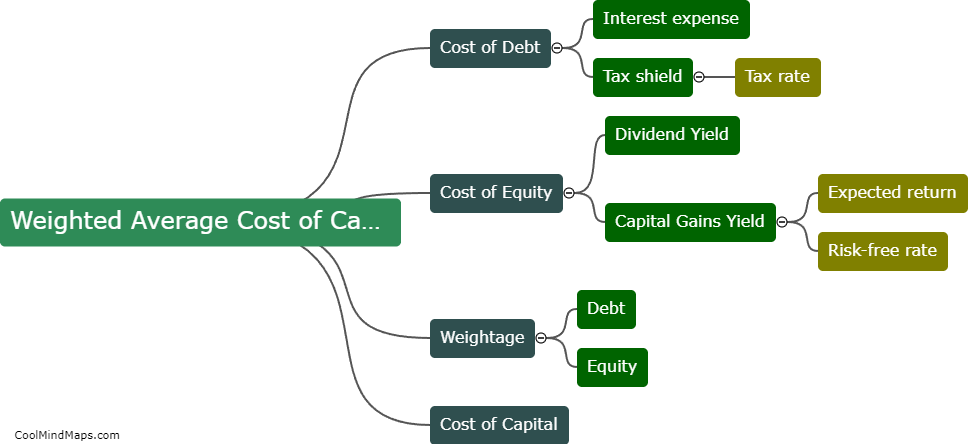

Is the coupon rate on existing debt used as the pre-tax cost of debt?

The coupon rate on existing debt is not always used as the pre-tax cost of debt. While the coupon rate represents the interest rate paid to bondholders, it does not account for the tax savings that are available due to interest payments being tax-deductible expenses for corporations. The pre-tax cost of debt takes into consideration both the coupon rate and the tax benefits associated with interest expenses. Hence, in order to accurately determine the pre-tax cost of debt, one must factor in the coupon rate as well as the applicable tax rate that affects the interest payments.

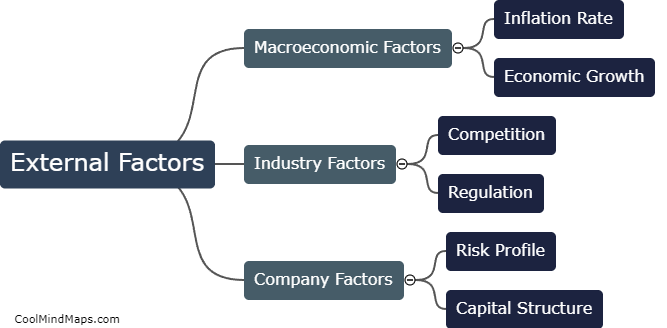

This mind map was published on 19 December 2023 and has been viewed 91 times.