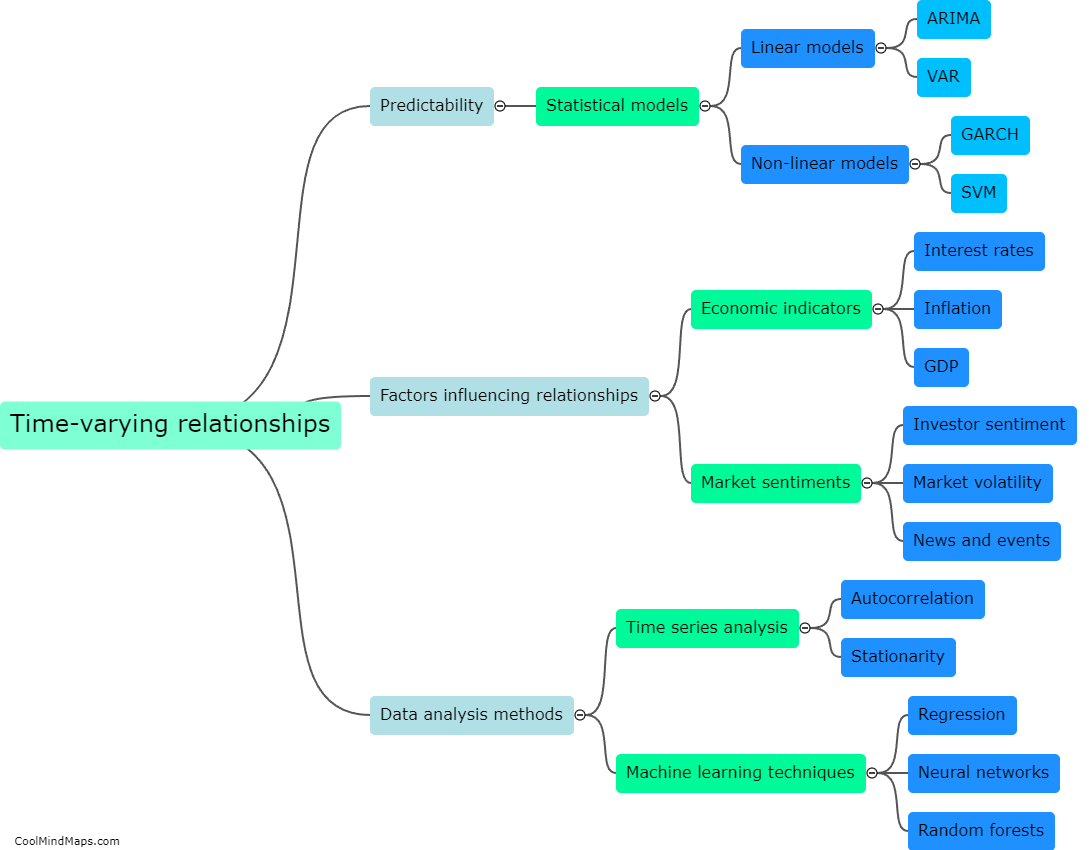

What are time-varying relationships in financial markets?

Time-varying relationships in financial markets refer to the ever-changing dynamics and correlations between various financial instruments or assets over different time periods. These relationships can fluctuate in response to a myriad of factors, including economic conditions, investor sentiment, market shocks, and policy changes. Time-varying relationships can be observed within a single market or between different markets, and they often impact asset prices, portfolio diversification strategies, and risk management practices. Understanding and analyzing these time-varying relationships is essential for investors, as it helps in identifying opportunities, managing risks, and making informed investment decisions.

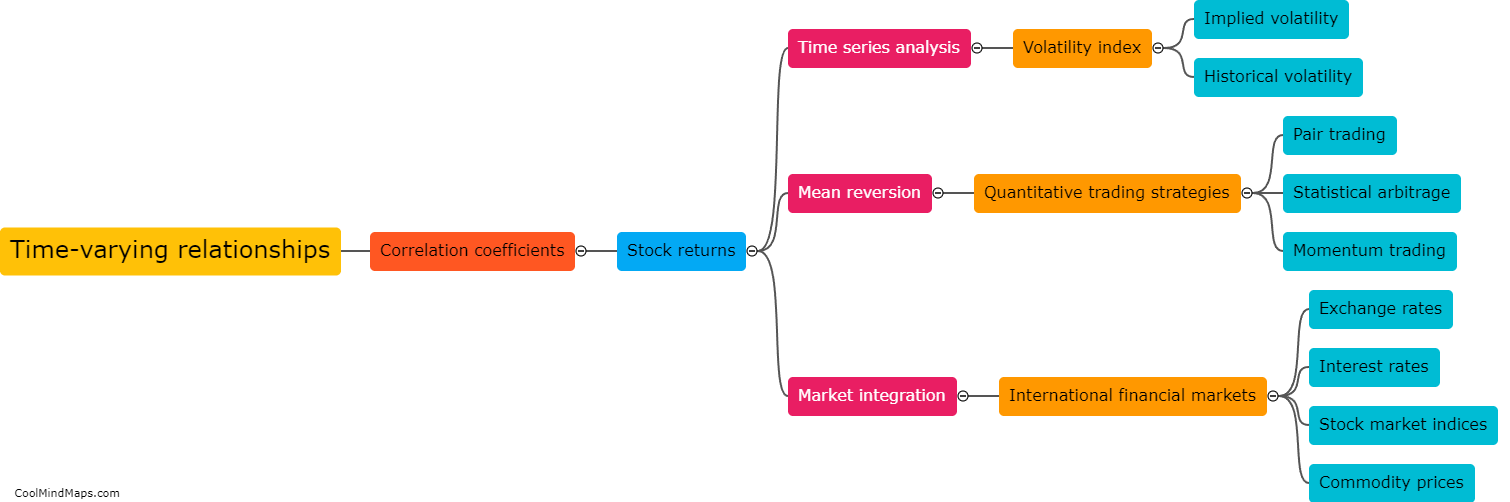

This mind map was published on 22 December 2023 and has been viewed 92 times.