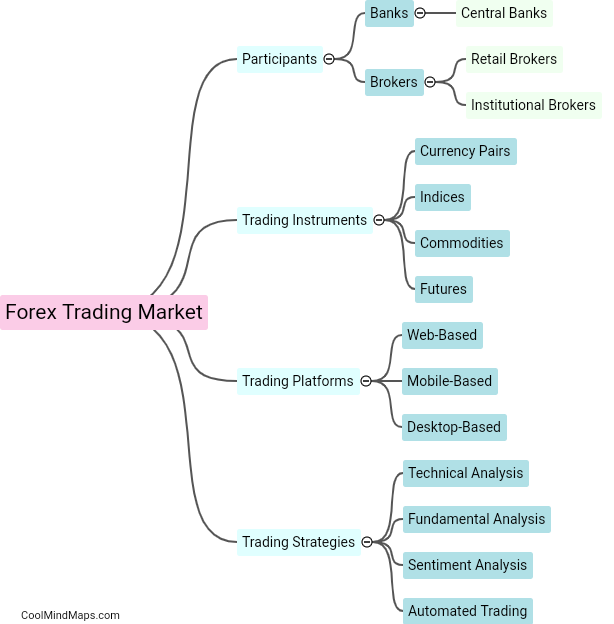

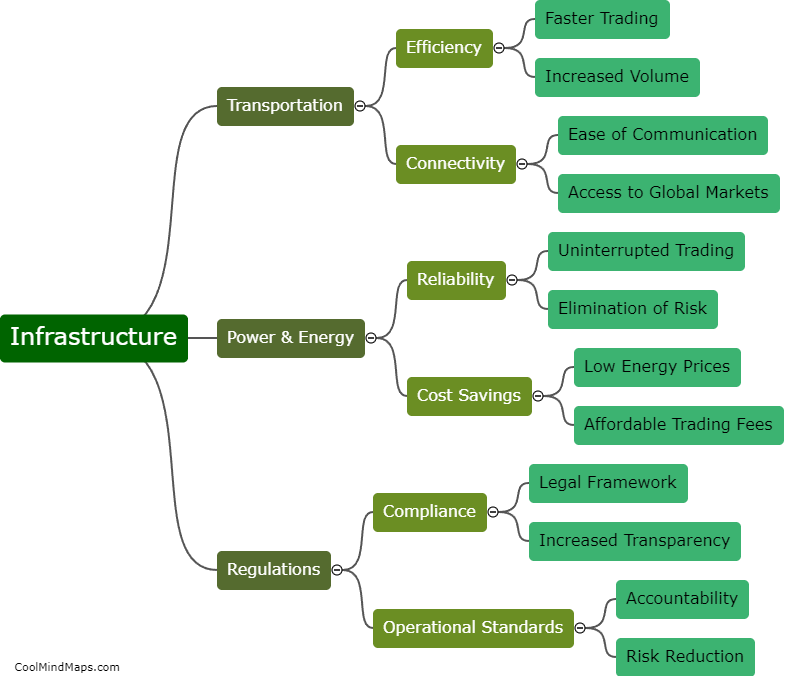

What is the impact of infrastructure on forex trading market?

The infrastructure plays a vital role in the forex trading market as it directly affects the speed, efficiency, and reliability of the trade execution process. Advanced communication networks, high-speed internet connections, and cutting-edge trading platforms enable traders to access global markets and execute trades in real-time, ensuring efficient market participation. Conversely, poor infrastructure hampers traders' ability to stay connected to the market, increases the latency in trade execution, and lowers the overall quality of trading. For this reason, countries with superior infrastructure have a competitive edge in the forex market, making them more attractive to international investors, which leads to more significant foreign investments and economic growth.

This mind map was published on 20 June 2023 and has been viewed 102 times.