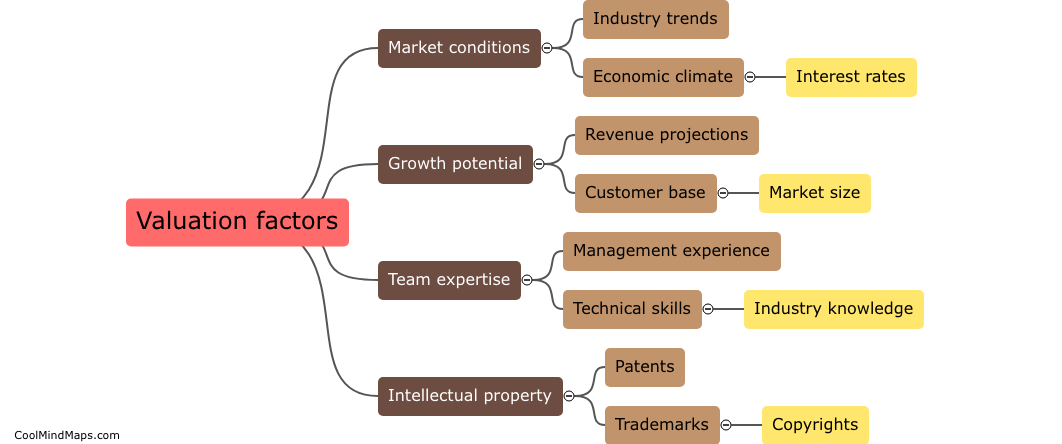

What factors affect the valuation of a start-up?

Several factors can influence the valuation of a start-up. One crucial factor is the market potential of the product or service the start-up offers. If the start-up has a unique and innovative solution that addresses a significant market need, it is likely to attract more interest and a higher valuation. Another factor is the start-up's growth potential, including its revenue growth rate, user base, and expansion plans. A strong team with relevant experience and skills also contributes to the start-up's valuation, as investors have more confidence in the team's ability to execute the business plan. Other factors may include competition, intellectual property, customer acquisition costs, and overall market conditions. Ultimately, a combination of these factors and investor sentiment determines the valuation of a start-up.

This mind map was published on 1 November 2023 and has been viewed 100 times.