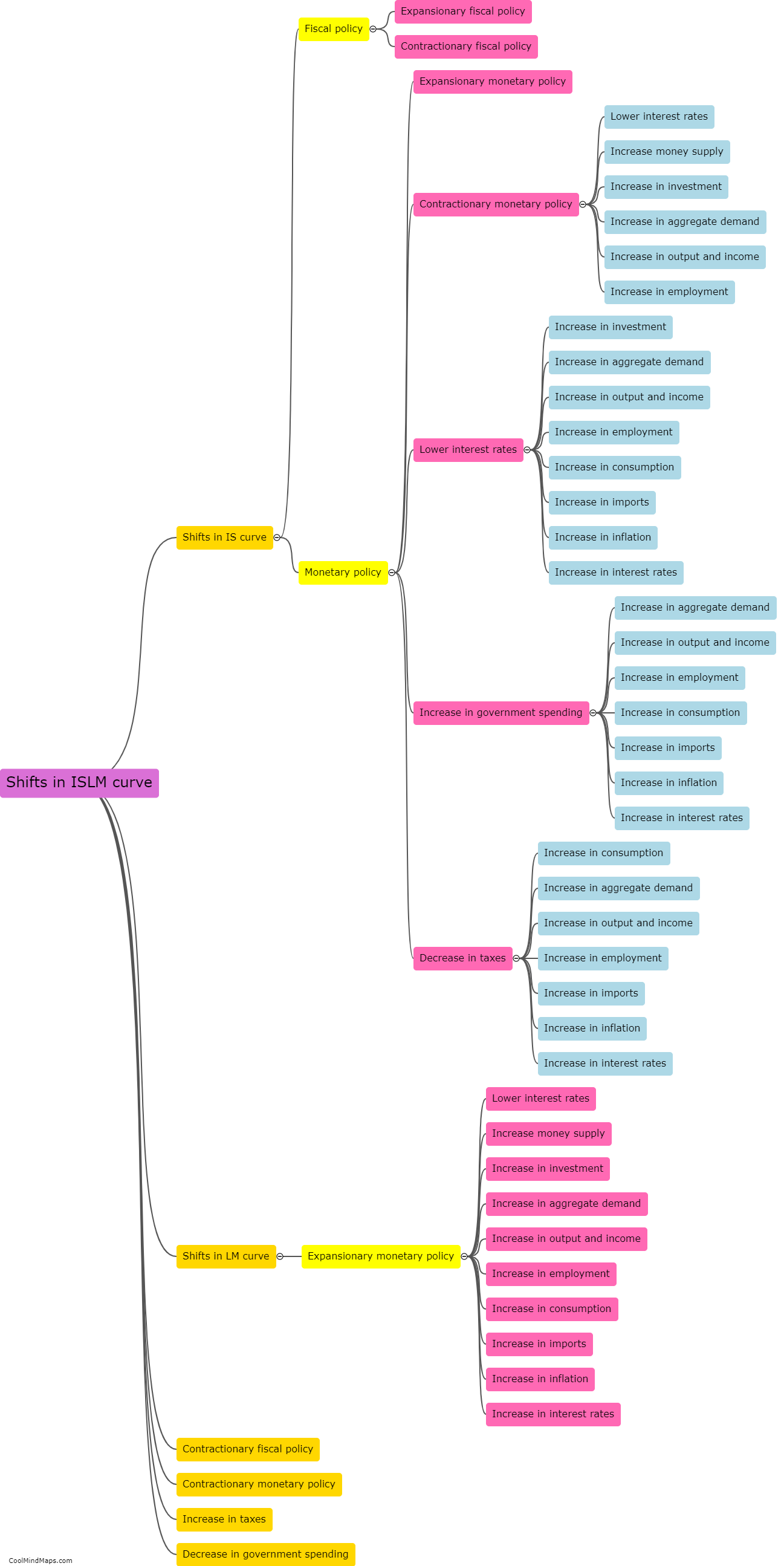

What are the implications of shifts in the ISLM curve?

