What strategies can digital businesses adopt for financial planning and budgeting?

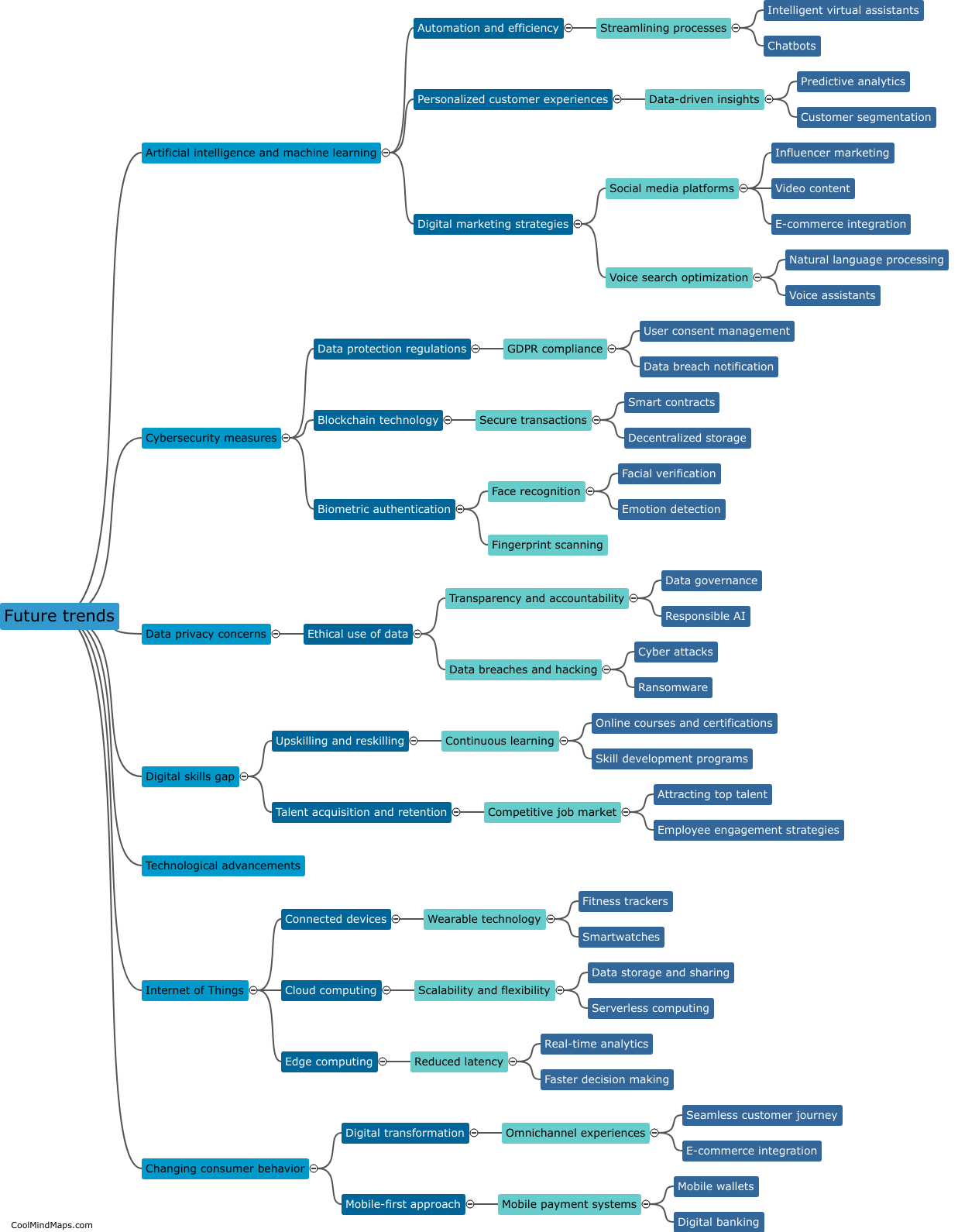

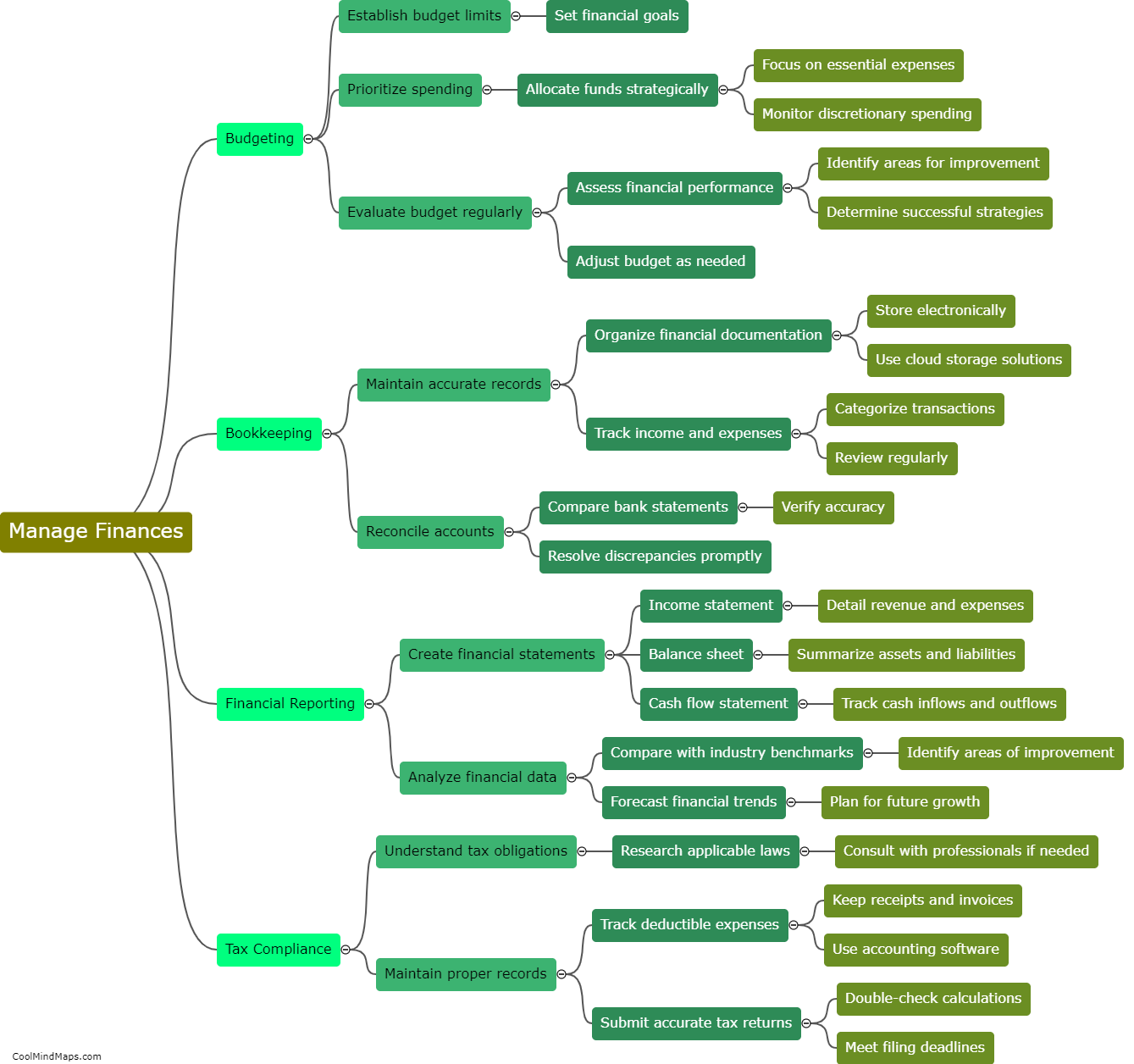

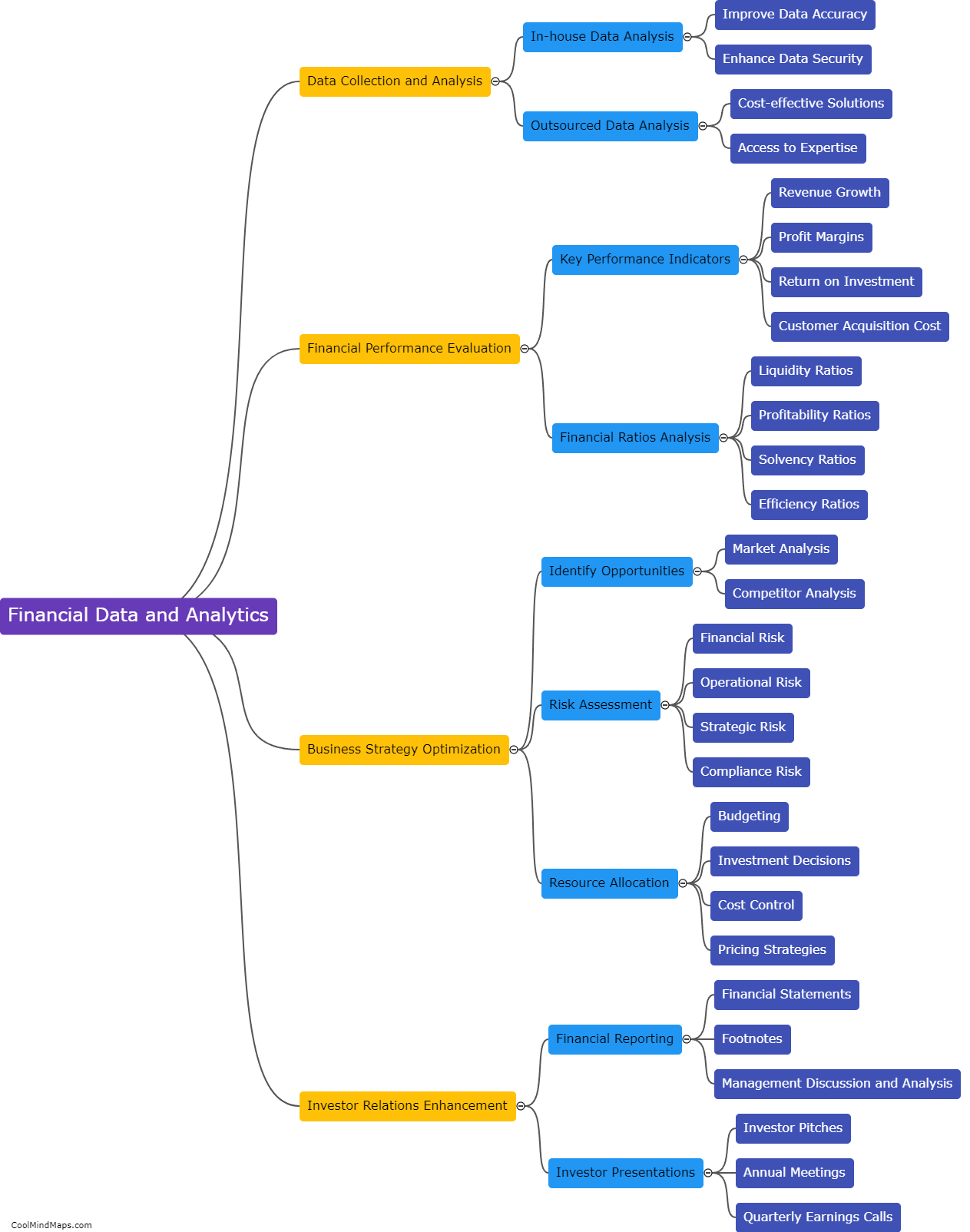

In order to effectively manage finances and plan budgets, digital businesses can employ several strategies. Firstly, they can leverage financial planning software that offers comprehensive tools for forecasting, tracking expenses, and analyzing financial data. This enables businesses to accurately project future revenues and expenses, facilitating proactive decision-making. Additionally, digital businesses can adopt cloud-based accounting systems, which streamline financial processes and allow for real-time collaboration. By automating routine tasks like invoicing and expense tracking, these systems free up time for finance teams to focus on strategic planning. Moreover, digital businesses can successfully leverage data analytics to gain insights into consumer behavior and market trends. This helps in optimizing resource allocation, identifying cost-saving opportunities, and prioritizing investment areas. By embracing these strategies, digital businesses can enhance their financial planning and budgeting practices, ultimately leading to increased profitability and sustainable growth.

This mind map was published on 6 November 2023 and has been viewed 114 times.