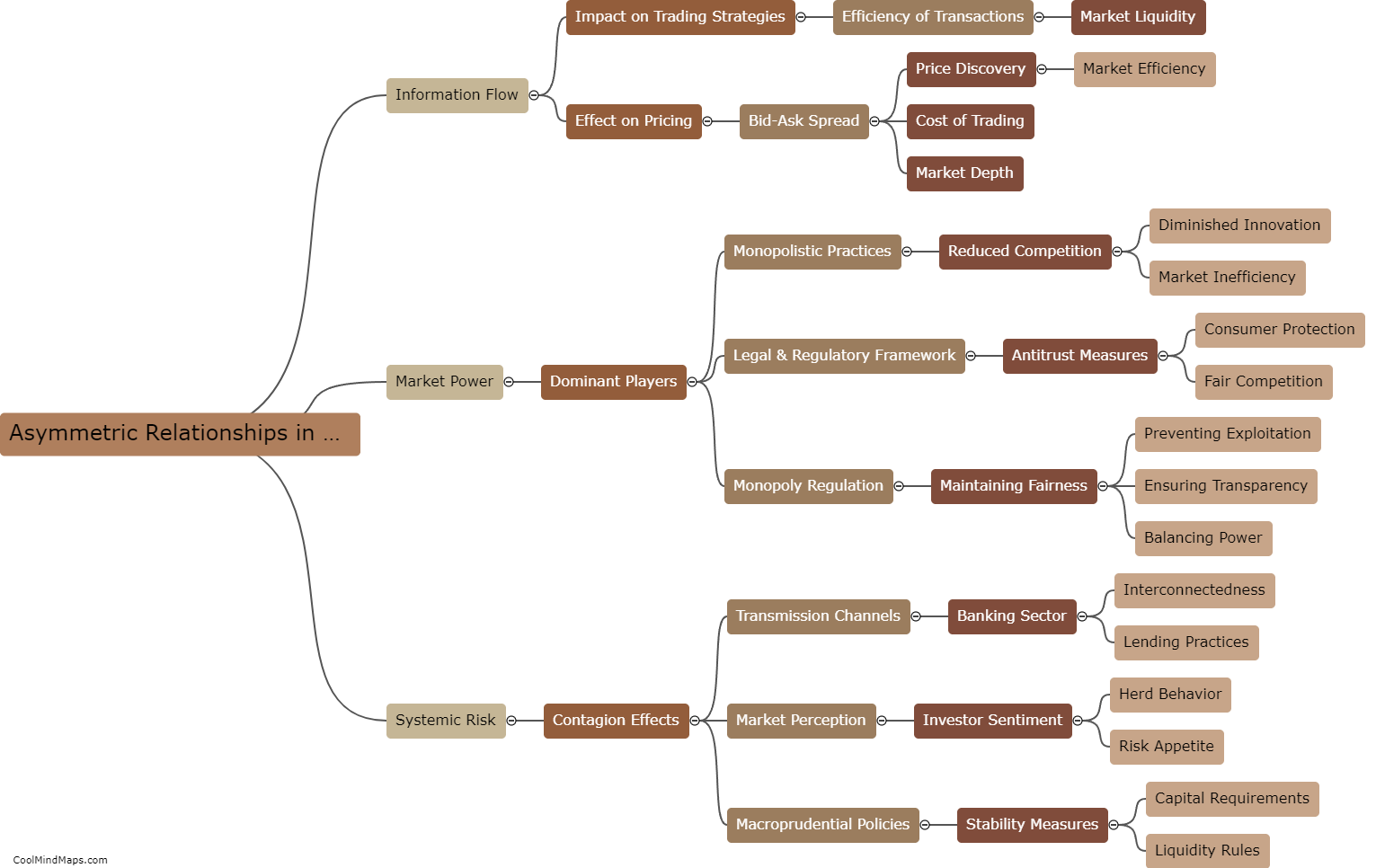

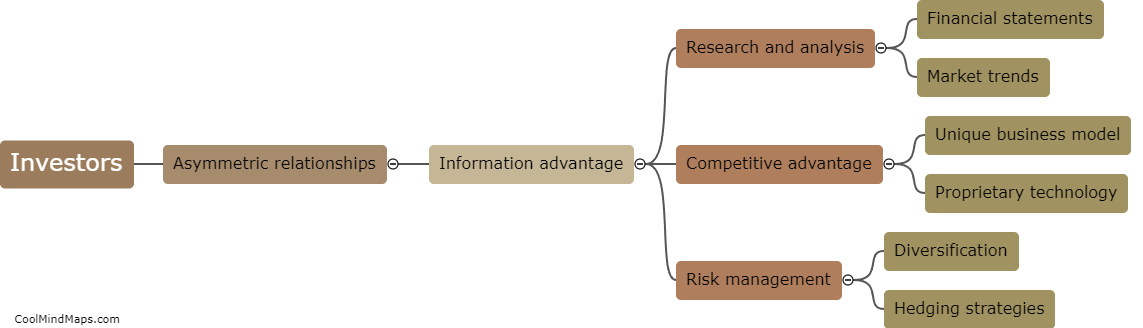

How does asymmetry affect financial markets?

