What is insider trading?

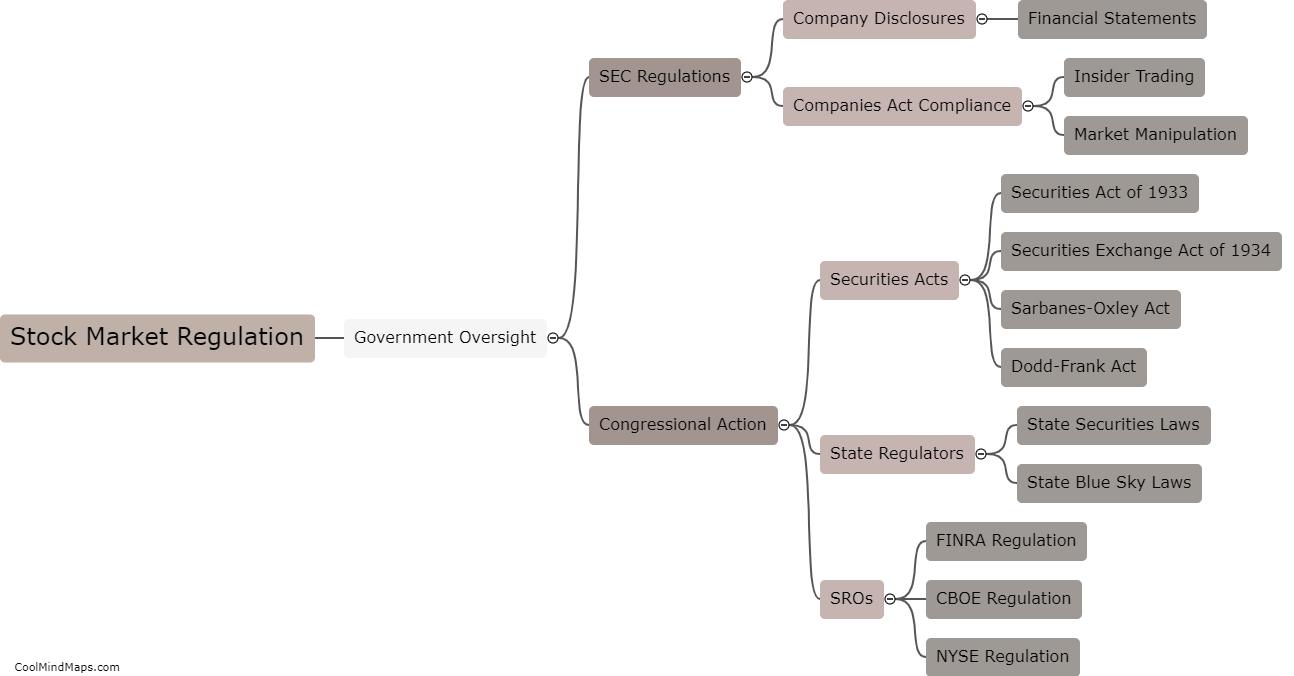

Insider trading is the illegal practice of buying or selling stocks and other securities based on non-public information that only insiders, like executives or board members of a company, have access to. This unfair practice gives individuals an advantage over the ordinary shareholders in the market because they can make trades based on valuable information that has not yet been made public. Since insider trading is illegal and unethical, it undermines investor confidence and the integrity of the financial market. The Securities and Exchange Commission (SEC) actively investigates and prosecutes insider trading cases to prevent it from happening and maintain a level playing field for all investors.

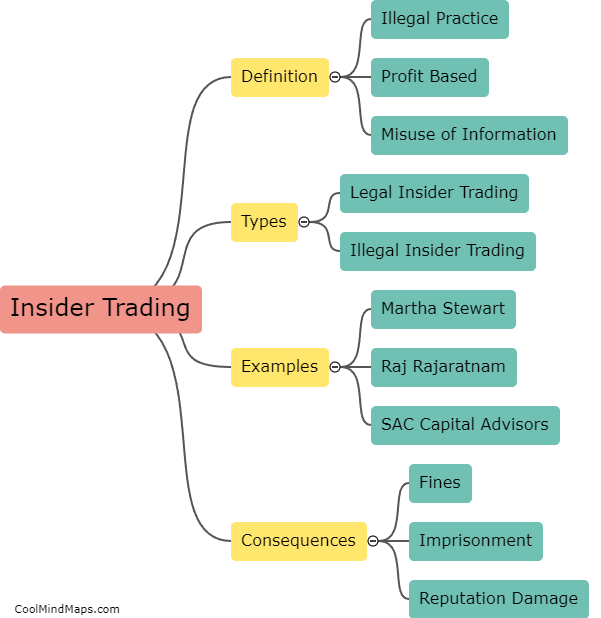

This mind map was published on 18 April 2023 and has been viewed 154 times.