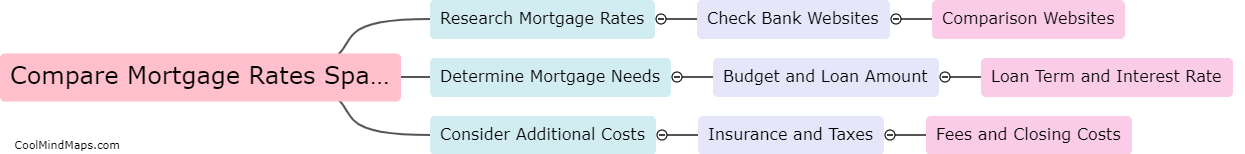

How to compare mortgage rates in Spain?

When comparing mortgage rates in Spain, it's important to take into account interest rates, loan terms, and fees. One way to do this is to shop around and compare offers from multiple lenders. Additionally, consider working with a mortgage broker who can help you navigate the Spanish mortgage market and find the best rates and terms for your specific financial needs and situation. It's also important to read the fine print and understand all of the potential costs associated with the mortgage, such as closing costs and prepayment penalties. Taking the time to compare rates and negotiate terms can save you money in the long run.

This mind map was published on 17 May 2023 and has been viewed 130 times.