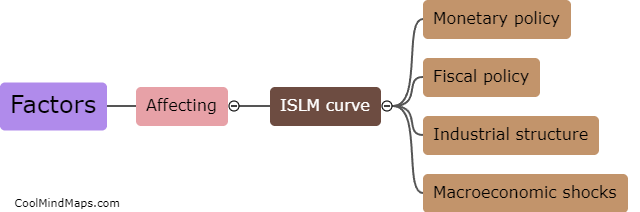

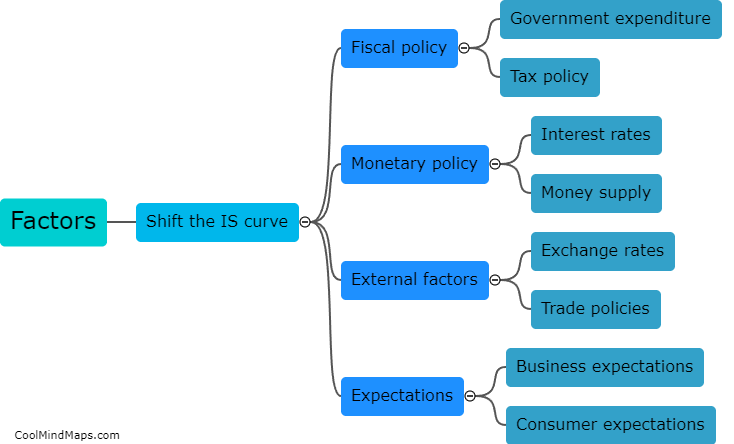

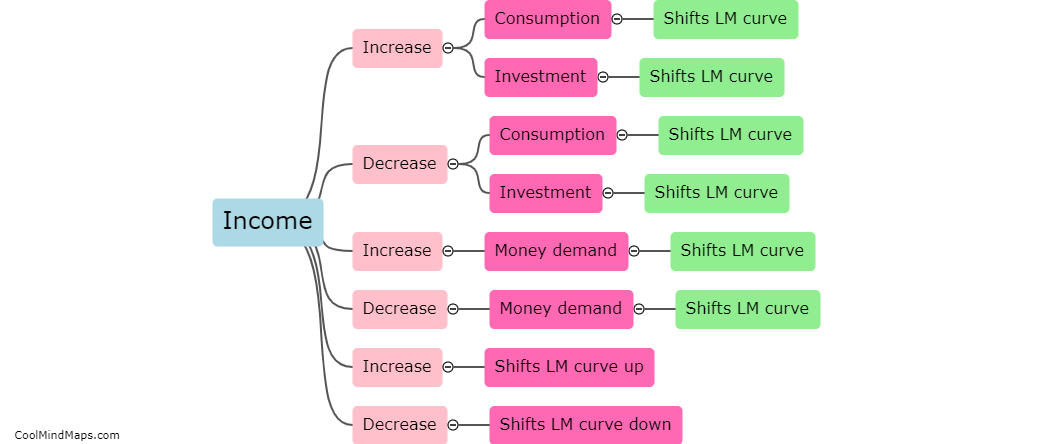

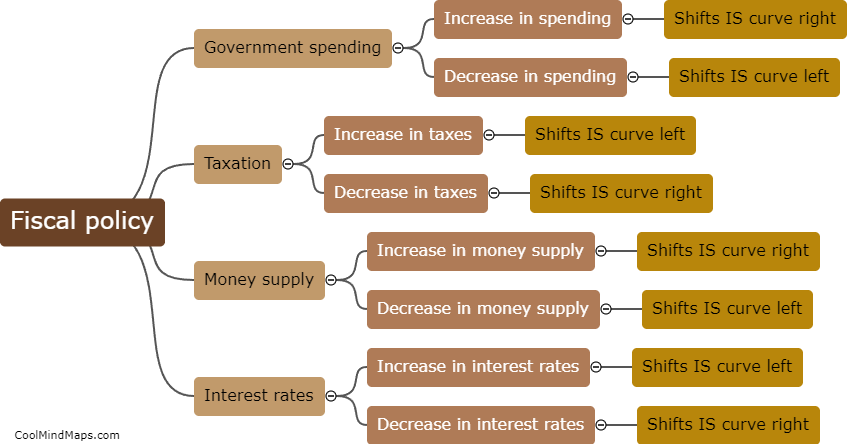

Shifts in the ISLM curve have significant implications for the economy and policy decisions. The IS curve represents the relationship between real interest rates and output or income in the economy, while the LM curve represents the relationship between real interest rates and the supply of money. When either of these curves shifts, it indicates changes in the spending and investment behavior of individuals, firms, and the government. For example, a shift in the IS curve to the right suggests increased aggregate demand, leading to higher levels of output and potentially inflationary pressures. On the other hand, a shift in the LM curve to the left indicates a decrease in the money supply, which can lead to higher interest rates and lower levels of investment and consumption. Policymakers typically respond to these shifts by adjusting fiscal or monetary policies to stabilize the economy and achieve desired growth and stability objectives.

This mind map was published on 18 September 2023 and has been viewed 93 times.