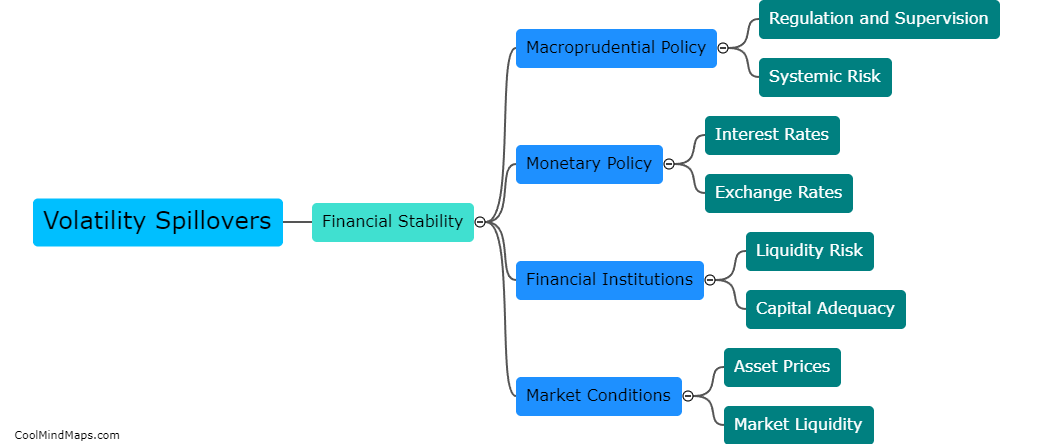

What methods can be used to identify volatility spillovers during crises?

