What is tax law?

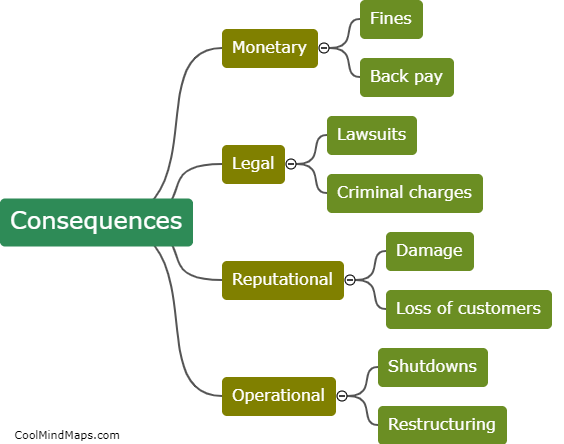

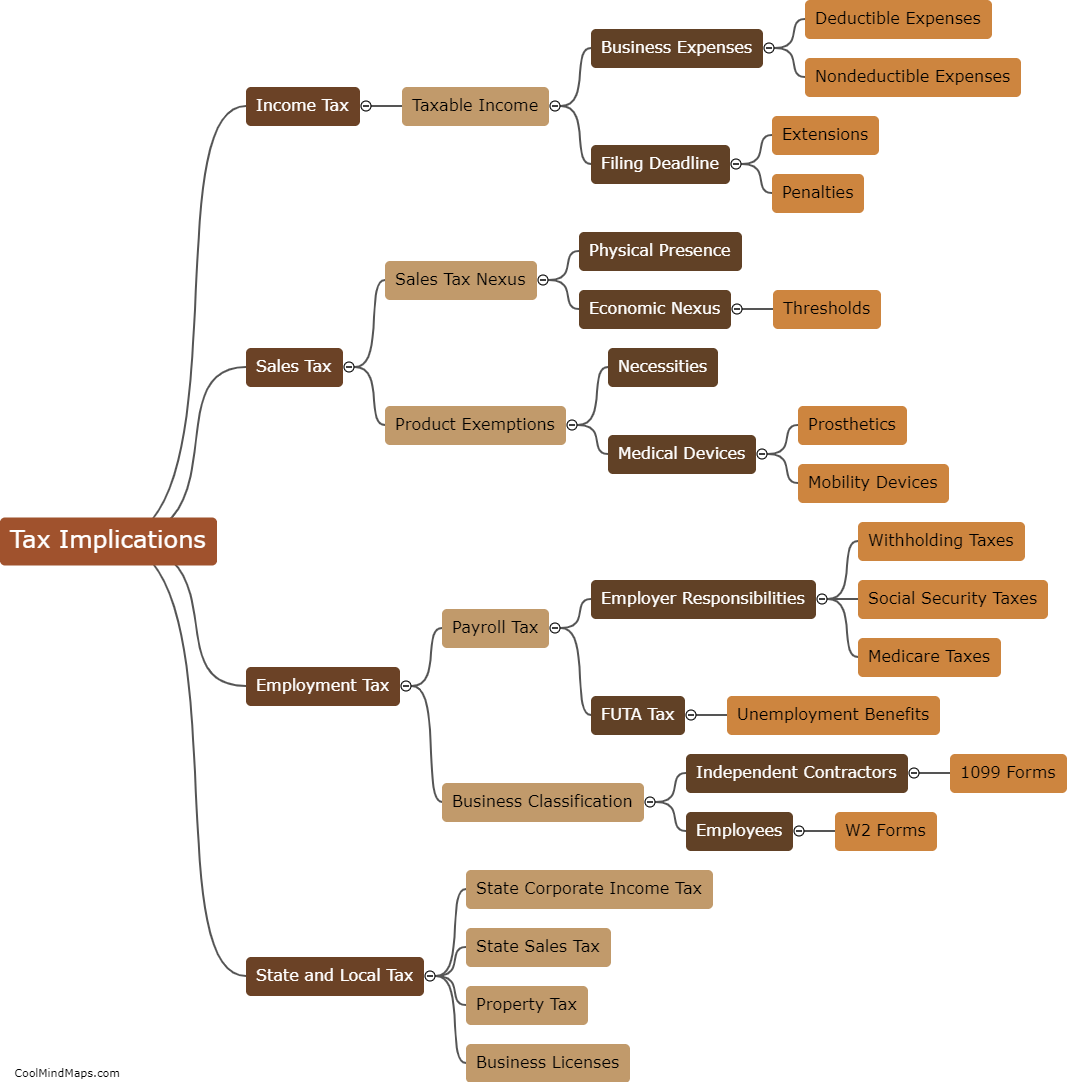

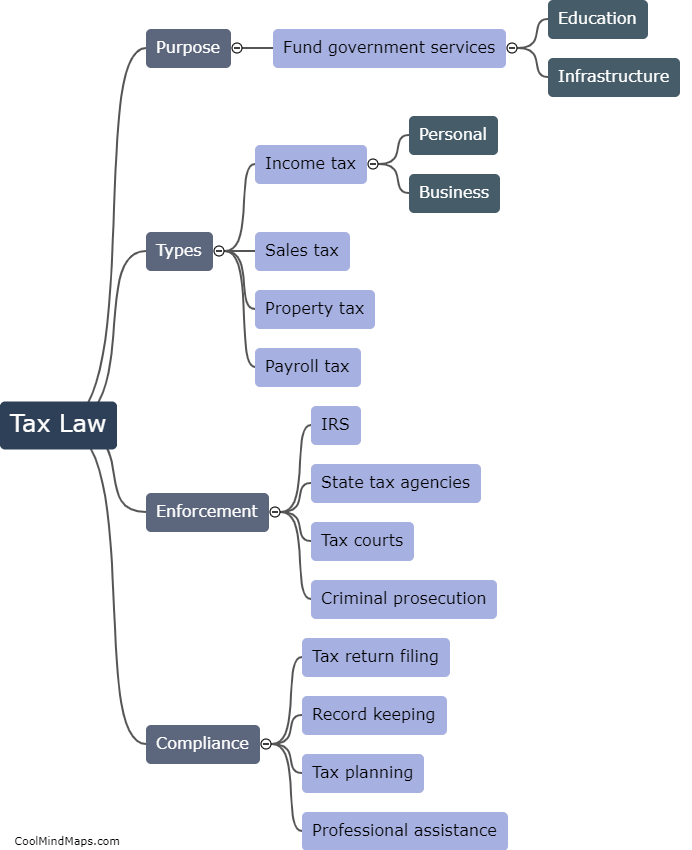

Tax law refers to a set of legal rules and regulations that govern how individuals and businesses are required to pay taxes to the government. It covers the different types of taxes, such as income tax, sales tax, property tax and estate tax, and sets out the procedures and requirements for tax compliance. Tax law also deals with the enforcement of tax laws, including the power of the government to collect taxes, audit tax returns, and impose penalties for non-compliance. Understanding tax law is essential for individuals and businesses to manage their tax obligations and avoid legal penalties.

This mind map was published on 18 April 2023 and has been viewed 106 times.