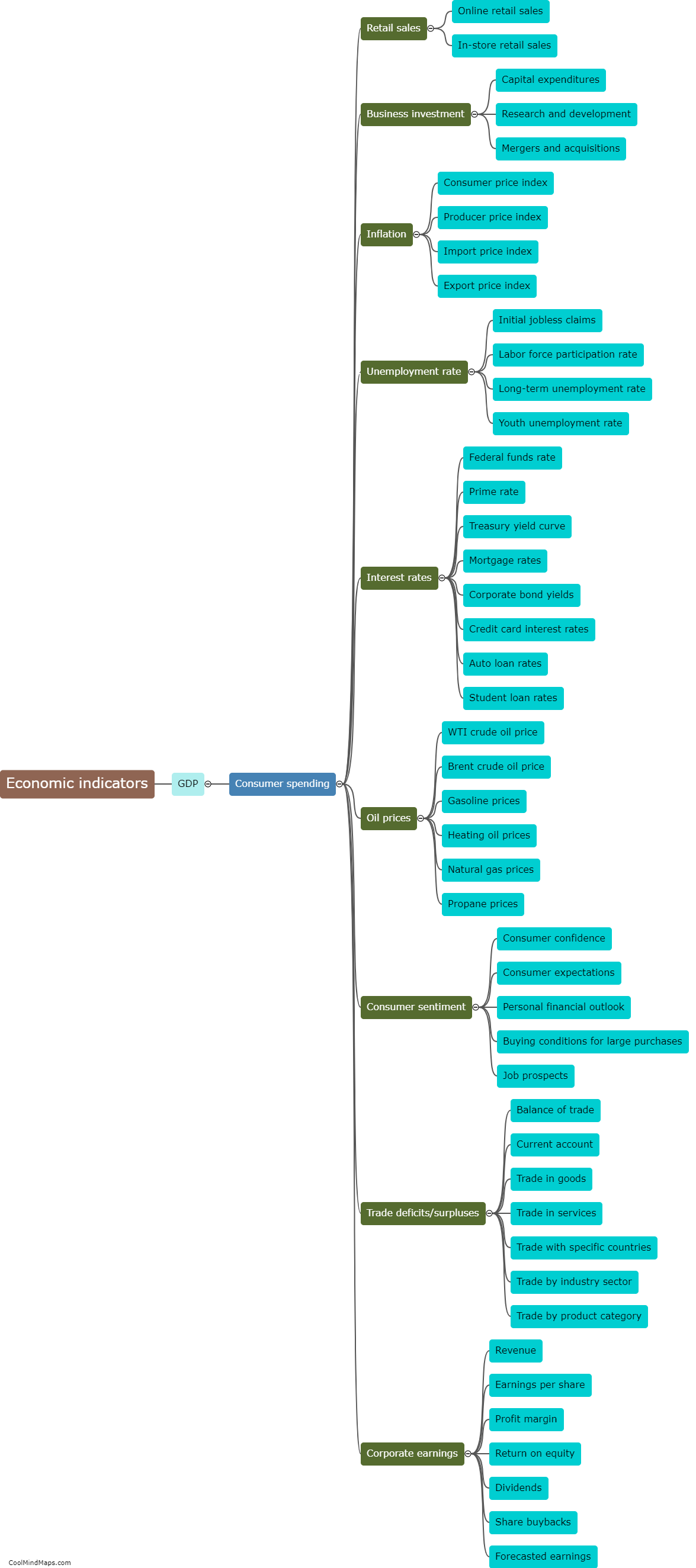

What economic indicators impact the stock market?

Several economic indicators have a significant impact on the stock market. One of the primary indicators is the overall health of the economy, as measured by factors such as GDP growth, inflation rate, and employment figures. When the economy is performing well, investors are more optimistic about corporate earnings and tend to drive stock prices higher. Another crucial indicator is interest rates, particularly those set by central banks. Lower interest rates make borrowing cheaper for businesses and consumers, stimulating economic growth and leading to higher stock prices. Additionally, indicators such as consumer spending, housing market data, and manufacturing activity can provide insights into the strength of different sectors and influence investor sentiment. Overall, these economic indicators provide valuable information that investors use to make informed decisions about buying and selling stocks.

This mind map was published on 1 August 2023 and has been viewed 122 times.