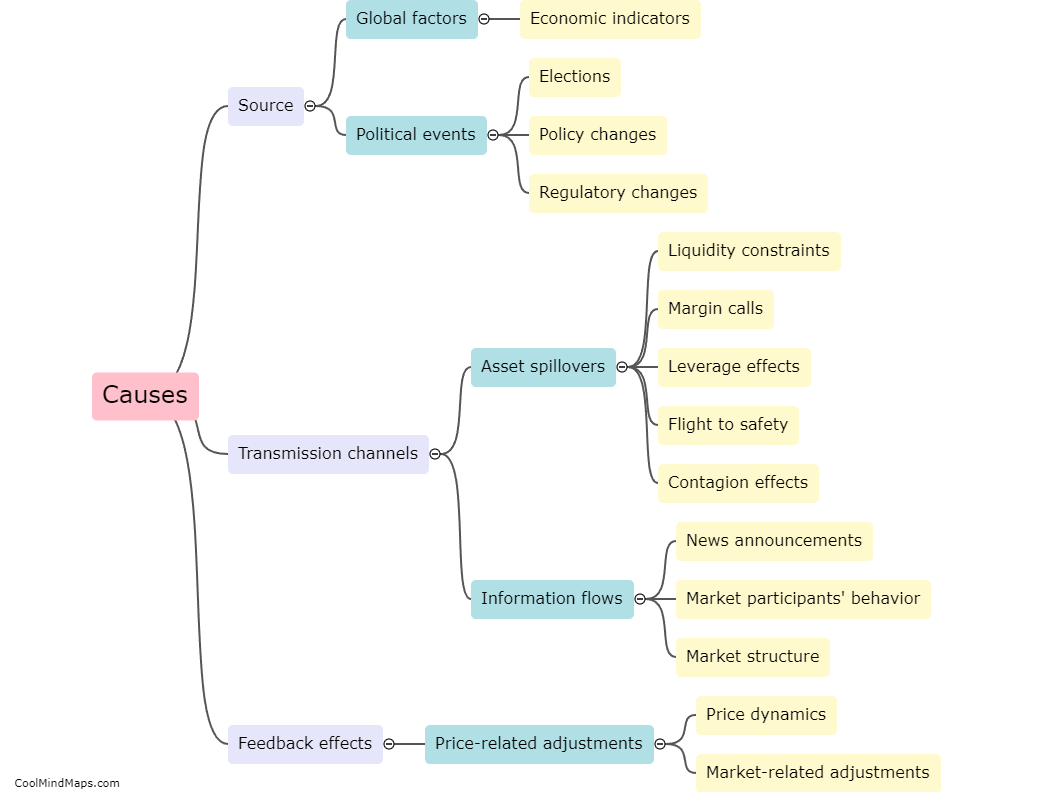

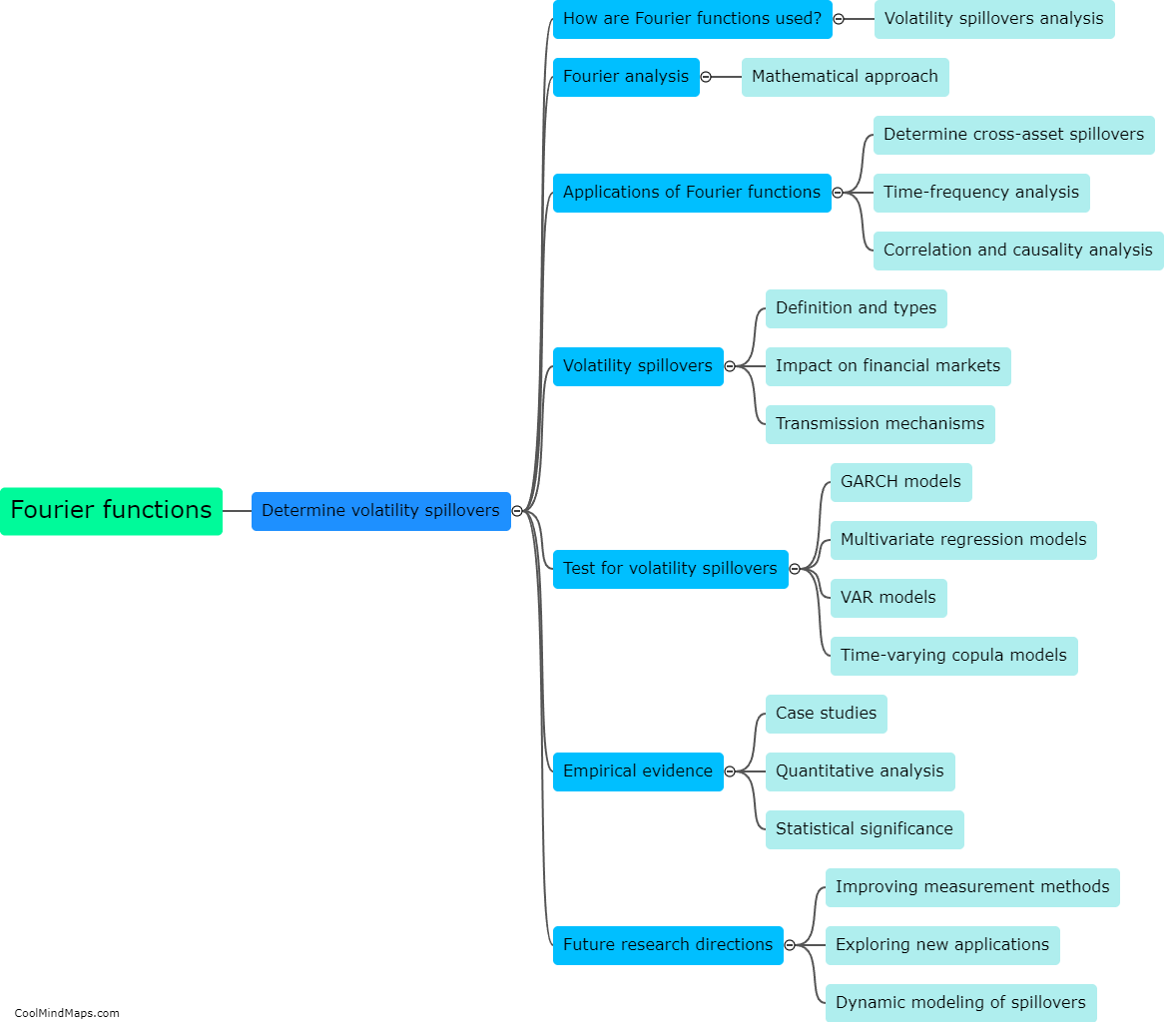

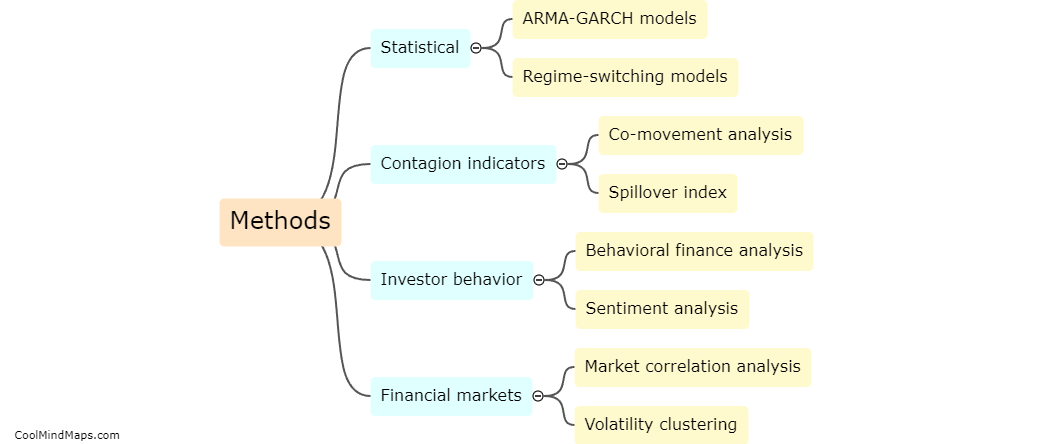

During crises, such as financial or economic turmoil, identifying volatility spillovers becomes crucial as they can potentially amplify the negative effects and contagion across markets. Several methods exist to identify volatility spillovers during such crises. One commonly used approach is the use of dynamic conditional correlation models, which allow for the estimation of time-varying correlations between assets. This method helps uncover connections between different markets and detect when volatility spillovers