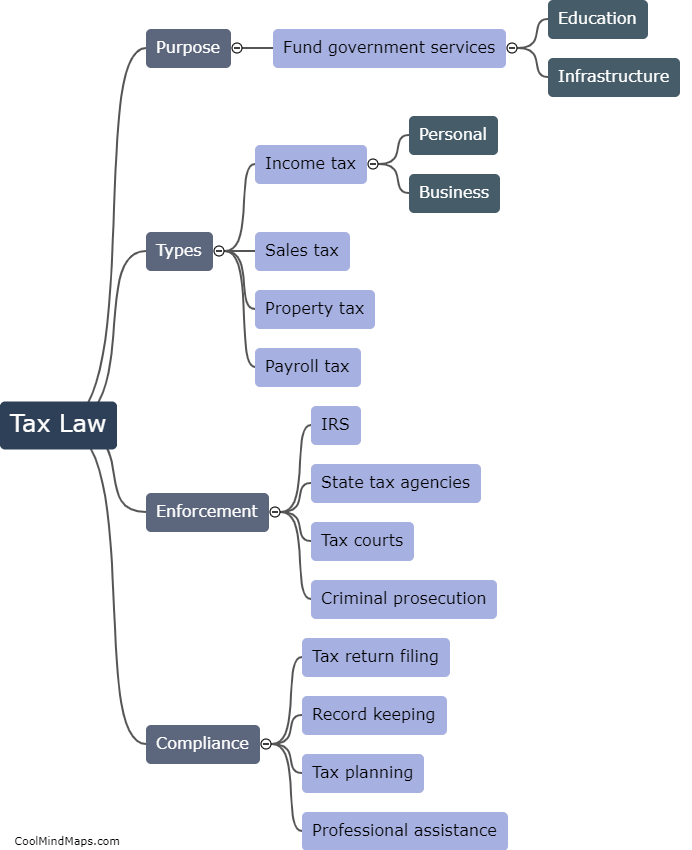

What is the role of accountants in tax law?

