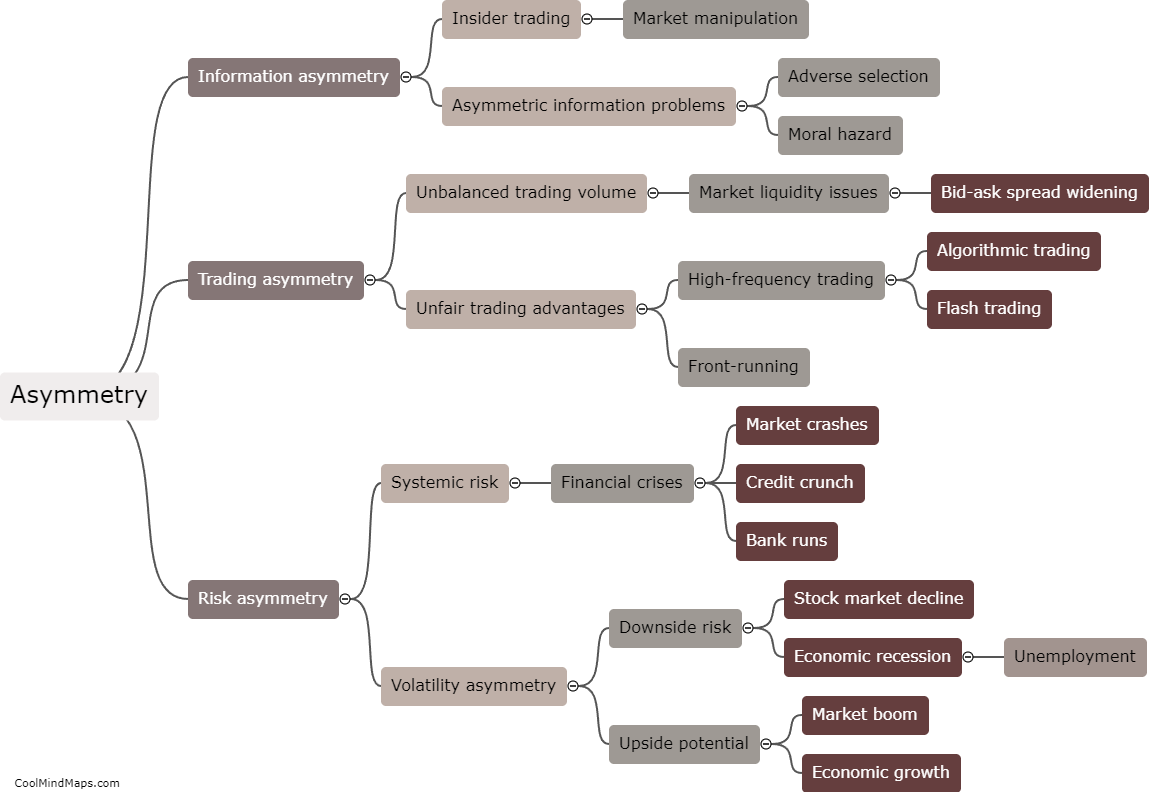

How do asymmetric relationships impact financial markets?

