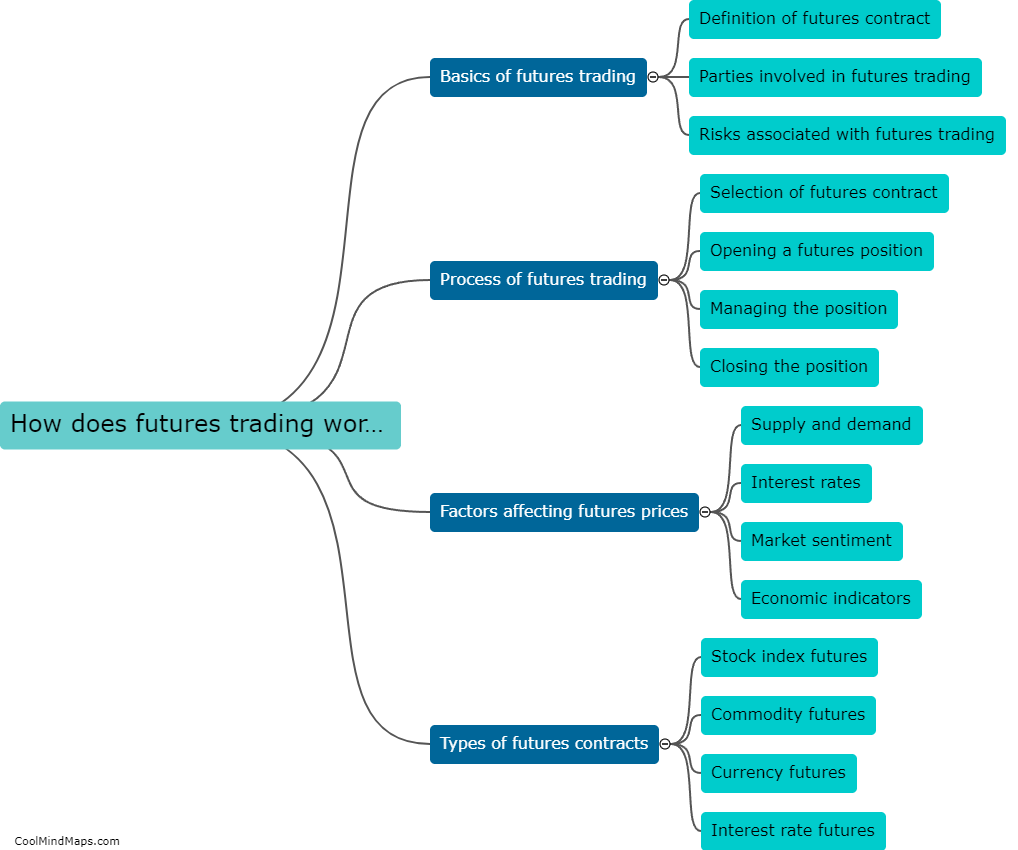

How does futures trading work?

Futures trading involves the buying and selling of contracts for future delivery of a particular asset, such as commodities, currencies, or indexes, at a predetermined price and date. These contracts are standardized and traded on organized exchanges like the Chicago Mercantile Exchange. When trading futures, traders can speculate on the price of the underlying asset going up (buying a contract) or down (selling a contract) in the future. Unlike stock trading, futures trading does not involve ownership of the physical asset but rather profits or losses are based on the price movement of the contract. Traders can enter into long or short positions and can close out their positions by offsetting the contract before its expiration date or by taking delivery of the physical asset. Futures trading provides opportunities for hedging against price volatility, leverage for potential higher returns, and liquidity due to the active marketplace.

This mind map was published on 5 October 2023 and has been viewed 139 times.