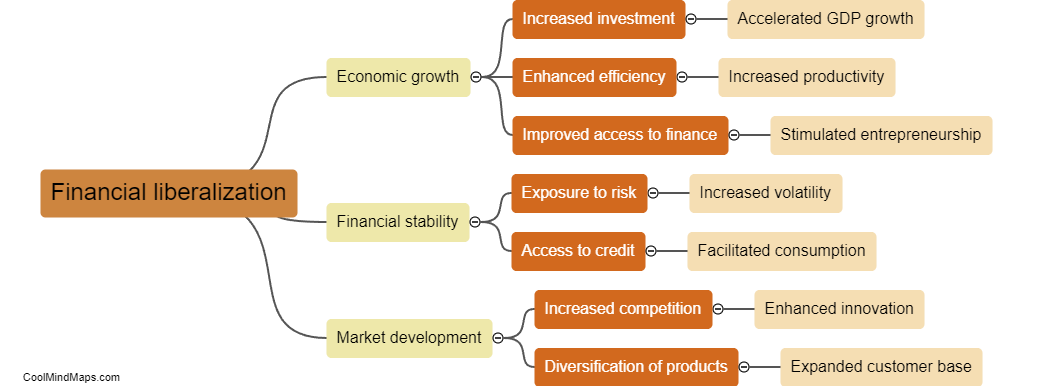

How does financial liberalization impact the economy?

Financial liberalization refers to the process of removing restrictions and regulations on financial markets, allowing for more competition and freedom in the financial sector. This can have both positive and negative impacts on the economy. On one hand, financial liberalization can lead to increased access to credit, greater investment opportunities, and more efficient allocation of capital. This can stimulate economic growth and development. However, financial liberalization can also increase the risk of financial instability, as it may lead to speculative bubbles, excessive risk-taking, and increased volatility in financial markets. As a result, policymakers must strike a balance between promoting financial innovation and safeguarding financial stability when liberalizing the financial sector.

This mind map was published on 21 February 2024 and has been viewed 124 times.