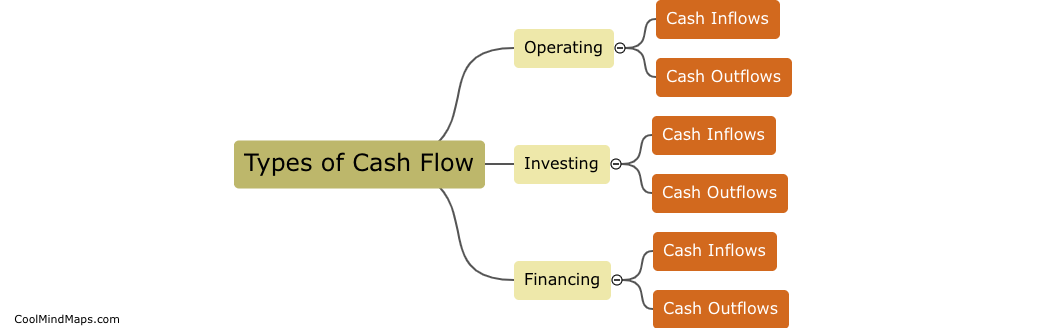

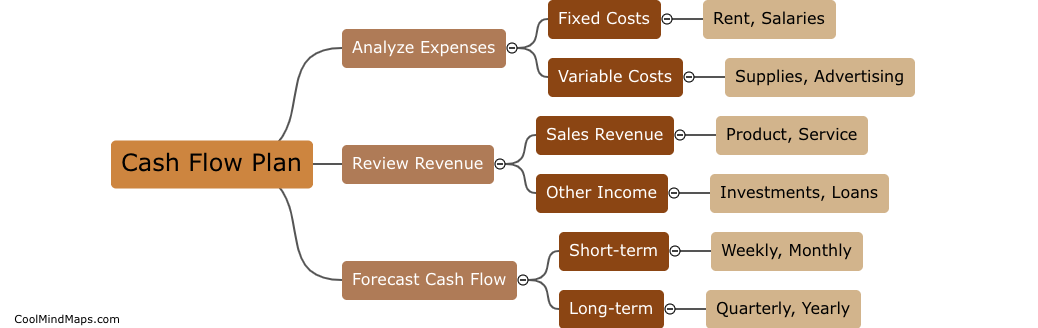

How can cash flow planning improve financial stability?

Cash flow planning is an essential tool that enables businesses and individuals to forecast and manage their cash inflows and outflows effectively. By tracking revenue and expenditures, cash flow planning can help prevent cash shortages or surpluses, making it easier for individuals to stay focused on long-term financial goals. Maintaining a stable cash flow allows one to be more proactive in paying bills, controlling debt and investments, and managing additional expenses. By planning ahead with a clear understanding of cash inflows and outflows, an individual or business can make informed financial decisions that minimize the need for emergency funding and improve overall financial stability.

This mind map was published on 24 April 2023 and has been viewed 109 times.