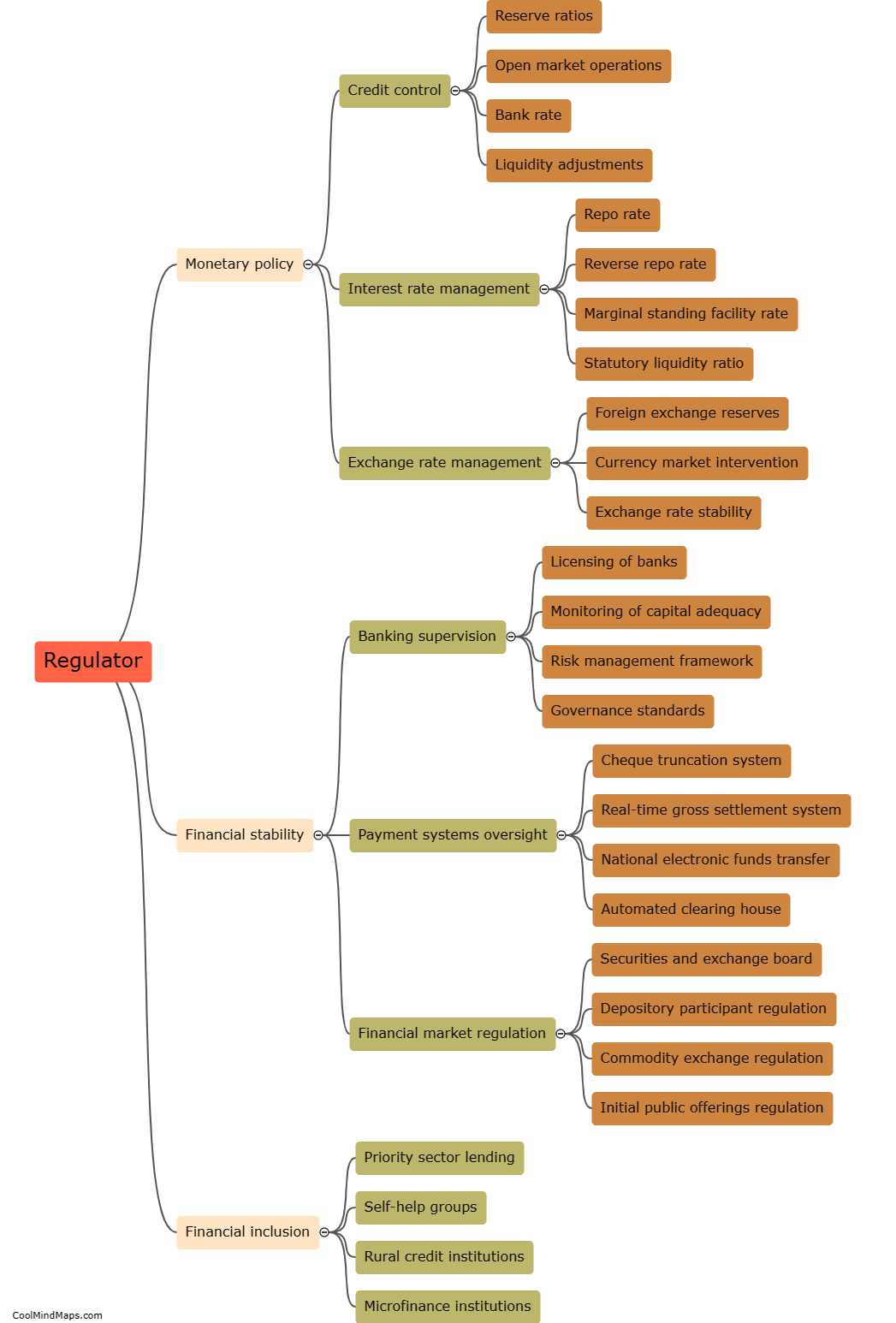

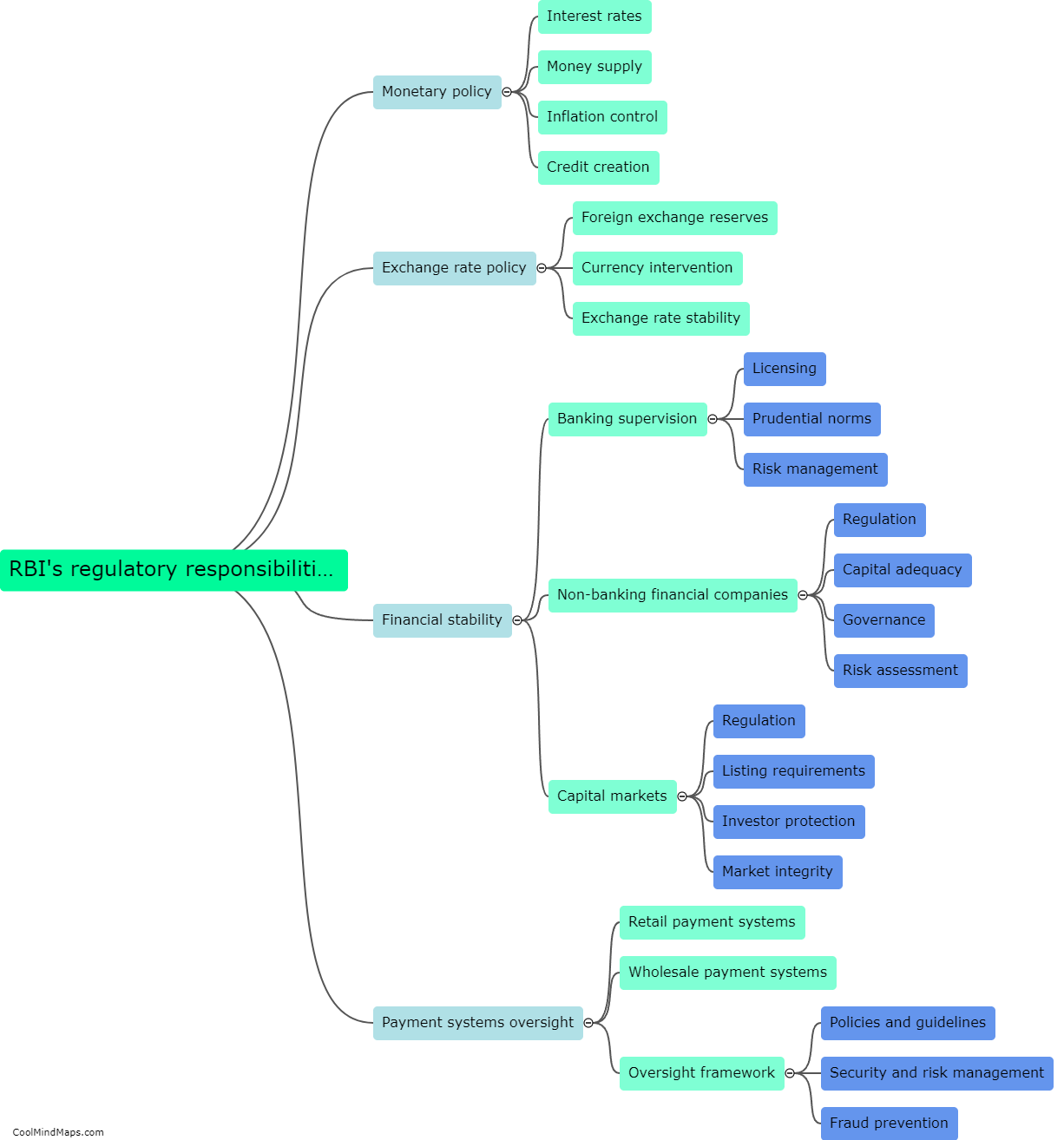

The Reserve Bank of India (RBI) plays a crucial role in maintaining financial stability in the country. One of its key functions is the regulation and supervision of the banking system. The RBI sets and enforces prudential norms to ensure the soundness and stability of banks, including capital adequacy requirements and risk management standards. It also conducts regular inspections and audits to monitor compliance by banks. Additionally, the RBI acts as the lender of last resort, providing liquidity support to banks in times of financial distress and ensuring the stability of the financial system. Furthermore, it formulates and implements monetary policy to control inflation and maintain price stability, which is vital for overall financial stability. Through its various functions, the RBI plays a vital role in safeguarding the stability and integrity of India's financial system.

This mind map was published on 2 October 2023 and has been viewed 97 times.