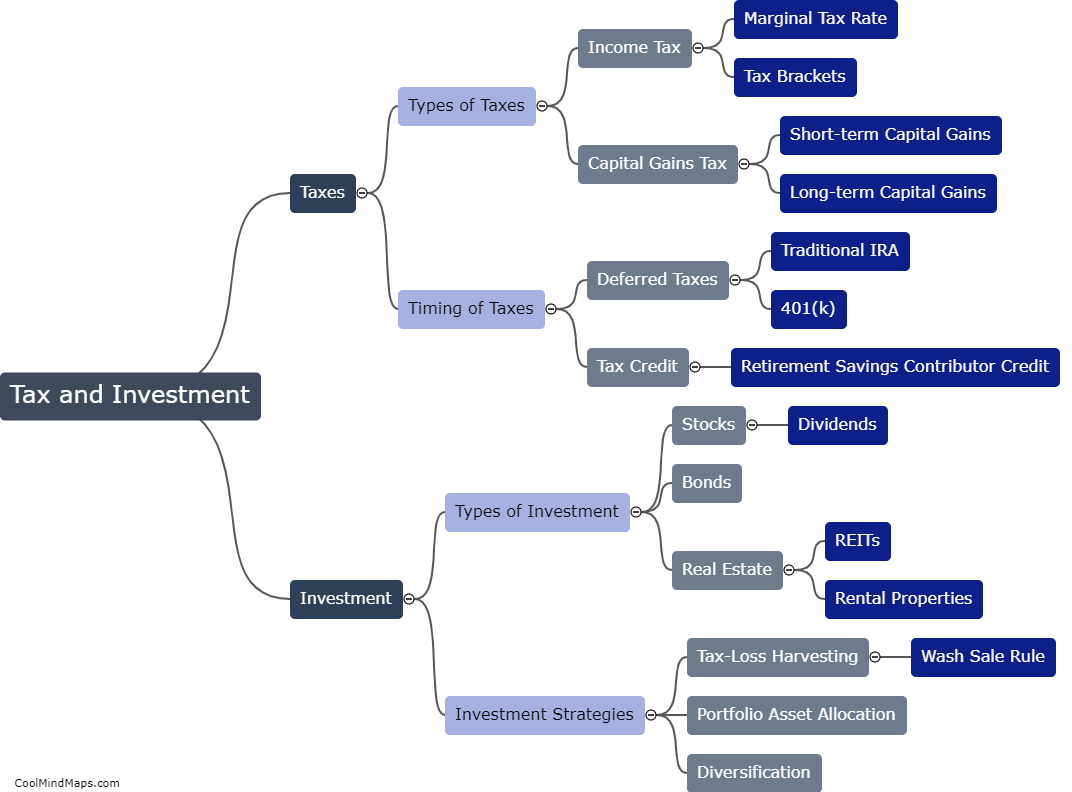

How do taxes impact investment decisions?

Taxes have a significant impact on investment decisions. Higher taxes on investment income reduce the potential profits from investments, leading to lower returns. This can discourage investors from allocating funds towards potentially profitable investments. However, tax incentives such as tax credits or deductions can encourage investment in certain areas such as renewable energy, affordable housing, or low-income communities. With proper planning and understanding of tax laws, investors can make informed decisions that maximize their returns while minimizing their tax burden.

This mind map was published on 18 April 2023 and has been viewed 104 times.