Is the cost of equity equal to the dividend rate or return on equity?

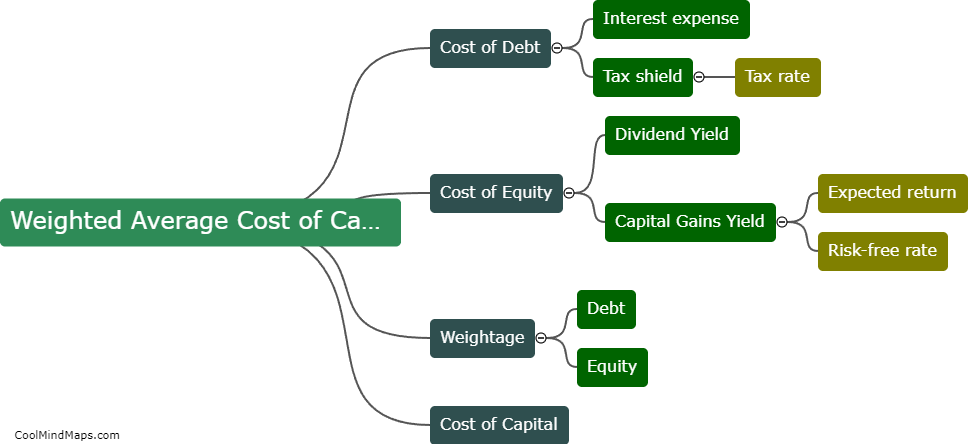

No, the cost of equity is not necessarily equal to the dividend rate or return on equity. The cost of equity refers to the rate of return that an investor requires in exchange for owning shares of a company's stock. It represents the opportunity cost for investors as they could have invested their money elsewhere. This cost is typically estimated using models such as the capital asset pricing model (CAPM) or the dividend discount model (DDM). On the other hand, the dividend rate or return on equity represents the percentage of a company's profits distributed to shareholders in the form of dividends. While dividends may be one component of the return on equity, it also includes the capital gains or losses from changes in stock price. Therefore, the cost of equity takes into account a broader perspective, factoring in future capital gains and the risk associated with the investment.

This mind map was published on 5 December 2023 and has been viewed 84 times.