What are the rules and regulations for non-profit fundraising?

Non-profit fundraising is subject to a set of rules and regulations designed to ensure transparency, accountability, and the ethical use of funds. These regulations may vary depending on the country and jurisdiction but generally involve obtaining the necessary licenses and permits, adhering to reporting and record-keeping requirements, and complying with specific fundraising practices. Non-profits are often required to register with relevant government agencies and provide financial statements periodically. They must also ensure that donations are used for their intended purposes and maintain appropriate documentation to demonstrate the legitimacy of their fundraising activities. Violations of these rules can lead to penalties, loss of tax-exempt status, or legal consequences.

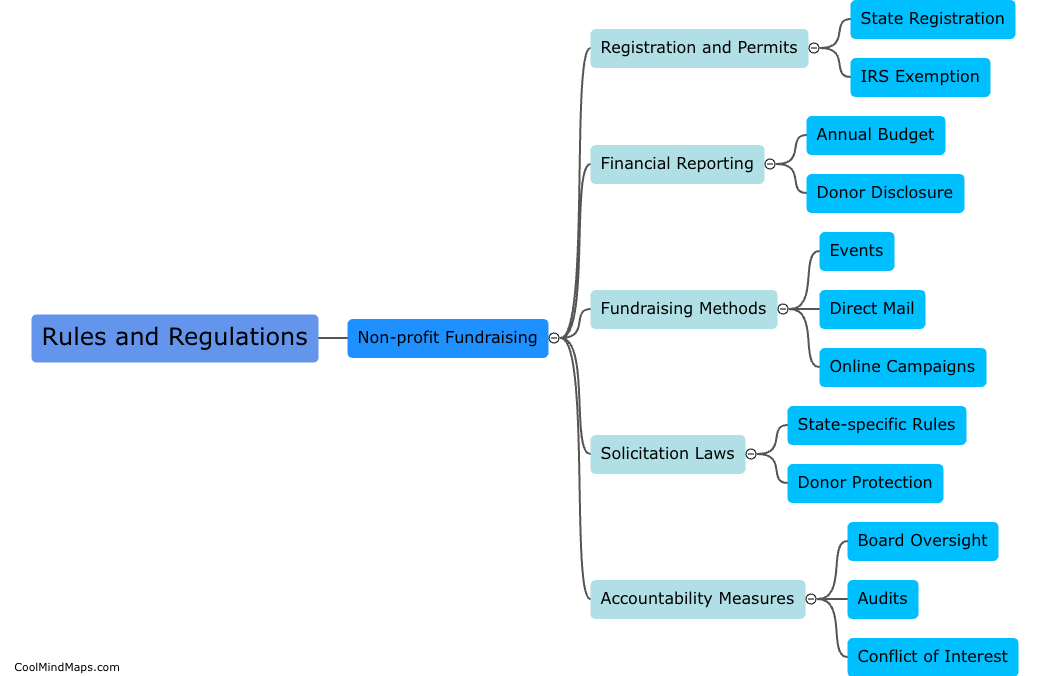

This mind map was published on 19 August 2023 and has been viewed 102 times.