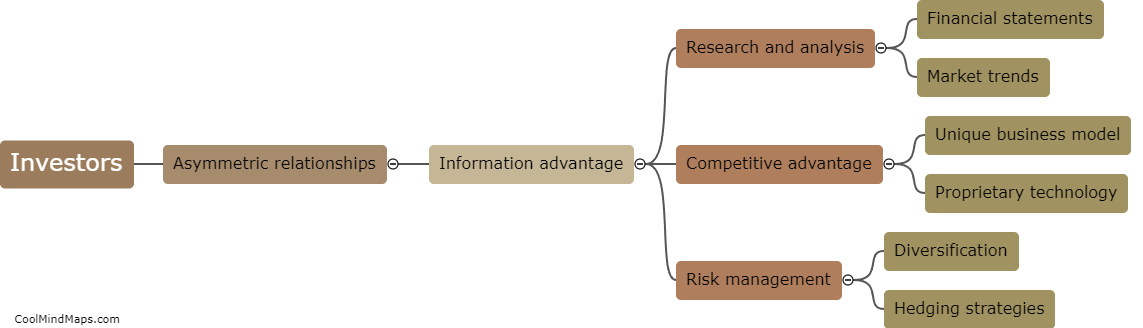

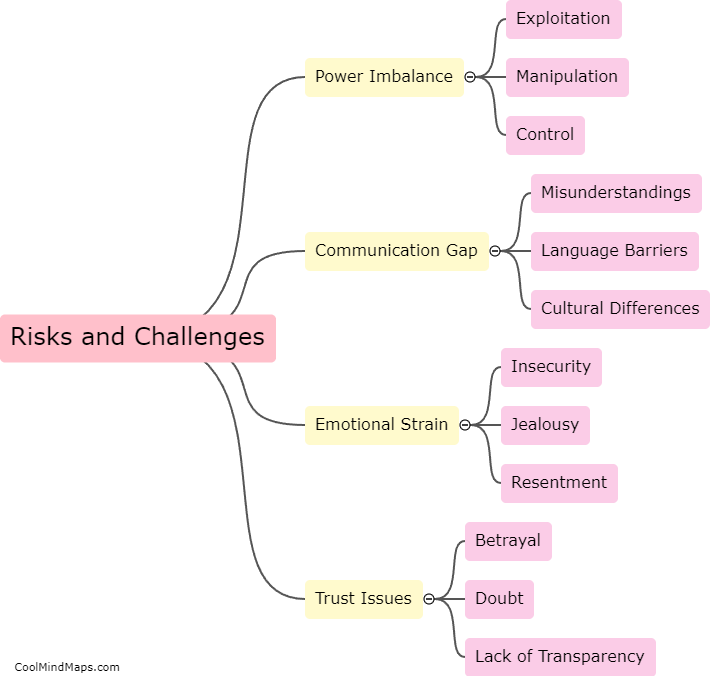

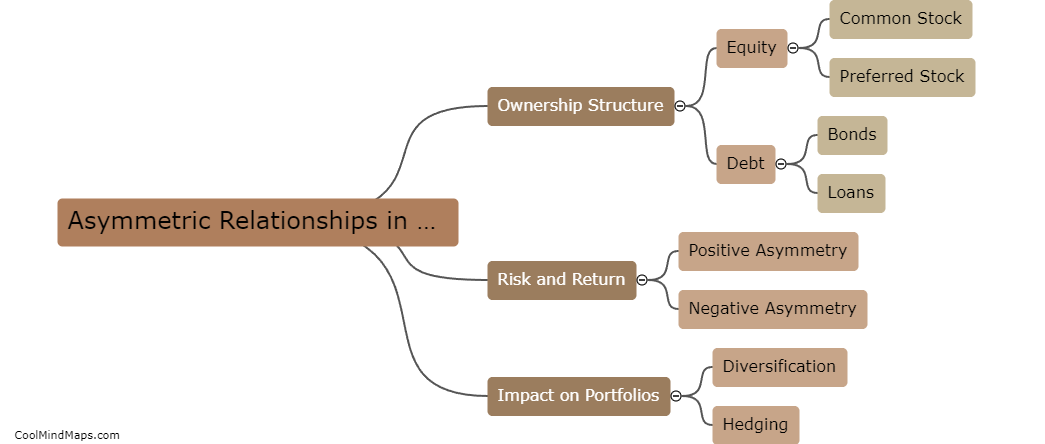

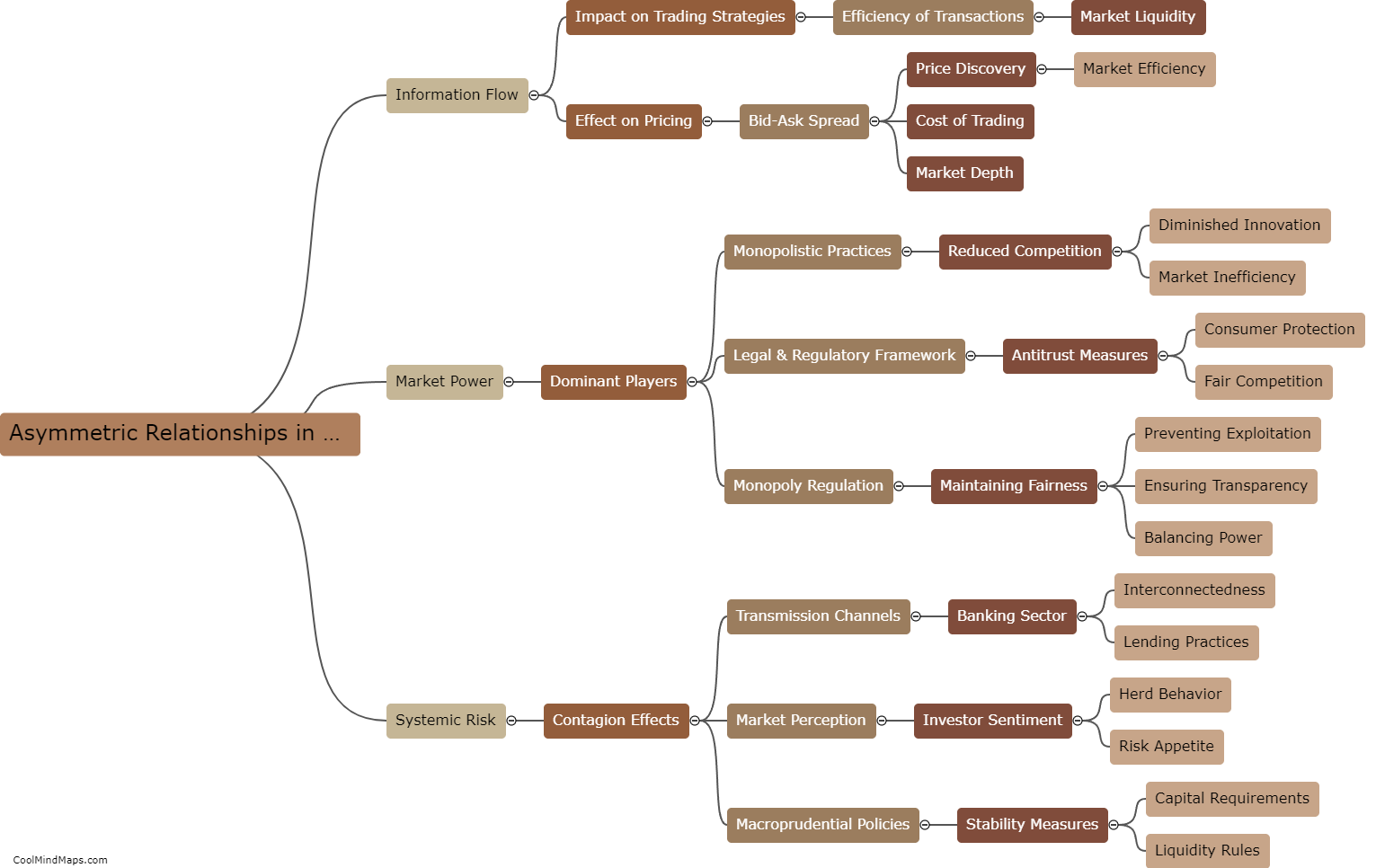

Asymmetric relationships have a significant impact on financial markets as they can create imbalances and distortions in the flow of information, resources, and power. In such relationships, one party possesses more knowledge, expertise, or market dominance than the other, leading to unequal transactions and outcomes. This can result in market inefficiencies, reduced competition, higher transaction costs, and increased vulnerability to financial crises. Investors and market participants may make suboptimal decisions based on incomplete or biased information. Additionally, asymmetric relationships can amplify market volatility, leading to increased uncertainty and risk. Therefore, addressing and mitigating these asymmetries is crucial for ensuring fair and efficient financial markets.

This mind map was published on 7 January 2024 and has been viewed 84 times.