What are the key factors in planning a worker's worklife until retirement?

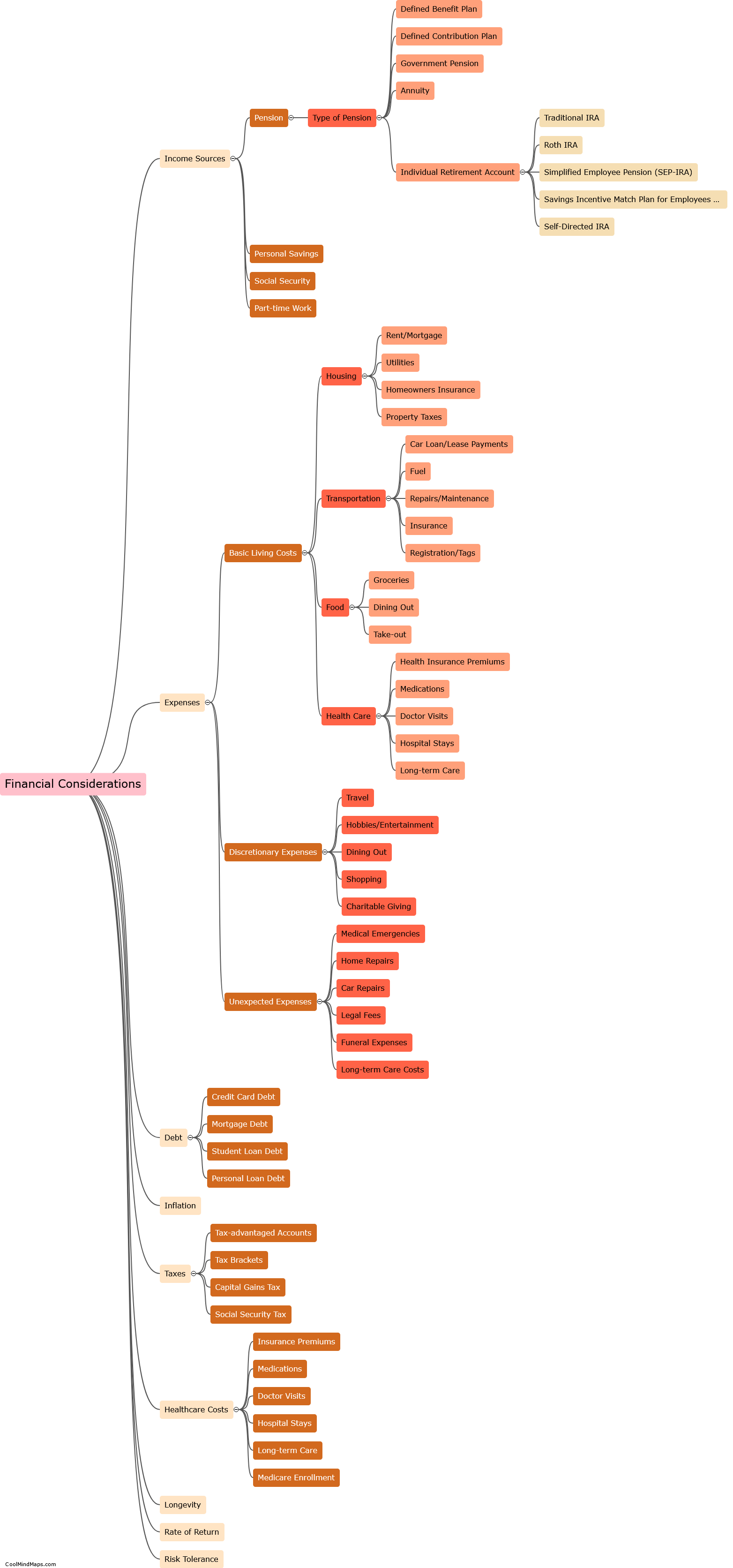

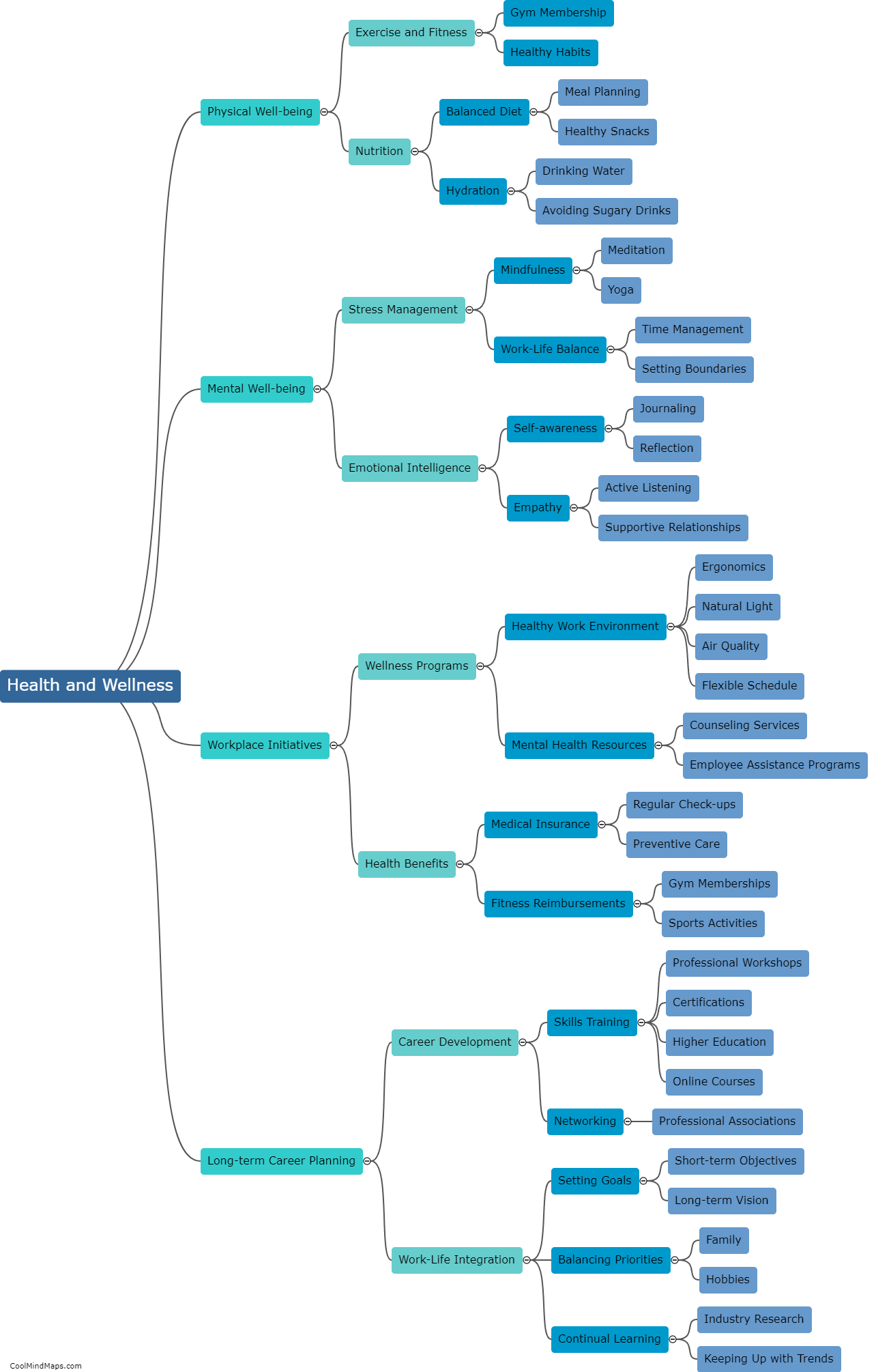

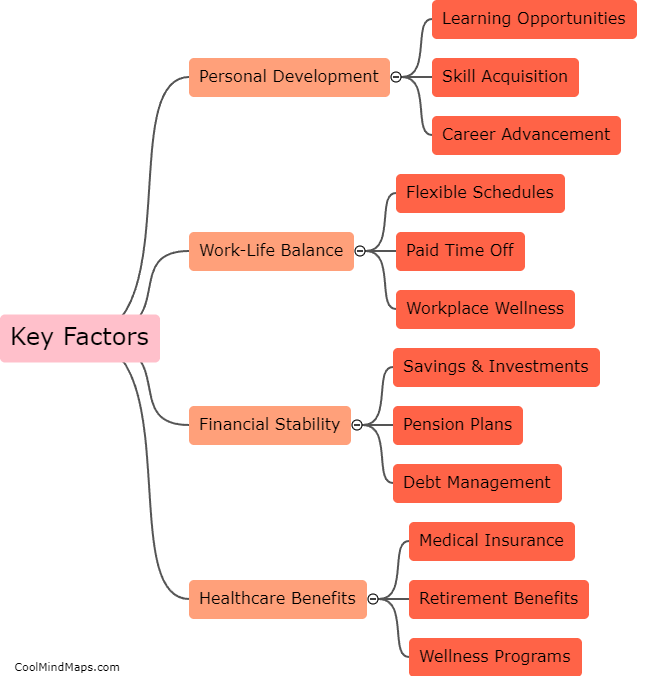

When planning a worker's worklife until retirement, there are several key factors to consider. Firstly, it is essential to assess the worker's financial needs and goals for retirement. This includes determining the desired lifestyle during retirement and estimating the required savings and investments to achieve those goals. Secondly, it is vital to evaluate the worker's current employment benefits, such as pension plans or retirement savings accounts, and understand how they align with the retirement goals. If necessary, additional retirement savings options, such as individual retirement accounts (IRAs) or annuities, should be explored. Additionally, considering the worker's health and insurance coverage, particularly long-term care insurance, is crucial as medical expenses can significantly impact retirement planning. Lastly, ongoing monitoring and adjustments to the retirement plan are necessary to adapt to changing economic conditions and personal circumstances. By addressing these factors, individuals can better plan a secure and fulfilling worklife until retirement.

This mind map was published on 11 September 2023 and has been viewed 85 times.