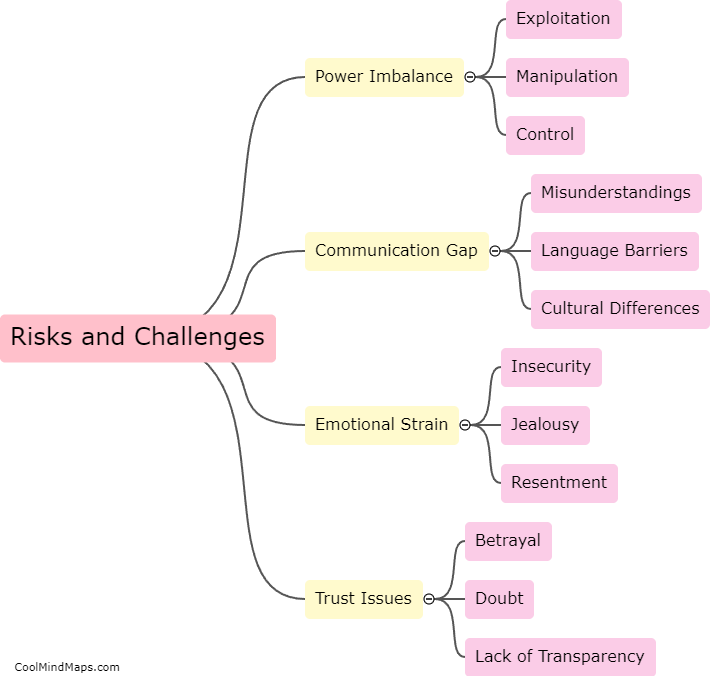

Asymmetry in financial markets refers to the unequal distribution of information among market participants, which can significantly impact market dynamics and outcomes. In an asymmetric information scenario, where some market participants possess more information than others, it creates an uneven playing field and can lead to adverse consequences. For instance, if insider trading occurs, where certain individuals trade based on non-publicized information, it erodes market integrity and undermines investor confidence. Asymmetry can also cause market inefficiencies, as mispricing occurs due to incomplete knowledge. Moreover, it may lead to adverse selection and moral hazard problems, as less-informed investors bear higher risks by making uninformed choices. Adequate regulation, transparency, and the dissemination of accurate information are crucial in reducing information asymmetry and fostering fair and efficient financial markets.

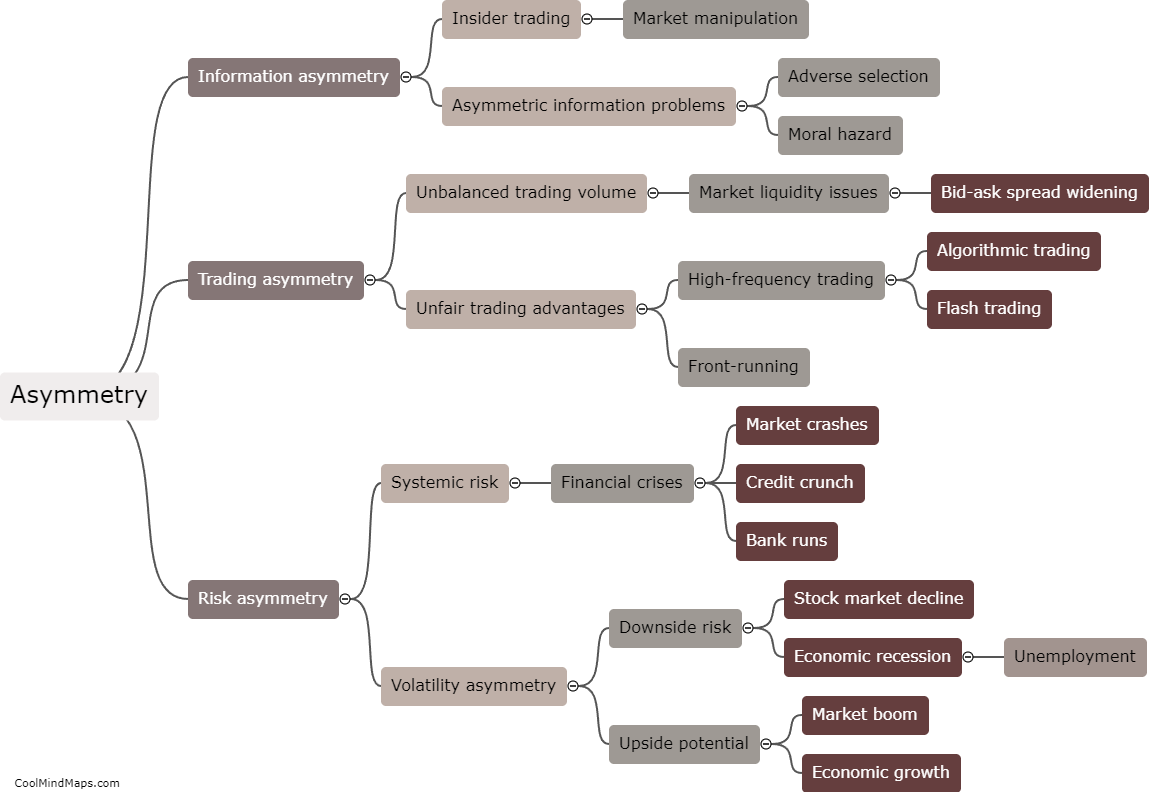

This mind map was published on 21 December 2023 and has been viewed 97 times.