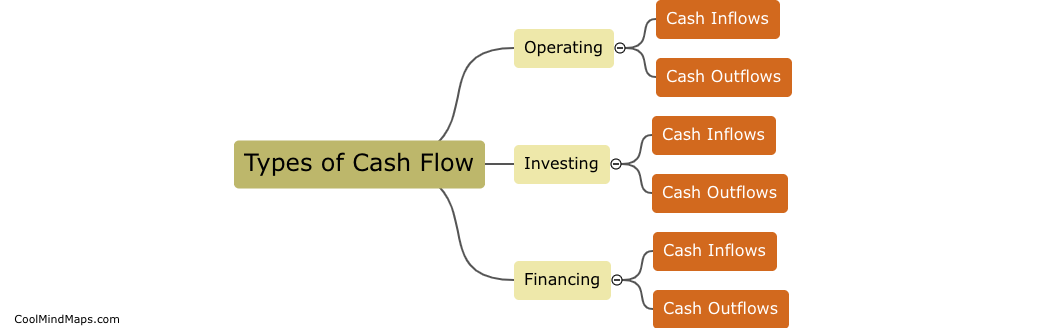

What are the types of cash flow?

Cash flow refers to the movement of money in and out of a business over a period of time. It’s essential for any business to manage their cash flow to meet their financial obligations and invest in future growth. There are three types of cash flow: operating, investing, and financing. Operating cash flow is the money generated from a business’s day-to-day operations, such as sales revenue and expenses. Investing cash flow refers to the money spent or gained from investments in assets or property, plant, and equipment. Financing cash flow includes the money used to raise or repay debt or equity, such as dividends or share buybacks. Keeping track of these types of cash flow can help businesses improve their financial position by effectively planning and managing their finances.

This mind map was published on 24 April 2023 and has been viewed 115 times.