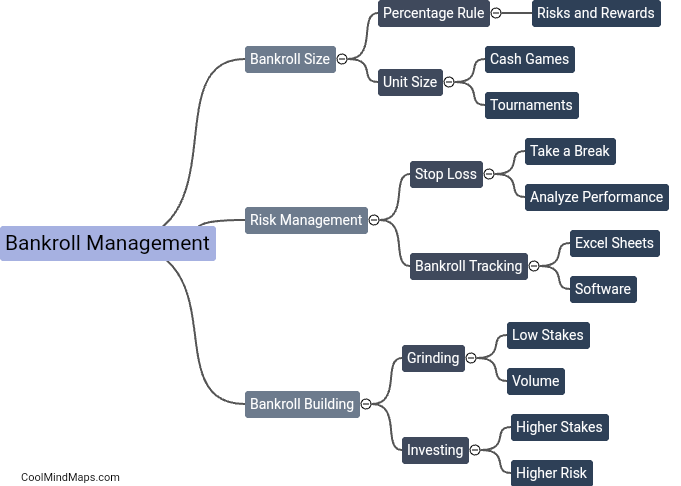

Which features are necessary for efficient bankroll management?

Efficient bankroll management is crucial for any individual involved in financial planning and investing. Some important features that are necessary for efficient bankroll management include clear goals and objectives, a well-defined budgeting system, risk assessment and evaluation, diversification of investments, and disciplined decision-making. Setting clear and achievable financial goals helps individuals focus on their priorities and establish a roadmap for their financial journey. A well-defined budgeting system helps individuals track their income, expenses, and savings, enabling them to effectively manage their cash flow and make informed financial decisions. Conducting thorough risk assessments and evaluations helps individuals understand the potential risks associated with their investments and adjust their strategies accordingly. Diversification of investments helps spread risk and optimize returns, as a portfolio with various asset classes tends to be more resilient in volatile markets. Finally, disciplined decision-making is crucial to avoid impulsive actions and emotions-driven choices, allowing individuals to maintain a long-term perspective and achieve their financial objectives. By incorporating these necessary features into their bankroll management, individuals can navigate the financial landscape effectively and achieve financial stability and success.

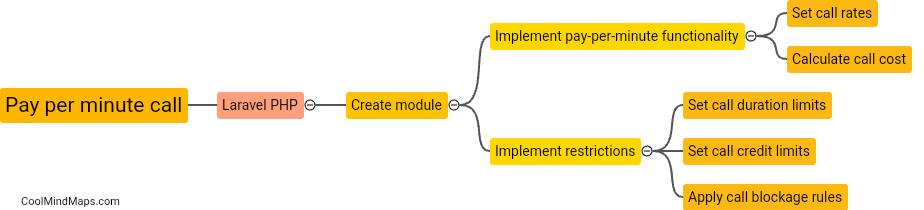

This mind map was published on 21 January 2024 and has been viewed 94 times.