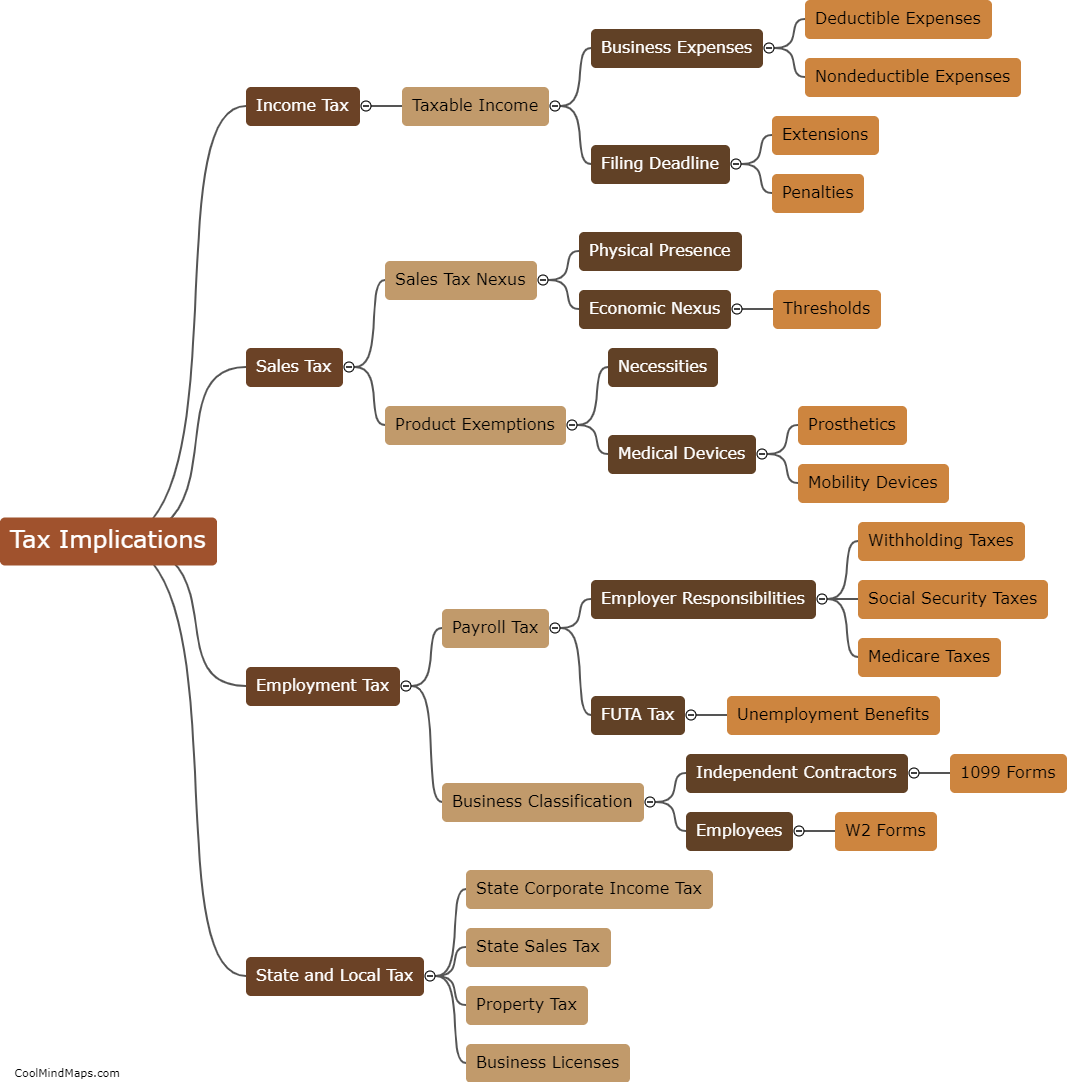

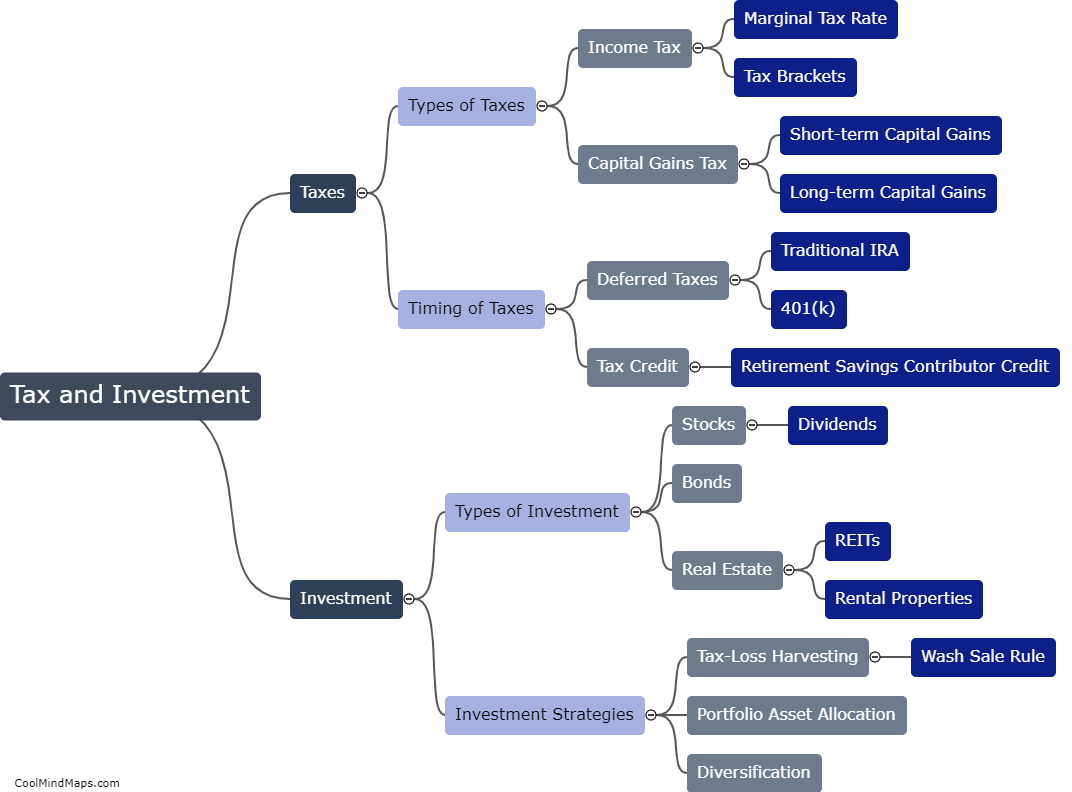

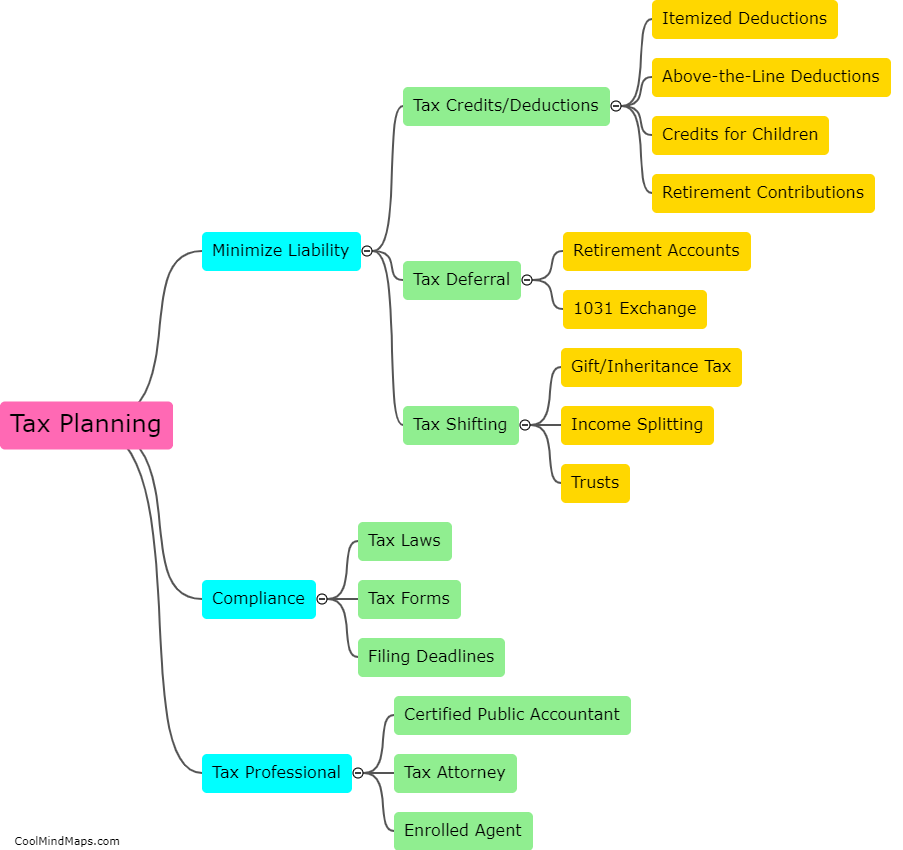

The role of accountants in tax law is critical, as they are responsible for ensuring that individuals and businesses are in compliance with various tax laws and regulations. Accountants help their clients navigate the complex tax system, including filing tax returns and making tax payments. Furthermore, they provide advice on tax planning and strategies to minimize taxes. They also can represent their clients when dealing with the tax authorities and help with resolving any tax disputes. Overall, accountants play an essential role in ensuring that their clients' finances are managed efficiently and that they are fully compliant with tax laws.

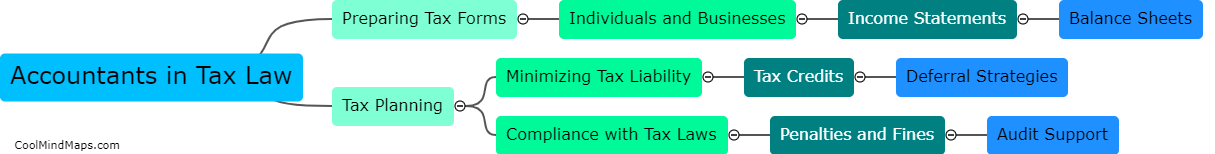

This mind map was published on 18 April 2023 and has been viewed 89 times.