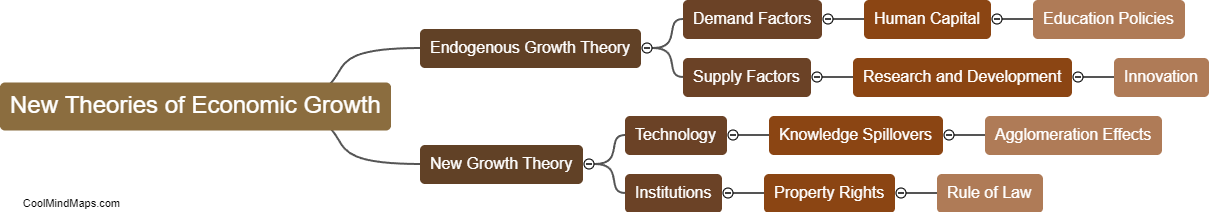

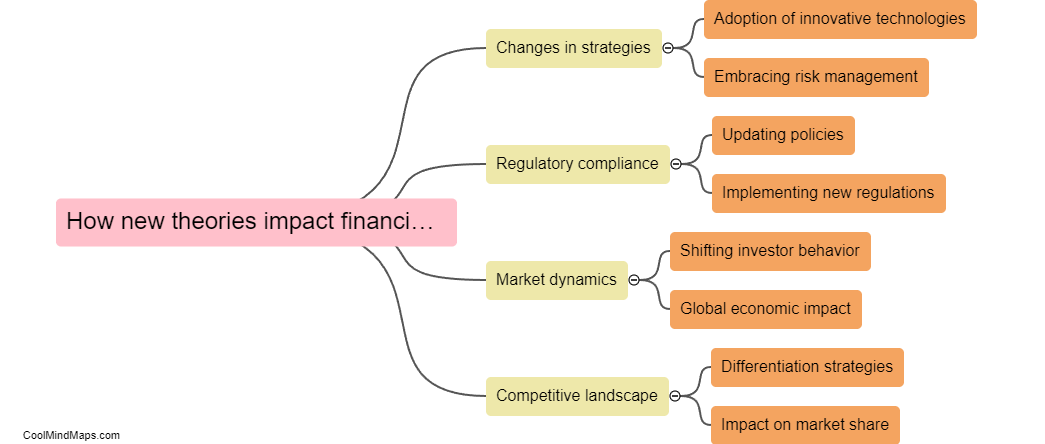

How do new theories impact financial institutions and policies?

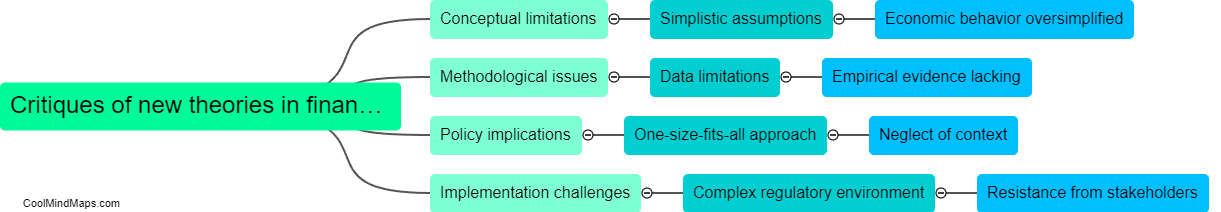

New theories can have a significant impact on financial institutions and policies by challenging existing paradigms and shifting the way these institutions operate. For example, the introduction of behavioral finance theories has brought attention to the psychological factors that influence decision-making in financial markets. This has led to the development of new risk management strategies and investment approaches to better address the irrational behavior of market participants. Additionally, new economic theories such as modern monetary theory have influenced policymakers to rethink traditional approaches to monetary policy, fiscal policy, and financial regulation. Overall, new theories can lead to a reshaping of financial institutions and policies to better adapt to changing economic environments and market conditions.

This mind map was published on 21 February 2024 and has been viewed 146 times.