What factors beyond the firm's control affect WACC?

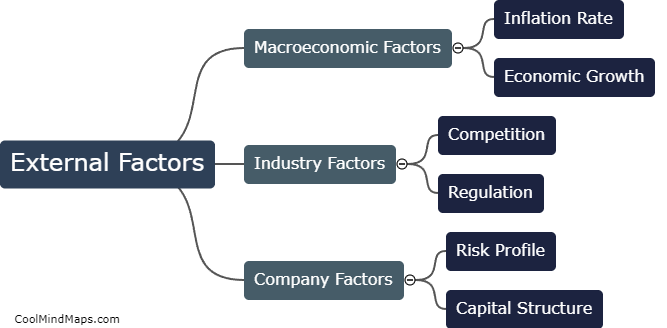

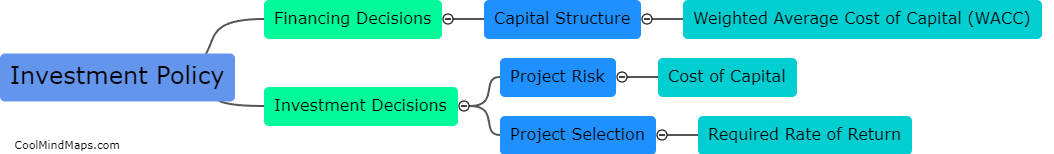

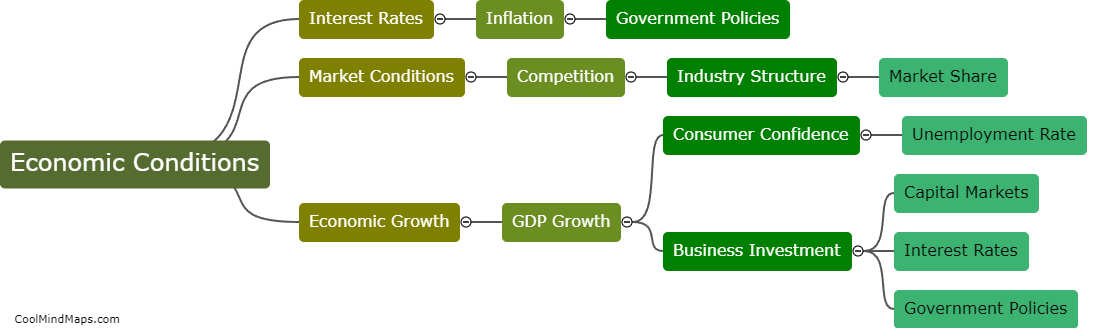

There are several factors beyond a firm's control that can affect its weighted average cost of capital (WACC). One of the primary factors is the overall state of the economy. During times of economic downturn, interest rates tend to be higher, which can increase the cost of debt and equity financing for a firm, leading to a higher WACC. Additionally, market conditions and investor sentiment also play a crucial role in determining the WACC. If the market perceives a higher risk associated with a particular industry or firm, investors may demand a higher return, leading to an increase in the WACC. Furthermore, government regulations, tax policies, and changes in legislation can also impact the WACC by altering the cost of capital. Therefore, while a firm has control over certain factors influencing the WACC, external factors like macroeconomic conditions, market sentiment, and regulatory changes can significantly impact the WACC.

This mind map was published on 5 December 2023 and has been viewed 106 times.