occur. Additionally, event study analysis can be employed to examine how an unexpected shock in one market affects the volatility of other related markets. Other methods like vector autoregressive models, Granger causality tests, and network analysis techniques are also used to identify and quantify volatility spillover effects during crises. By employing these methods, policymakers, investors, and researchers can gain insights into the transmission mechanisms of crises and take appropriate measures to manage their impact.

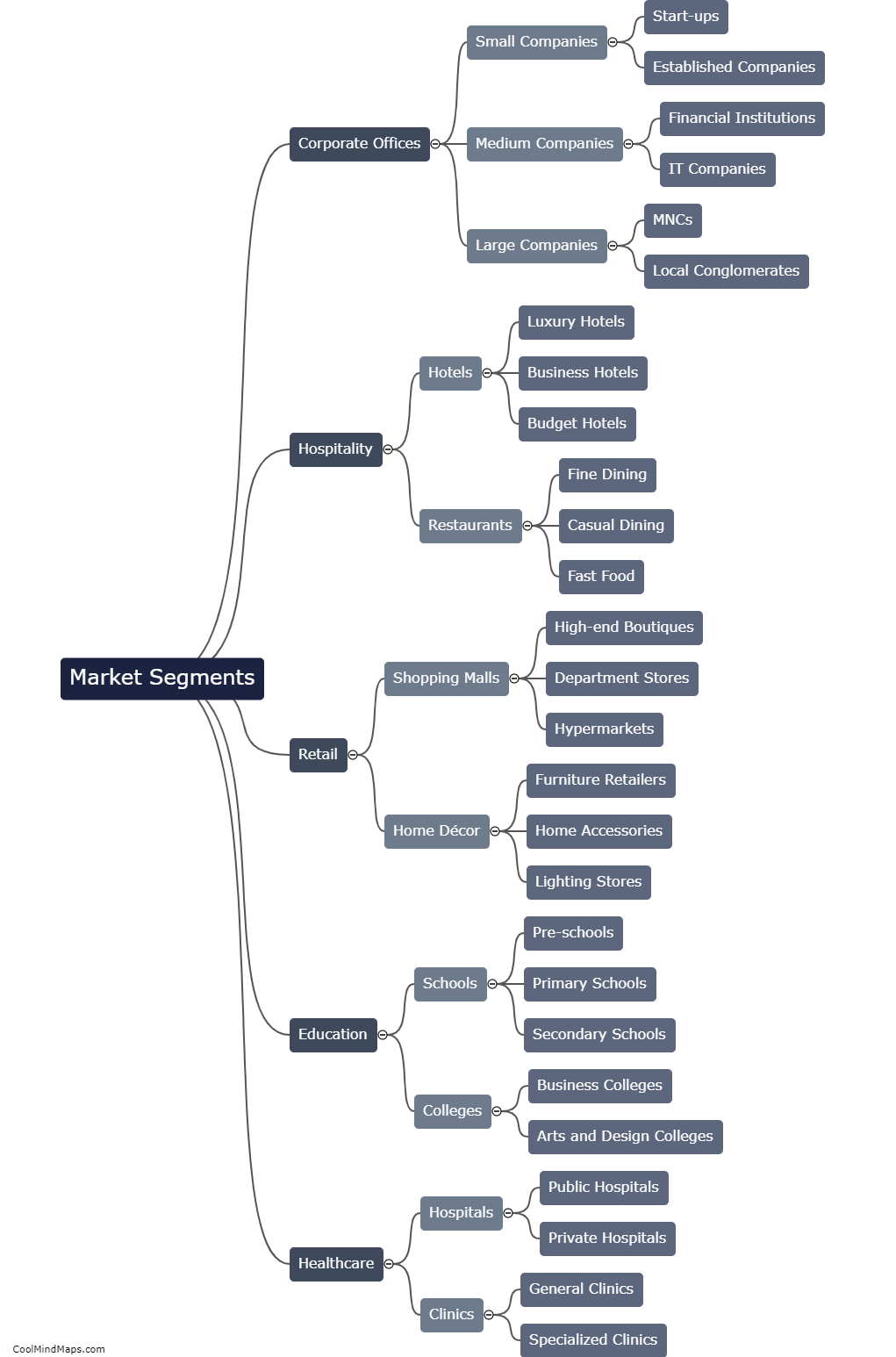

This mind map was published on 27 November 2023 and has been viewed 92 times.