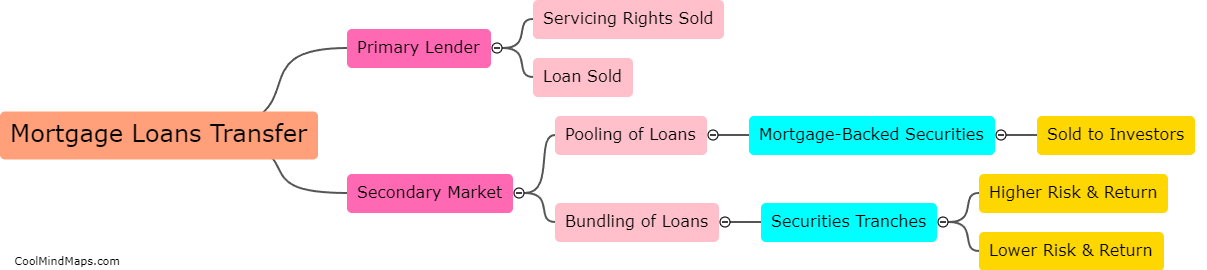

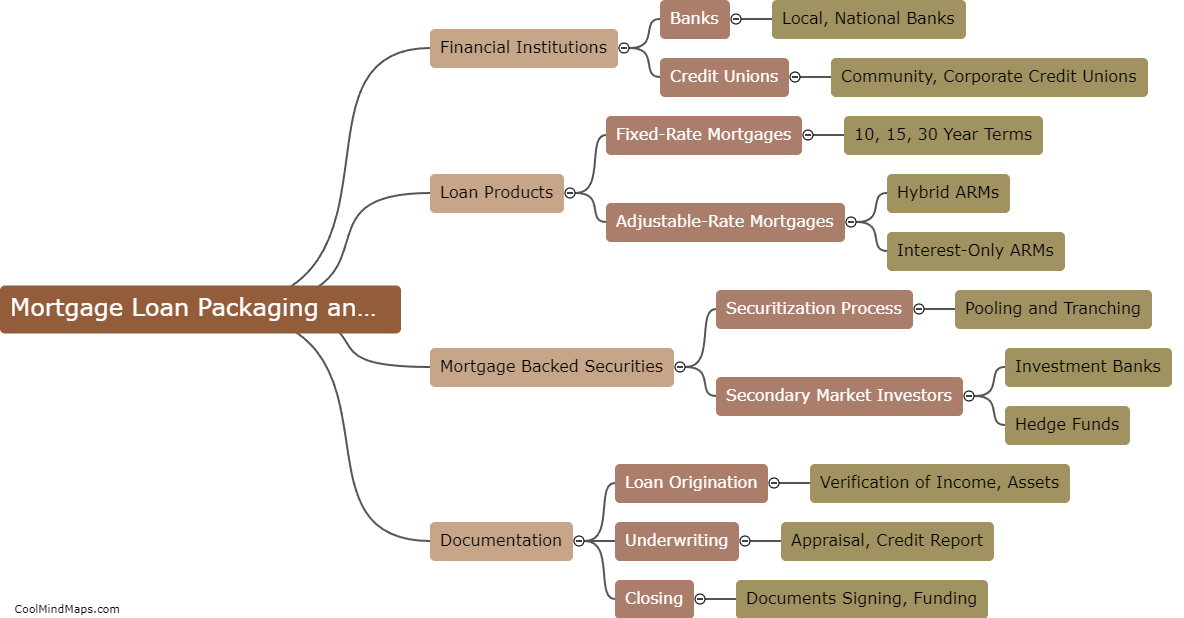

How is a mortgage loan packaged and sold?

When a lender provides a mortgage loan to a borrower, they package it with other loans of similar quality and sell them to investors as mortgage-backed securities (MBS). The lender pools the mortgage loans together and creates a trust, with the MBS representing ownership in the trust. The investors receive a portion of the interest and principal payments made by the borrowers, while the lender receives a fee for managing the mortgage loans. The sale of MBS allows lenders to free up capital and make more loans, while investors receive a steady stream of income from the mortgage payments.

This mind map was published on 28 May 2023 and has been viewed 121 times.